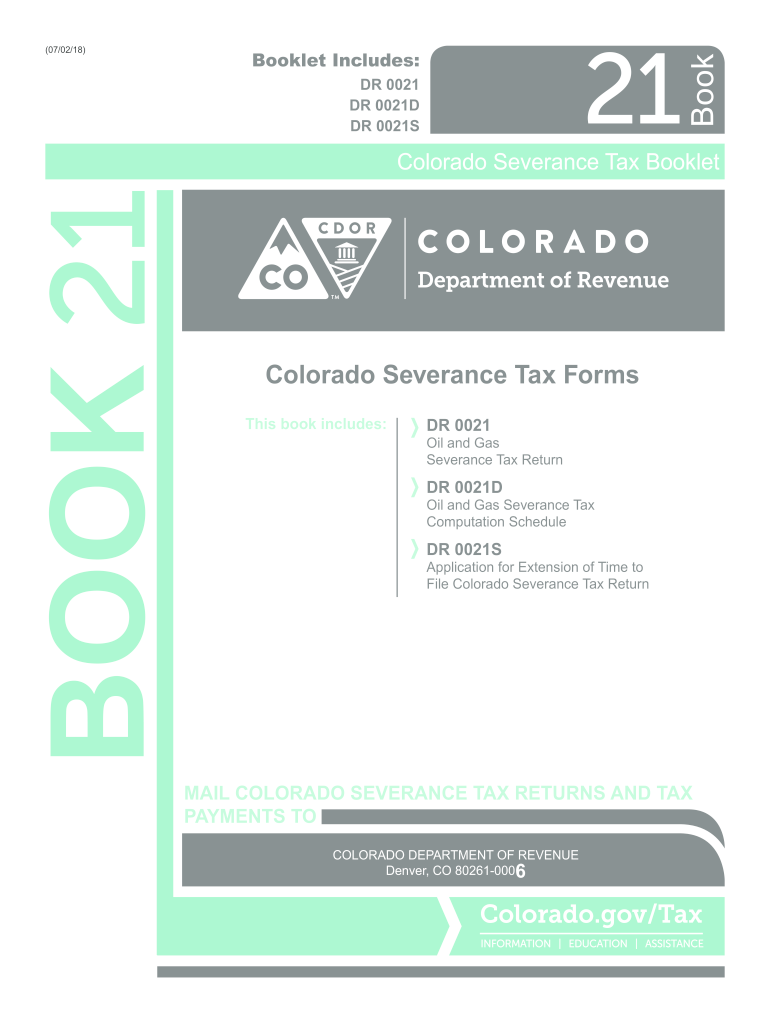

Colorado Severance Tax 2018

What is the Colorado Severance Tax

The Colorado Severance Tax is a tax imposed on the extraction of non-renewable resources, such as oil, gas, coal, and minerals. This tax is essential for generating revenue for the state and is calculated based on the volume of resources extracted. The rates vary depending on the type of resource, and the tax applies to both individuals and businesses involved in extraction activities. Understanding the specifics of this tax is crucial for compliance and financial planning.

How to use the Colorado Severance Tax

Utilizing the Colorado Severance Tax involves accurately reporting the resources extracted and calculating the tax owed. Taxpayers must complete the appropriate forms, which detail the amount of resources extracted and any deductions or credits applicable. It is important to maintain thorough records of extraction activities, as these will support the calculations made on the tax forms. By following the guidelines provided by the Colorado Department of Revenue, taxpayers can ensure proper compliance.

Steps to complete the Colorado Severance Tax

Completing the Colorado Severance Tax involves several key steps:

- Gather necessary documentation, including records of resource extraction and any relevant financial statements.

- Obtain the correct form for the severance tax, which may vary based on the type of resource.

- Accurately fill out the form, ensuring all information is complete and correct.

- Calculate the total tax owed based on the extraction amounts and applicable rates.

- Submit the completed form by the designated deadline, either online or via mail.

Legal use of the Colorado Severance Tax

The legal framework governing the Colorado Severance Tax is established by state law, which outlines the obligations of taxpayers. Compliance with these regulations is essential to avoid penalties. Taxpayers should familiarize themselves with the specific legal requirements, including filing deadlines and documentation needed. Adhering to these laws not only ensures lawful operation but also contributes to the state's revenue for public services.

Required Documents

To complete the Colorado Severance Tax, several documents are typically required:

- Records of resource extraction, including production reports.

- Financial statements that reflect the income generated from extraction activities.

- Any prior tax forms related to severance tax for reference.

- Documentation supporting any deductions or credits claimed.

Penalties for Non-Compliance

Failure to comply with the Colorado Severance Tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand the importance of timely and accurate filing to avoid these consequences. Regularly reviewing compliance requirements and maintaining organized records can help mitigate the risk of non-compliance.

Quick guide on how to complete co severance 2018 2019 form

Your assistance manual on how to prepare your Colorado Severance Tax

If you wish to understand how to finalize and submit your Colorado Severance Tax, here are a few straightforward instructions on how to simplify the tax submission process.

