Severance TaxForms & InstructionsDepartment of Revenue 2021

Understanding the Colorado Severance Tax

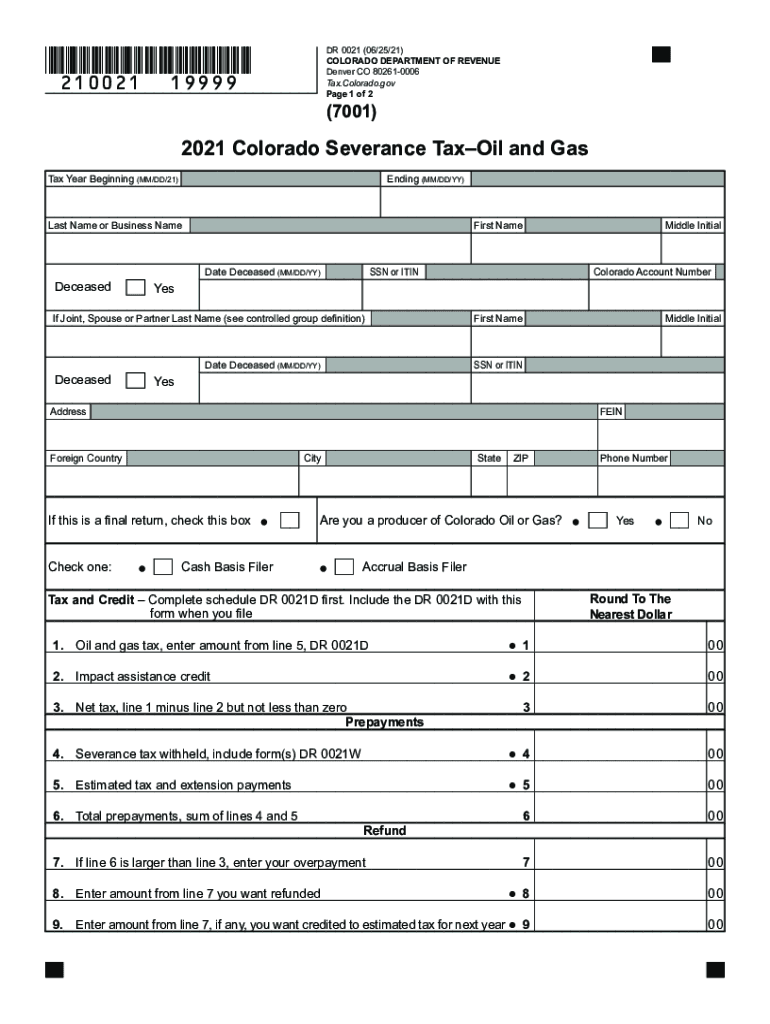

The Colorado severance tax is a tax imposed on the extraction of non-renewable resources such as oil, gas, and minerals. This tax is crucial for funding various state programs and services. It is essential for businesses operating in these sectors to understand their obligations under this tax framework. The Colorado Department of Revenue administers the severance tax and provides the necessary forms and instructions for compliance.

Steps to Complete the Colorado Severance Tax Forms

Completing the Colorado severance tax forms involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial data related to the extraction of resources. This includes production volumes, sales prices, and any deductions applicable under state law. Next, access the appropriate forms, such as the Colorado DR 0021, and fill them out carefully. Ensure that all calculations are accurate, as errors can lead to penalties. Finally, submit the completed forms by the designated deadline to avoid any late fees or compliance issues.

Required Documents for Filing the Colorado Severance Tax

When filing the Colorado severance tax, specific documents are necessary to support your submission. Key documents include production reports, sales invoices, and any contracts related to the extraction of resources. Additionally, businesses may need to provide documentation for any deductions they plan to claim, such as costs associated with production or transportation. Keeping thorough records will facilitate the filing process and help ensure compliance with state regulations.

Penalties for Non-Compliance with Colorado Severance Tax Regulations

Failure to comply with Colorado severance tax regulations can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to stay informed about their filing requirements and deadlines. Regularly reviewing compliance status and maintaining accurate records can help mitigate the risk of non-compliance and the associated penalties.

Filing Deadlines for the Colorado Severance Tax

Timely filing of the Colorado severance tax is critical for avoiding penalties. The filing deadline typically aligns with the end of the month following the quarter in which the resources were extracted. For instance, if resources are extracted in the first quarter, the tax forms must be submitted by the end of April. Businesses should mark these deadlines on their calendars and prepare their documentation in advance to ensure timely submission.

Legal Use of the Colorado Severance Tax Forms

The Colorado severance tax forms are legally binding documents that must be completed accurately to ensure compliance with state tax laws. When filled out correctly, these forms serve as official records of a business's tax obligations. It is crucial to use the most current version of the forms and adhere to the instructions provided by the Colorado Department of Revenue. This ensures that the forms meet all legal requirements and are accepted by the state.

Quick guide on how to complete severance taxforms ampamp instructionsdepartment of revenue

Complete Severance TaxForms & InstructionsDepartment Of Revenue effortlessly on any device

Electronic document management has gained traction among businesses and individuals alike. It serves as a superb eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without holdups. Manage Severance TaxForms & InstructionsDepartment Of Revenue on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Severance TaxForms & InstructionsDepartment Of Revenue with ease

- Find Severance TaxForms & InstructionsDepartment Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would prefer to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Severance TaxForms & InstructionsDepartment Of Revenue and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct severance taxforms ampamp instructionsdepartment of revenue

Create this form in 5 minutes!

How to create an eSignature for the severance taxforms ampamp instructionsdepartment of revenue

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an e-signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it work in Colorado?

airSlate SignNow is an eSignature platform that allows businesses in Colorado to send and sign documents electronically. The process is simple: upload your document, add recipient details, and they can sign it securely online. This streamlines workflows, making it more efficient for companies in Colorado to manage their paperwork.

-

How much does airSlate SignNow cost for businesses in Colorado?

Pricing for airSlate SignNow varies based on the plan you choose. In Colorado, businesses can opt for affordable pricing tiers that accommodate different needs, whether you’re a small startup or a larger corporation. Additionally, there are often discounts available for annual subscriptions.

-

What features does airSlate SignNow offer for users in Colorado?

airSlate SignNow boasts a variety of features tailored to enhance document management for users in Colorado. These include advanced eSignature capabilities, customizable templates, in-app collaboration, and secure storage. This allows Colorado businesses to improve their efficiency and reduce turnaround times.

-

Is airSlate SignNow compliant with laws in Colorado?

Yes, airSlate SignNow is fully compliant with eSignature laws in Colorado, including the Uniform Electronic Transactions Act (UETA) and the ESIGN Act. This means that the eSignatures collected via the platform are legally binding and secure, providing peace of mind for businesses operating in the state.

-

What are the benefits of using airSlate SignNow for companies in Colorado?

Using airSlate SignNow, Colorado companies can enjoy numerous benefits such as increased efficiency, reduced paper usage, and cost savings. The platform allows quick document turnaround, facilitating faster decision-making processes, which is crucial for maintaining a competitive edge in Colorado's diverse business landscape.

-

Can airSlate SignNow integrate with other tools used by businesses in Colorado?

Absolutely! airSlate SignNow easily integrates with various business tools commonly used in Colorado, including CRM systems, payment platforms, and cloud storage services. This flexibility allows Colorado businesses to embed eSignatures seamlessly into their existing workflows, enhancing productivity.

-

How does airSlate SignNow ensure document security for users in Colorado?

airSlate SignNow prioritizes document security by employing industry-standard encryption and secure data storage solutions. For businesses in Colorado, this ensures that all sensitive information remains protected during the signing process and beyond, fostering trust among clients and teams.

Get more for Severance TaxForms & InstructionsDepartment Of Revenue

- Warranty deed from individual to husband and wife missouri form

- Quitclaim deed from corporation to husband and wife missouri form

- Warranty deed from corporation to husband and wife missouri form

- Quitclaim deed from corporation to individual missouri form

- Mo warranty form

- Quitclaim deed from corporation to llc missouri form

- Quitclaim deed from corporation to corporation missouri form

- Warranty deed from corporation to corporation missouri form

Find out other Severance TaxForms & InstructionsDepartment Of Revenue

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template