Colorado Income Tax Booklet 2019

What is the Colorado Income Tax Booklet

The Colorado Income Tax Booklet is an essential document for individuals and businesses in Colorado to understand their tax obligations. It provides detailed instructions on how to complete income tax returns, including necessary forms and schedules. This booklet outlines the state's tax rates, eligibility criteria, and various deductions and credits that taxpayers may claim. It is crucial for ensuring compliance with Colorado tax laws and for accurately reporting income to the Colorado Department of Revenue.

How to use the Colorado Income Tax Booklet

Using the Colorado Income Tax Booklet involves several steps to ensure accurate tax filing. First, taxpayers should review the booklet thoroughly to understand the requirements and forms needed for their specific situation. Next, gather all necessary documents, such as W-2s, 1099s, and other income statements. Follow the instructions in the booklet to complete the required forms, ensuring that all information is accurate and complete. Finally, submit the forms either electronically or via mail, as specified in the booklet.

Steps to complete the Colorado Income Tax Booklet

Completing the Colorado Income Tax Booklet involves a systematic approach:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Review the booklet for specific instructions related to your filing status.

- Fill out the required forms accurately, ensuring all calculations are correct.

- Claim any applicable deductions and credits as outlined in the booklet.

- Double-check all entries for accuracy before submission.

- Submit the completed forms by the deadline, either online or by mail.

Legal use of the Colorado Income Tax Booklet

The Colorado Income Tax Booklet serves as a legally binding document when completed and submitted according to state regulations. It is essential that taxpayers adhere to the guidelines provided within the booklet to ensure compliance with Colorado tax laws. Any discrepancies or inaccuracies may lead to penalties or audits by the Colorado Department of Revenue. Therefore, understanding the legal implications of the booklet is vital for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines are crucial for taxpayers to avoid penalties. The Colorado Income Tax Booklet specifies important dates, including the due date for filing individual income tax returns, typically on April fifteenth. Extensions may be available, but they must be requested in advance. It is essential to keep track of these deadlines to ensure timely submission and compliance with state tax regulations.

Required Documents

To complete the Colorado Income Tax Booklet, taxpayers must gather specific documents, including:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation required for specific credits or deductions.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Colorado Income Tax Booklet. Forms can be filed electronically through the Colorado Department of Revenue’s online portal, which is often the fastest method. Alternatively, taxpayers can mail their completed forms to the designated address provided in the booklet. In-person submissions may also be possible at local tax offices, depending on availability and current regulations. Each method has its own processing times and requirements, so it is important to choose the one that best suits individual needs.

