Kansas Tax Form K 120s 2019

What is the Kansas Tax Form K 120s

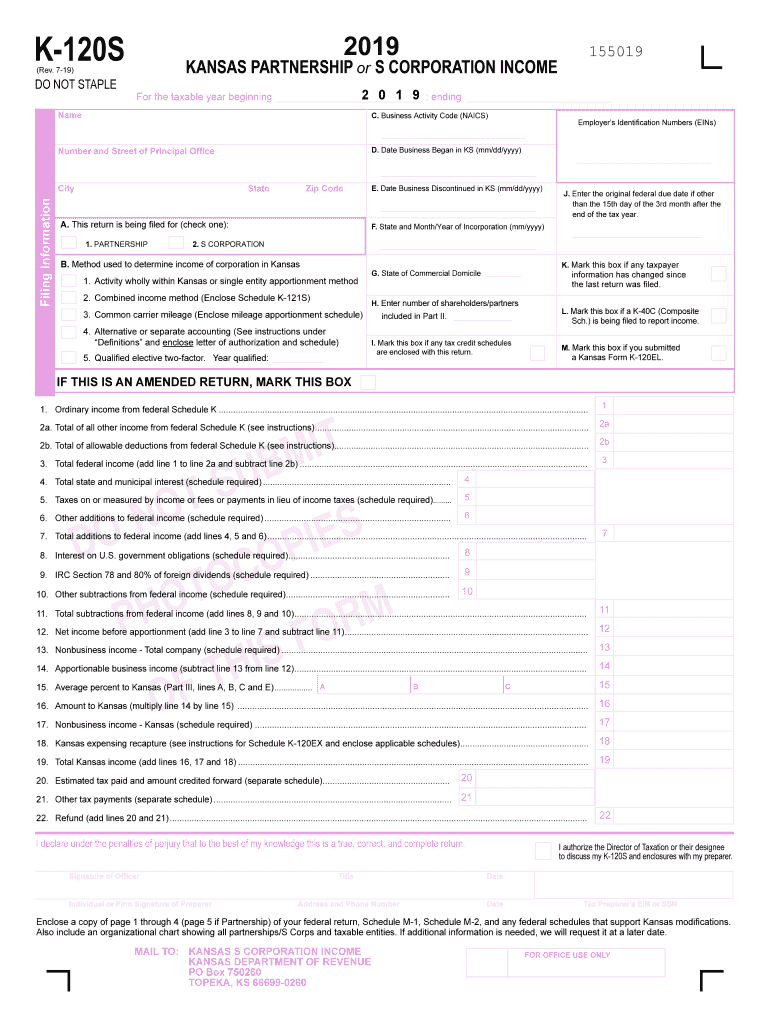

The Kansas Tax Form K 120s is a state-specific tax document designed for S corporations operating within Kansas. This form is essential for reporting income, deductions, and credits, allowing the state to assess the tax obligations of these entities. The K 120s form is particularly important for businesses that have elected to be treated as S corporations under federal tax law, enabling them to pass income directly to shareholders and avoid double taxation at the corporate level.

How to use the Kansas Tax Form K 120s

Using the Kansas Tax Form K 120s involves several steps to ensure accurate reporting of your S corporation's financial activities. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, complete the form by accurately filling in details such as total income, allowable deductions, and tax credits. It is crucial to review the instructions carefully to ensure compliance with state regulations. Once completed, the form must be submitted to the Kansas Department of Revenue by the specified deadline.

Steps to complete the Kansas Tax Form K 120s

Completing the Kansas Tax Form K 120s involves the following steps:

- Gather financial records, including income statements and expense reports.

- Fill out the identification section with your S corporation's name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions in the designated sections.

