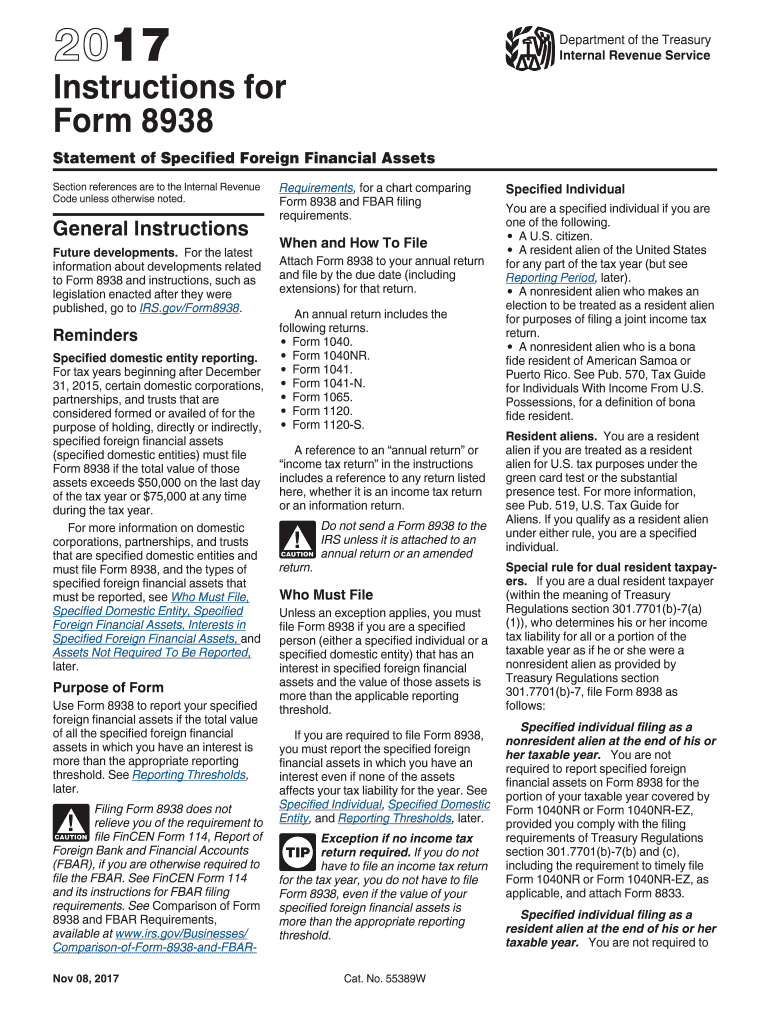

Irs 8938 Instructions Form 2017

What is the Irs 8938 Instructions Form

The Irs 8938 Instructions Form is a tax document that U.S. taxpayers use to report specified foreign financial assets to the Internal Revenue Service (IRS). This form is required for individuals who have an interest in foreign assets exceeding certain thresholds. It is part of the IRS's efforts to ensure compliance with tax laws related to foreign investments and accounts. The form helps the IRS track foreign income and assets, which may be subject to U.S. taxation.

How to use the Irs 8938 Instructions Form

Using the Irs 8938 Instructions Form involves several steps to ensure accurate reporting of foreign financial assets. Taxpayers must first determine if they meet the reporting threshold based on their filing status and the value of their foreign assets. Once eligibility is confirmed, the form must be filled out with detailed information about each foreign asset, including the type of asset, account numbers, and the maximum value during the tax year. It is essential to review the instructions thoroughly to avoid errors that could lead to penalties.

Steps to complete the Irs 8938 Instructions Form

Completing the Irs 8938 Instructions Form requires careful attention to detail. Here are the key steps:

- Determine if you are required to file the form based on your foreign asset holdings.

- Gather necessary information about each foreign financial asset, including account numbers and maximum values.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with your annual tax return by the specified deadline.

Legal use of the Irs 8938 Instructions Form

The Irs 8938 Instructions Form is legally binding when completed and submitted according to IRS regulations. It is crucial for taxpayers to provide accurate and truthful information, as any discrepancies can lead to penalties or legal repercussions. The form is part of the U.S. tax compliance framework, and failure to file it when required can result in significant fines. Understanding the legal implications of the form is essential for proper compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Irs 8938 Instructions Form align with the annual tax return deadlines. Typically, taxpayers must submit the form by April fifteenth of the following year, with an automatic extension available until October fifteenth if the tax return is also extended. It is important to stay informed about any changes to deadlines announced by the IRS, as failure to file on time can result in penalties.

