the Internal Revenue Service Has Made Progress Treasury 2020

IRS Guidelines for Form 8938

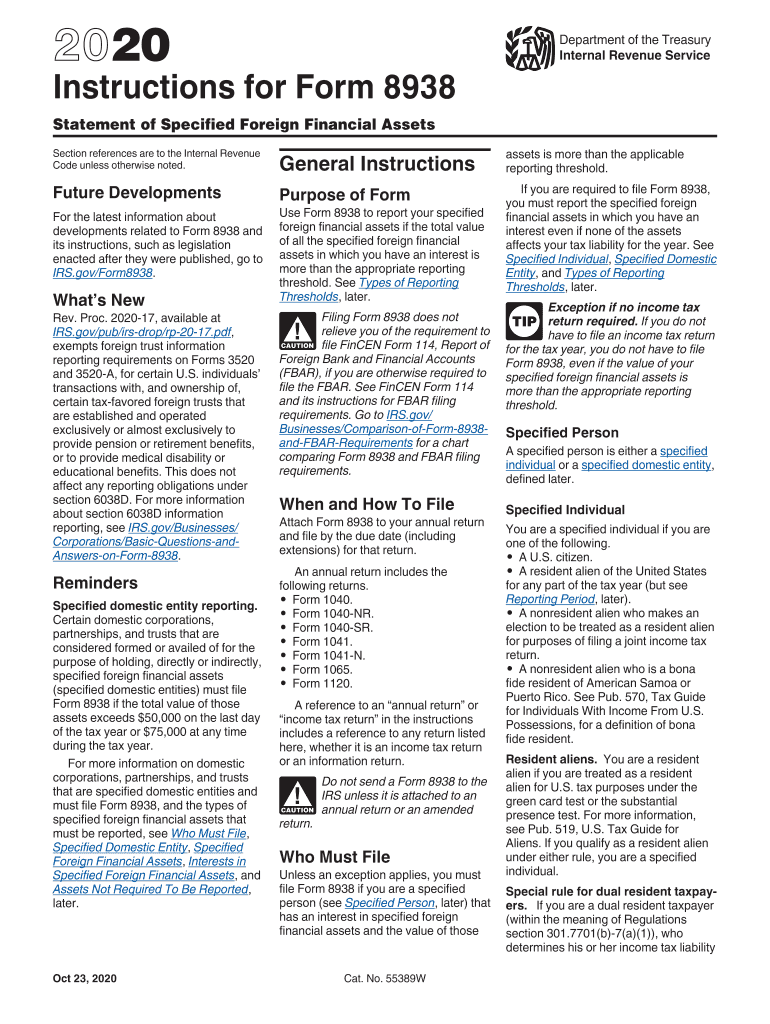

The IRS Form 8938, also known as the Statement of Specified Foreign Financial Assets, is a crucial document for U.S. taxpayers with specified foreign financial assets that exceed certain thresholds. The guidelines provided by the IRS outline who must file this form, the types of assets that need to be reported, and the specific thresholds based on filing status. Understanding these guidelines is essential to ensure compliance and avoid potential penalties.

Steps to Complete the 2016 Form 8938

Filling out the 2016 Form 8938 requires careful attention to detail. Here are the key steps:

- Gather information about your specified foreign financial assets, including account numbers, asset values, and the names of financial institutions.

- Determine if your assets exceed the reporting thresholds based on your filing status (single, married filing jointly, etc.).

- Complete the form by accurately entering the required information in the designated sections, ensuring that all data is correct.

- Review the completed form for accuracy before submission.

Filing Deadlines for Form 8938

The deadline for filing Form 8938 aligns with your federal income tax return. For most taxpayers, this means the form is due on April 15. If you file for an extension, the deadline may be extended to October 15. It is important to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file Form 8938 when required can result in significant penalties. The IRS imposes a penalty of $10,000 for failing to file the form, with additional penalties for continued failure to file after receiving a notice from the IRS. Understanding these penalties emphasizes the importance of timely and accurate filing.

Required Documents for Form 8938

To complete Form 8938, you will need to gather various documents that provide information about your foreign financial assets. This includes:

- Bank statements from foreign financial institutions.

- Statements from foreign mutual funds or other investment accounts.

- Documentation of foreign stocks, bonds, or other financial assets.

Having these documents ready will streamline the completion of the form and help ensure accuracy.

Digital vs. Paper Version of Form 8938

Taxpayers have the option to file Form 8938 either digitally or on paper. Filing electronically can simplify the process, as many tax software programs can guide you through the completion of the form. However, some individuals may prefer to file a paper version for personal record-keeping. Regardless of the method chosen, it is crucial to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete the internal revenue service has made progress treasury

Prepare The Internal Revenue Service Has Made Progress Treasury effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage The Internal Revenue Service Has Made Progress Treasury on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

How to alter and electronically sign The Internal Revenue Service Has Made Progress Treasury with ease

- Obtain The Internal Revenue Service Has Made Progress Treasury and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this task.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to preserve your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign The Internal Revenue Service Has Made Progress Treasury and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the internal revenue service has made progress treasury

Create this form in 5 minutes!

How to create an eSignature for the the internal revenue service has made progress treasury

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 8938 form 2016 no No Download Needed needed?

The 8938 form 2016 is a tax form required by the IRS for specified individuals to report foreign financial assets. This form can be completed easily online, without the need for any downloads, making it more accessible for users who prefer paperless solutions.

-

How can airSlate SignNow help with the 8938 form 2016 no No Download Needed needed?

airSlate SignNow simplifies the process of completing and eSigning the 8938 form 2016 no No Download Needed needed. With its user-friendly interface, you can fill out the form online and ensure it is signed securely without needing to download software.

-

Is there a cost associated with using airSlate SignNow for the 8938 form 2016 no No Download Needed needed?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different needs and budgets. You can choose the plan that best fits your requirements while still benefiting from a no-download solution for the 8938 form 2016.

-

What features does airSlate SignNow offer for the 8938 form 2016 no No Download Needed needed?

airSlate SignNow provides features like real-time collaboration, document sharing, and automatic reminders that enhance the experience of completing the 8938 form 2016 no No Download Needed needed. These features ensure that the form is processed efficiently and securely.

-

Are there any integrations available with airSlate SignNow for the 8938 form 2016 no No Download Needed needed?

Yes, airSlate SignNow integrates with various applications, allowing you to connect your workflow seamlessly while working on the 8938 form 2016 no No Download Needed needed. Popular integrations include Google Drive, Dropbox, and more, which enhance document management.

-

Can I access the 8938 form 2016 no No Download Needed needed from any device?

Absolutely! airSlate SignNow's platform is cloud-based, meaning you can access the 8938 form 2016 no No Download Needed needed from any device with internet connectivity. This ensures that you can work on your form anytime, anywhere.

-

Is airSlate SignNow secure for submitting the 8938 form 2016 no No Download Needed needed?

Yes, airSlate SignNow prioritizes security, implementing advanced encryption and security protocols to safeguard your data while completing the 8938 form 2016 no No Download Needed needed. You can confidently submit your form knowing your information is protected.

Get more for The Internal Revenue Service Has Made Progress Treasury

- Pdf charity golf tournament flyer the italian catholic federation form

- Request to withdra from m ocps form

- Medical history form for personal training

- Basketball rotation generator form

- Signature page form

- Bus field trip request lincoln elementary school district 27 form

- Keg registration identification form missouri division of alcohol atc dps mo

- Agency appointment application oregon mutual insurance form

Find out other The Internal Revenue Service Has Made Progress Treasury

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now