- Calculate the tax liability based on the instructions provided.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Kansas Tax Form K 120s

The Kansas Tax Form K 120s is legally binding when completed and submitted according to state regulations. It is essential for S corporations to adhere to the guidelines set forth by the Kansas Department of Revenue to ensure that their filings are accepted and processed without issues. Non-compliance with the requirements can lead to penalties or delays in processing. Therefore, understanding the legal implications and maintaining accurate records is crucial for all entities using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Tax Form K 120s are typically aligned with the federal tax deadlines. Generally, S corporations must file their K 120s by the fifteenth day of the third month following the end of their tax year. For corporations operating on a calendar year, this means the due date is March 15. It is important to stay informed about any changes to these deadlines, as late submissions may incur penalties.

Required Documents

To complete the Kansas Tax Form K 120s, several documents are necessary:

- Income statements detailing revenue generated by the corporation.

- Expense reports outlining all deductions claimed.

- Shareholder information, including ownership percentages and distributions.

- Any relevant tax credit documentation.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state requirements.

Quick guide on how to complete instructions for form it 203 nystaxgov

Effortlessly prepare Kansas Tax Form K 120s on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Kansas Tax Form K 120s on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to modify and electronically sign Kansas Tax Form K 120s effortlessly

- Find Kansas Tax Form K 120s and click Get Form to begin.

- Use the available tools to fill out your form.

- Mark pertinent sections of the documents or obscure confidential information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose your method of sharing the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Kansas Tax Form K 120s to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 203 nystaxgov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 203 nystaxgov

How to create an eSignature for the Instructions For Form It 203 Nystaxgov online

How to create an eSignature for the Instructions For Form It 203 Nystaxgov in Chrome

How to make an electronic signature for putting it on the Instructions For Form It 203 Nystaxgov in Gmail

How to make an eSignature for the Instructions For Form It 203 Nystaxgov straight from your smart phone

How to make an eSignature for the Instructions For Form It 203 Nystaxgov on iOS

How to make an eSignature for the Instructions For Form It 203 Nystaxgov on Android

People also ask

-

What are the k 120s instructions 2018 for using airSlate SignNow?

The k 120s instructions 2018 guide provides step-by-step details on how to effectively use airSlate SignNow for sending and eSigning documents. This resource is designed to help users navigate the platform with ease, ensuring they can take full advantage of its features.

-

How can I integrate airSlate SignNow with other tools using the k 120s instructions 2018?

The k 120s instructions 2018 include information on how to integrate airSlate SignNow with various applications like Google Drive and Dropbox. Following these instructions allows for seamless workflow automation, enhancing productivity and collaboration.

-

What pricing options are outlined in the k 120s instructions 2018?

The k 120s instructions 2018 provide an overview of the various pricing plans available for airSlate SignNow. These plans cater to different business sizes and needs, ensuring that you can find a cost-effective solution that fits your budget.

-

What benefits can I expect from following the k 120s instructions 2018?

By adhering to the k 120s instructions 2018, users can unlock numerous benefits including reduced turnaround time on documents and improved efficiency in managing electronic signatures. This ultimately leads to a more streamlined business process.

-

Are there specific features highlighted in the k 120s instructions 2018?

Yes, the k 120s instructions 2018 detail several key features of airSlate SignNow, such as document templates, audit trails, and mobile access. These features enhance user experience and ensure compliance with legal standards.

-

Can the k 120s instructions 2018 help with document security?

Absolutely! The k 120s instructions 2018 emphasize the importance of document security features within airSlate SignNow, including encryption and user authentication. Following these guidelines ensures that sensitive information is protected.

-

Is customer support addressed in the k 120s instructions 2018?

The k 120s instructions 2018 provide information on how to access customer support for airSlate SignNow. This ensures that users can get help quickly whenever they encounter issues or have inquiries, enhancing the overall user experience.

Get more for Kansas Tax Form K 120s

- Fixed term residential lease form

- Residential rental agreement and receipt for deposit rose realty form

- Greater louisville association of realtors form

- Blank tenancy agreement form

- Guide for completing form ab 83f absa absa

- Cra01 form

- Zimbabwe police clearance fingerprint form

- Raarmore reciprocity reciprocal listing packet to have a form

Find out other Kansas Tax Form K 120s

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online