Form 5074 Allocation of Individual Income Tax to Guam or the Commonwealth of the Northern Mariana Islands CNMI 2020

What is the 5074 tax form?

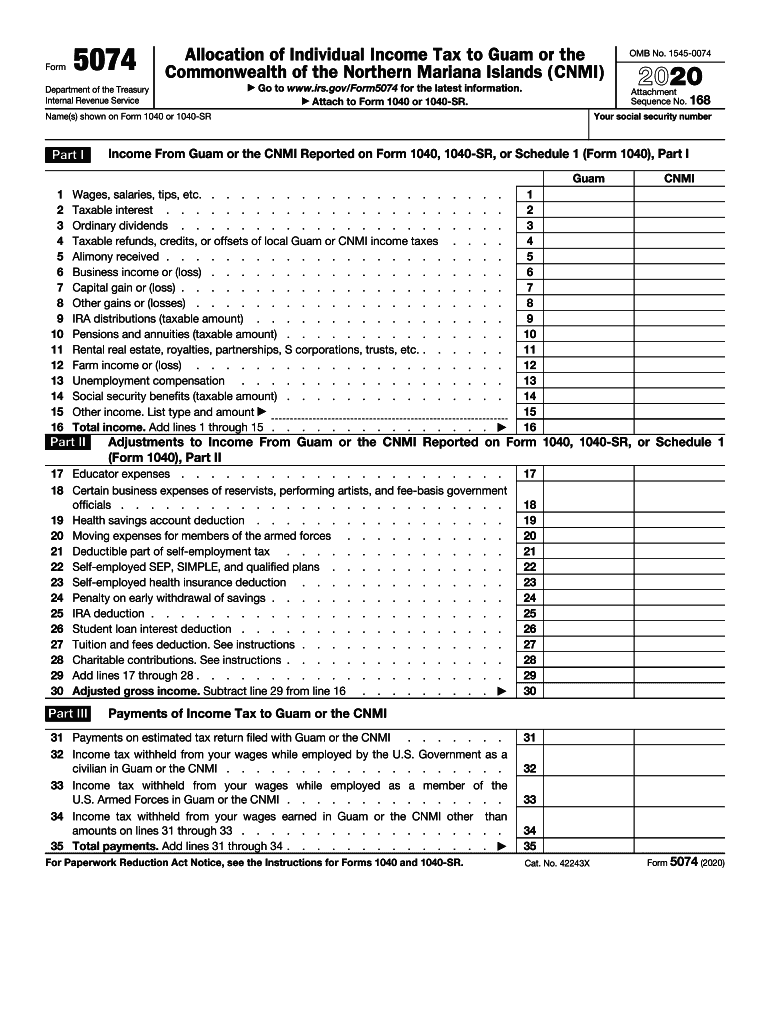

The 5074 tax form, officially known as the Allocation of Individual Income Tax to Guam or the Commonwealth of the Northern Mariana Islands (CNMI), is a document used by U.S. citizens and residents who have income sourced from these territories. This form allows individuals to allocate their income tax obligations between the U.S. federal government and the local government of Guam or CNMI. Understanding this form is essential for ensuring compliance with tax regulations and for accurately reporting income earned in these regions.

Steps to complete the 5074 tax form

Completing the 5074 tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, determine your total income from sources within Guam or CNMI. Then, follow these steps:

- Fill out your personal information at the top of the form, including your name, address, and Social Security number.

- Report your total income earned from Guam or CNMI in the designated section.

- Allocate the appropriate amount of tax liability to the local government and the federal government based on your income.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

It is advisable to consult a tax professional if you have questions about specific entries or allocations.

How to obtain the 5074 tax form

The 5074 tax form can be obtained from the official IRS website or through local tax offices in Guam or CNMI. It is available in PDF format for easy download and printing. Additionally, tax preparation software may include the form, allowing for digital completion and submission. Ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

IRS Guidelines for the 5074 tax form

The IRS provides specific guidelines for completing the 5074 tax form, which are essential for compliance. These guidelines include instructions on how to allocate income correctly, deadlines for submission, and the importance of accurate reporting. Taxpayers should refer to the IRS instructions accompanying the form to understand their obligations fully. Adhering to these guidelines helps avoid penalties and ensures that tax liabilities are met appropriately.

Legal use of the 5074 tax form

The legal use of the 5074 tax form is crucial for individuals earning income in Guam or CNMI. This form must be filed to allocate tax responsibilities correctly and to ensure compliance with both federal and local tax laws. Failure to file the form or incorrect allocations can lead to legal implications, including penalties or audits. It is important for taxpayers to understand their rights and responsibilities when using this form to avoid any legal issues.

Filing deadlines for the 5074 tax form

Filing deadlines for the 5074 tax form align with the general tax filing deadlines set by the IRS. Typically, the form must be submitted by April 15 of the following tax year. However, if you are unable to meet this deadline, you may request an extension. It is important to stay informed about any changes to deadlines, especially in light of special circumstances that may affect tax filing periods.

Quick guide on how to complete 2020 form 5074 allocation of individual income tax to guam or the commonwealth of the northern mariana islands cnmi

Easily Prepare Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without unnecessary delays. Work on Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI from any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI with Ease

- Obtain Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 5074 allocation of individual income tax to guam or the commonwealth of the northern mariana islands cnmi

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 5074 allocation of individual income tax to guam or the commonwealth of the northern mariana islands cnmi

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 5074 tax form and why is it important?

The 5074 tax form is crucial for reporting income from foreign investments or assets. Accurately completing the 5074 tax form helps avoid penalties and ensures compliance with tax regulations, making it essential for taxpayers with international ties.

-

Can airSlate SignNow help me with signing the 5074 tax form?

Yes, airSlate SignNow allows you to easily eSign the 5074 tax form digitally. With its user-friendly interface, you can quickly fill out and sign the form, making document management seamless and efficient.

-

Is there a cost associated with using airSlate SignNow for the 5074 tax form?

airSlate SignNow offers various pricing plans that cater to different business needs, ensuring you have a cost-effective solution for managing your 5074 tax form. The pricing is affordable and designed to provide value for users looking to streamline their document signing process.

-

What features of airSlate SignNow assist with the 5074 tax form?

airSlate SignNow provides features such as document templates, cloud storage, and secure eSigning options, all of which facilitate the process of handling your 5074 tax form. These features make it easier to manage, track, and store your important documents.

-

Does airSlate SignNow integrate with other platforms for the 5074 tax form?

Yes, airSlate SignNow integrates with various popular platforms, such as Google Drive and Dropbox, enabling you to access and manage your 5074 tax form efficiently. This integration helps streamline your workflow and keeps all relevant documents in one place.

-

How secure is airSlate SignNow when handling the 5074 tax form?

airSlate SignNow employs advanced encryption and security measures to ensure the confidentiality of your 5074 tax form and all related documents. You can trust that your data is protected while using our platform for eSigning.

-

Is there customer support available for assistance with the 5074 tax form?

Yes, airSlate SignNow offers robust customer support to assist you with any questions regarding the 5074 tax form. Whether you need help with eSigning or understanding the document management process, our team is here to help.

Get more for Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI

- Wwwcourseherocomfile83111769pptc040pdf save reset form protected when completed b

- Taxcoloradogovcontact us by mailcontact us by maildepartment of revenue colorado form

- Cr 701 motion request to quash warrant and set hearing form

- Adult hepatitis form

- Sinp 100 22 form

- 481 2 form

- Temporary resident visa in canada applicanttemporary resident visa in canada applicantapplication for a visitor visa temporary form

- Canada supplementary form

Find out other Form 5074 Allocation Of Individual Income Tax To Guam Or The Commonwealth Of The Northern Mariana Islands CNMI

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document