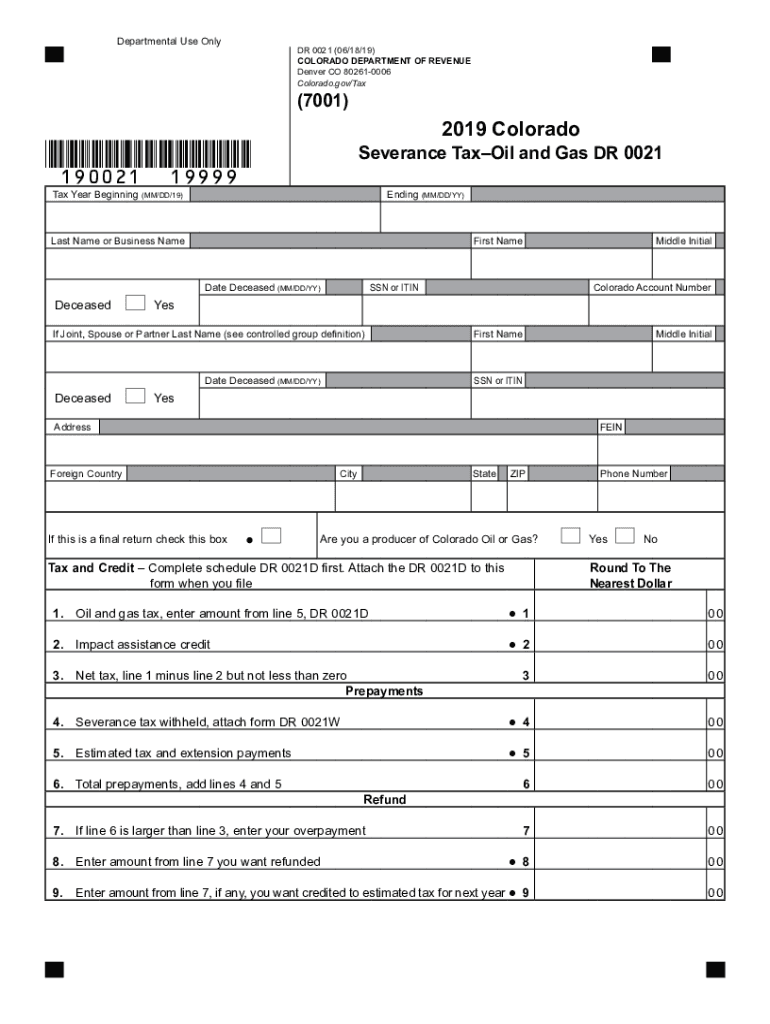

Quick guide on how to complete severance taxforms ampamp instructionsdepartment of

Complete Colorado Income Tax Booklet effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Colorado Income Tax Booklet on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Colorado Income Tax Booklet seamlessly

- Obtain Colorado Income Tax Booklet and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Select important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, invite link, or download it to your PC.

Eliminate worries about lost or misplaced documents, burdensome form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Colorado Income Tax Booklet and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct severance taxforms ampamp instructionsdepartment of

Create this form in 5 minutes!

How to create an eSignature for the severance taxforms ampamp instructionsdepartment of

How to make an electronic signature for the Severance Taxforms Ampamp Instructionsdepartment Of online

How to generate an eSignature for your Severance Taxforms Ampamp Instructionsdepartment Of in Chrome

How to generate an electronic signature for putting it on the Severance Taxforms Ampamp Instructionsdepartment Of in Gmail

How to generate an electronic signature for the Severance Taxforms Ampamp Instructionsdepartment Of straight from your smartphone

How to make an electronic signature for the Severance Taxforms Ampamp Instructionsdepartment Of on iOS

How to make an eSignature for the Severance Taxforms Ampamp Instructionsdepartment Of on Android devices

People also ask

-

What is a co booklet and how does airSlate SignNow utilize it?

A co booklet is a digital document that allows users to collaborate and manage information efficiently. With airSlate SignNow, you can create, send, and eSign co booklets, streamlining your document workflow and enhancing team collaboration.

-

How much does using airSlate SignNow for co booklets cost?

Pricing for airSlate SignNow varies depending on the plan you choose. Our affordable options provide businesses with access to essential features for managing co booklets, ensuring you only pay for what you need without compromising on functionality.

-

What features are available for co booklets in airSlate SignNow?

airSlate SignNow offers a variety of features for co booklets, including customizable templates, electronic signatures, and real-time collaboration. These tools help you create professional documents that can be completed and signed quickly, improving business efficiency.

-

What are the benefits of using airSlate SignNow for co booklets?

Using airSlate SignNow for co booklets provides several benefits, including faster turnaround times, reduced paper usage, and enhanced security for your documents. This eSigning solution automates workflows, helping you save valuable time and resources.

-

Can I integrate airSlate SignNow with other business tools for co booklets?

Yes, airSlate SignNow integrates seamlessly with a variety of business tools, allowing you to enhance your co booklet management. Popular integrations include Google Drive, Salesforce, and more, making it easy to incorporate eSigning into your existing processes.

-

Is airSlate SignNow suitable for businesses of all sizes for managing co booklets?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, from startups to large corporations. Its user-friendly interface and scalable pricing plans make it an ideal solution for efficiently managing co booklets across various industries.

-

How secure is the information in my co booklets when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance with industry standards to ensure that the information in your co booklets is protected, providing peace of mind for all your document transactions.

Get more for Colorado Income Tax Booklet

- Will county release of judgment form

- Download alvin community college form

- Transcript request steele canyon high school schscougars form

- Ucn 22434 the small business subcontracting plan pdf y12 doe form

- Vtr 272 form

- Eo decal form

- Fpp 16987 form

- On campus transcript request form on campus transcript request form

Find out other Colorado Income Tax Booklet

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile