Alaska Qualified Oil and Gas Service Industry Expenditure Credit 2017

What is the Alaska Qualified Oil And Gas Service Industry Expenditure Credit

The Alaska Qualified Oil and Gas Service Industry Expenditure Credit is a tax incentive designed to encourage investment in the oil and gas service sector within Alaska. This credit allows businesses to receive a reduction in their tax liability based on qualifying expenditures related to oil and gas services. It aims to stimulate economic growth and support the state's energy industry by providing financial relief to companies engaged in eligible activities.

How to use the Alaska Qualified Oil And Gas Service Industry Expenditure Credit

To utilize the Alaska Qualified Oil and Gas Service Industry Expenditure Credit, businesses must first determine their eligibility based on the types of services provided and the expenditures incurred. Eligible costs may include expenses for equipment, labor, and other operational costs directly associated with oil and gas services. Once eligibility is confirmed, businesses can apply the credit against their state tax obligations, effectively reducing the amount owed.

Steps to complete the Alaska Qualified Oil And Gas Service Industry Expenditure Credit

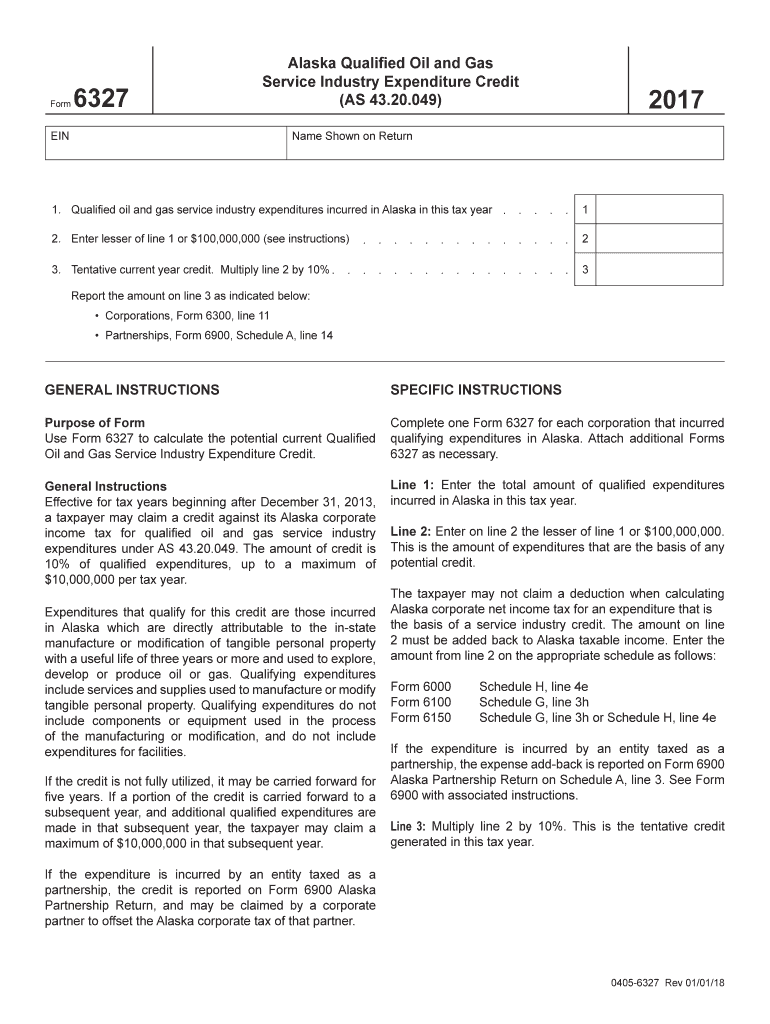

Completing the Alaska Qualified Oil and Gas Service Industry Expenditure Credit involves several key steps:

- Identify eligible expenditures related to oil and gas services.

- Gather necessary documentation to support the claimed expenses.

- Complete the appropriate forms as required by the state tax authority.

- Submit the completed forms along with any supporting documents by the specified deadline.

Eligibility Criteria

Eligibility for the Alaska Qualified Oil and Gas Service Industry Expenditure Credit is contingent upon several factors. Businesses must operate within the oil and gas service industry and incur qualifying expenditures. Additionally, the services provided must directly support oil and gas extraction or production activities. Companies should review the specific criteria outlined by the state to ensure compliance and maximize their potential credit.

Required Documents

To successfully claim the Alaska Qualified Oil and Gas Service Industry Expenditure Credit, businesses must prepare and submit various documents. Required documents typically include:

- Detailed records of qualifying expenditures.

- Invoices and receipts for services rendered.

- Tax forms specific to the credit application.

- Any additional documentation requested by the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Alaska Qualified Oil and Gas Service Industry Expenditure Credit are critical for compliance. Businesses must be aware of the specific dates for submitting their claims to avoid penalties. Typically, these deadlines align with the state’s tax filing schedule. It is advisable to consult the state tax authority's official guidelines for the most accurate and up-to-date information regarding important dates.