Penalties for Non-Compliance

Non-compliance with the Irs 8938 Instructions Form can lead to substantial penalties. Taxpayers who fail to file the form when required may face a penalty of $10,000 for each year of non-filing. Additionally, if the IRS determines that the failure to report was due to willful neglect, penalties can increase significantly. Understanding these potential consequences underscores the importance of accurate and timely filing.

Quick guide on how to complete irs 8938 instructions form 2017

Effortlessly Prepare Irs 8938 Instructions Form on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily access the correct form and securely store it on the internet. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly and without setbacks. Handle Irs 8938 Instructions Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Irs 8938 Instructions Form with Ease

- Obtain Irs 8938 Instructions Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Produce your signature with the Sign tool, which takes mere seconds and holds the same legal standing as a conventional ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Edit and electronically sign Irs 8938 Instructions Form and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 8938 instructions form 2017

Create this form in 5 minutes!

How to create an eSignature for the irs 8938 instructions form 2017

How to make an electronic signature for the Irs 8938 Instructions Form 2017 online

How to create an eSignature for your Irs 8938 Instructions Form 2017 in Google Chrome

How to make an electronic signature for putting it on the Irs 8938 Instructions Form 2017 in Gmail

How to make an electronic signature for the Irs 8938 Instructions Form 2017 right from your smart phone

How to generate an electronic signature for the Irs 8938 Instructions Form 2017 on iOS

How to make an eSignature for the Irs 8938 Instructions Form 2017 on Android OS

People also ask

-

What is the IRS 8938 Instructions Form and why is it important?

The IRS 8938 Instructions Form is a crucial document that U.S. taxpayers must file to report specified foreign financial assets. It helps the IRS ensure compliance with the Foreign Account Tax Compliance Act (FATCA). Understanding the IRS 8938 Instructions Form is essential for avoiding penalties or legal issues related to foreign asset reporting.

-

How can airSlate SignNow assist with the IRS 8938 Instructions Form?

airSlate SignNow offers a seamless solution for electronically signing and sending the IRS 8938 Instructions Form. Our platform simplifies the document workflow, allowing users to prepare and eSign their forms securely and efficiently. This streamlines the process of submitting important tax documents like the IRS 8938 Instructions Form.

-

Are there any costs associated with using airSlate SignNow for the IRS 8938 Instructions Form?

Yes, airSlate SignNow provides various pricing plans designed to accommodate different business needs. Each plan offers features that support document management, including the eSigning of the IRS 8938 Instructions Form. You can choose a plan that fits your budget while ensuring you have all the tools required for your tax documentation.

-

What features does airSlate SignNow offer for managing the IRS 8938 Instructions Form?

airSlate SignNow includes features like customizable templates, secure cloud storage, and real-time tracking for documents. These features enhance the management of important forms, such as the IRS 8938 Instructions Form, ensuring that you can easily access, share, and sign your documents when needed. Additionally, its user-friendly interface simplifies the entire process.

-

Can I integrate airSlate SignNow with other applications for IRS 8938 Instructions Form processing?

Yes, airSlate SignNow integrates seamlessly with various applications, enabling you to manage the IRS 8938 Instructions Form efficiently. You can connect with popular tools like Google Drive, Dropbox, and CRM systems, allowing for easy access to your documents and a streamlined workflow. This integration enhances your ability to handle tax forms alongside other business processes.

-

Is airSlate SignNow secure for handling sensitive documents like the IRS 8938 Instructions Form?

Absolutely! airSlate SignNow prioritizes security, using advanced encryption and compliance measures to protect your documents, including the IRS 8938 Instructions Form. Our platform ensures that your sensitive information remains confidential and secure from unauthorized access, giving you peace of mind when managing tax-related documents.

-

How do I get started with airSlate SignNow for the IRS 8938 Instructions Form?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, choose a pricing plan that suits your needs, and begin creating your IRS 8938 Instructions Form. Our intuitive platform guides you through the process of document preparation and eSigning, making it accessible for everyone.

Get more for Irs 8938 Instructions Form

Find out other Irs 8938 Instructions Form

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later