To begin with, you simply need to set up your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, create, and complete your income tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to modify information as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow these steps to complete your Colorado Severance Tax in just a few minutes:

- Establish your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Colorado Severance Tax in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting in paper form can lead to errors and delay in refunds. Naturally, before submitting your taxes electronically, check the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct co severance 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out the COMEDK 2019 application form?

COMEDK 2019 application is fully online based and there is no need to send the application by post or by any other method. Check the below-mentioned guidelines to register for the COMEDK 2019 exam:Step 1 Visit the official website of the COMEDK UGET- comedk.orgStep 2 Click on “Engineering Application”.Step 3 After that click on “Login or Register” button.Step 4 You will be asked to enter the Application SEQ Number/User ID and Password. But since you have not registered. You need to click on the “Click here for Registration”.Step 5 Fill in the required details like “Full Name”, “DOB”, “Unique Photo ID Proof”, “Photo ID Proof Number”, “Email ID” and “Mobile Number”.Step 6 Then click on the “Generate OTP”Step 7 After that you need to enter the captcha code and then an OTP will be sent to the mobile number that you have provided.Step 8 A new window having your previously entered registration details will open where you need to enter the OTP.Step 9 Re-check all the details, enter the captcha code and click on the “Register” button.Step 10 After that a page will appear where you will be having the User ID and all the details that you entered. Also, you will be notified that you have successfully registered yourself and a User ID and Password will be sent to your mobile number and email ID.COMEDK 2019 Notification | Steps To Apply For COMEDK UGET ExamCheck the below-mentioned guidelines to fill COMEDK Application Form after COMEDK Login.Step 1 Using your User ID and Password. Log in using the User ID and passwordStep 2 You will be shown that your application form is incomplete. So you need to go to the topmost right corner and click on the “Go to application” tab.Step 3 Go to the COMEDK official website and login with these credentials.Step 4 After that click on “Go to application form”.Step 5 Select your preferred stream and course.Step 6 Click on “Save and Continue”.Step 7 Carefully enter your Personal, Category and Academic details.Step 8 Upload your Photograph and Signature, Parents Signature, your ID Proof, and Declaration.Step 9 Enter your “Payment Mode” and “Amount”.Step 10 Enter “Security code”.Step 11 Tick the “I Agree” checkbox.Step 12 Click on the “Submit” button.

Create this form in 5 minutes!

How to create an eSignature for the co severance 2018 2019 form

How to create an electronic signature for your Co Severance 2018 2019 Form in the online mode

How to make an electronic signature for the Co Severance 2018 2019 Form in Google Chrome

How to generate an electronic signature for signing the Co Severance 2018 2019 Form in Gmail

How to make an electronic signature for the Co Severance 2018 2019 Form right from your smart phone

How to create an electronic signature for the Co Severance 2018 2019 Form on iOS

How to generate an eSignature for the Co Severance 2018 2019 Form on Android

People also ask

-

What is a co booklet in the context of airSlate SignNow?

A co booklet is a comprehensive digital document that allows multiple parties to collaborate and review files simultaneously. With airSlate SignNow, users can create and manage their co booklets efficiently, ensuring that everyone stays informed and engaged throughout the signing process.

-

How does airSlate SignNow enhance the functionality of a co booklet?

airSlate SignNow enhances co booklets by offering features such as real-time collaboration, notification alerts, and easy document sharing. Users can also track changes and comments made on the co booklet, making the entire process more transparent and organized.

-

What are the pricing options for using airSlate SignNow with co booklets?

airSlate SignNow offers various pricing plans that cater to different business needs, including options specifically designed for co booklets. You can choose from monthly or annual subscriptions based on your usage requirements, ensuring a cost-effective solution for your document management.

-

Can I integrate airSlate SignNow with other software to manage my co booklets?

Yes, airSlate SignNow allows seamless integrations with various applications, enabling users to manage their co booklets more effectively. Whether you’re using CRM software, cloud storage, or project management tools, integration can streamline your workflow and enhance productivity.

-

What are the primary benefits of using a co booklet with airSlate SignNow?

The primary benefits of using a co booklet with airSlate SignNow include improved collaboration, faster document turnaround times, and enhanced security. Users can easily eSign documents and ensure that every stakeholder is on the same page, all while protecting sensitive information.

-

Is it easy to use airSlate SignNow for managing co booklets?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple to create, share, and manage co booklets. Its intuitive interface ensures that users of all technical levels can navigate the platform without hassle.

-

Are there any limitations to the co booklet feature in airSlate SignNow?

While airSlate SignNow provides powerful tools for managing co booklets, certain limitations may apply based on your selected pricing plan. Users should review the specific features available in each plan to ensure they meet their co booklet needs.

Get more for Colorado Severance Tax

- Form 1454

- Notice of delegation of authority receipt for supplies da form 1687 nov 2015 ms ng

- Bdc summer professional semester 2016 application form

- Ics eft client authorisation form

- 790c bapplicationb for a safe haven enterprise visa form

- Syndicate entry form worddoc colemantexas

- Fairway ridge at mariana butte hoa ownerlandlordtenant form

- 48 hour notification bccbfaorgb form

Find out other Colorado Severance Tax

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document