Quick guide on how to complete alaska qualified oil and gas service industry expenditure credit

Prepare Alaska Qualified Oil And Gas Service Industry Expenditure Credit seamlessly on any gadget

Web-based document handling has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Alaska Qualified Oil And Gas Service Industry Expenditure Credit on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Alaska Qualified Oil And Gas Service Industry Expenditure Credit effortlessly

- Find Alaska Qualified Oil And Gas Service Industry Expenditure Credit and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important parts of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Alaska Qualified Oil And Gas Service Industry Expenditure Credit and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska qualified oil and gas service industry expenditure credit

Create this form in 5 minutes!

How to create an eSignature for the alaska qualified oil and gas service industry expenditure credit

How to create an electronic signature for your Alaska Qualified Oil And Gas Service Industry Expenditure Credit online

How to generate an eSignature for the Alaska Qualified Oil And Gas Service Industry Expenditure Credit in Google Chrome

How to generate an electronic signature for putting it on the Alaska Qualified Oil And Gas Service Industry Expenditure Credit in Gmail

How to create an electronic signature for the Alaska Qualified Oil And Gas Service Industry Expenditure Credit right from your smart phone

How to create an eSignature for the Alaska Qualified Oil And Gas Service Industry Expenditure Credit on iOS devices

How to create an electronic signature for the Alaska Qualified Oil And Gas Service Industry Expenditure Credit on Android devices

People also ask

-

What is the Alaska Qualified Oil And Gas Service Industry Expenditure Credit?

The Alaska Qualified Oil And Gas Service Industry Expenditure Credit is a financial incentive offered to businesses operating within the oil and gas service sector in Alaska. It is designed to stimulate growth and investment in eligible expenditures related to exploration and development activities. Understanding this credit can help businesses maximize their operational efficiency and profitability.

-

Who is eligible for the Alaska Qualified Oil And Gas Service Industry Expenditure Credit?

Eligibility for the Alaska Qualified Oil And Gas Service Industry Expenditure Credit typically includes businesses engaged in qualified oil and gas service operations within the state. Companies must meet specific criteria defined by Alaskan tax laws, ensuring that they perform services related to exploration, drilling, or production. Consulting with a tax professional is advisable for precise eligibility requirements.

-

How can businesses apply for the Alaska Qualified Oil And Gas Service Industry Expenditure Credit?

Businesses seeking to apply for the Alaska Qualified Oil And Gas Service Industry Expenditure Credit must complete the necessary forms as specified by the Alaska Department of Revenue. It is essential to gather and present all supporting documentation related to eligible expenditures. Timely submission of these forms can enhance approval chances and ensure compliance with state regulations.

-

What types of expenditures qualify under the Alaska Qualified Oil And Gas Service Industry Expenditure Credit?

Expenditures that qualify under the Alaska Qualified Oil And Gas Service Industry Expenditure Credit include costs associated with labor, materials, and equipment used in oil and gas service operations. Additionally, certain operational and administrative expenses may also be eligible, contributing to a more robust financial return for businesses within this sector. It's important to review specific guidelines from state authorities.

-

What are the benefits of utilizing the Alaska Qualified Oil And Gas Service Industry Expenditure Credit?

Utilizing the Alaska Qualified Oil And Gas Service Industry Expenditure Credit can signNowly reduce tax liabilities for eligible businesses, enhancing cash flow. This credit incentivizes investments in infrastructure and operational improvements, fostering long-term growth within the oil and gas industry. Ultimately, it supports the sustainability and profitability of service providers.

-

Are there any limitations on the Alaska Qualified Oil And Gas Service Industry Expenditure Credit?

Yes, there are limitations associated with the Alaska Qualified Oil And Gas Service Industry Expenditure Credit, including maximum credit amounts and stipulations on eligible expenses. Additionally, the credit may be subject to caps depending on specific operational levels. Businesses are encouraged to consult the latest state tax guidelines to understand these limitations thoroughly.

-

How does the Alaska Qualified Oil And Gas Service Industry Expenditure Credit impact financial planning?

The Alaska Qualified Oil And Gas Service Industry Expenditure Credit can have a signNow impact on financial planning for businesses in the oil and gas sector. By reducing tax obligations and freeing up capital, businesses can reinvest in growth strategies, enhance operational efficiency, and stabilize cash flows. This can lead to more informed decision-making regarding future investments and budgeting.

Get more for Alaska Qualified Oil And Gas Service Industry Expenditure Credit

- Disaster summary outline in png form

- Rn nursing care of children 2013 proctored exam form

- Form 471 medicaidalabamagov medicaid alabama

- How to fill out cuiab board appeal form 31127570

- Quarterly mortality report form nevada department of wildlife ndow

- Va sp 230 2012 2019 form

- Sp167 2012 2019 form

- Wisconsin concealed form

Find out other Alaska Qualified Oil And Gas Service Industry Expenditure Credit

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer