Partnership or S Corporation Income Tax Forms and Instruction Booklet Rev 7 22 2022

Understanding the Kansas K-120S Instructions 2023

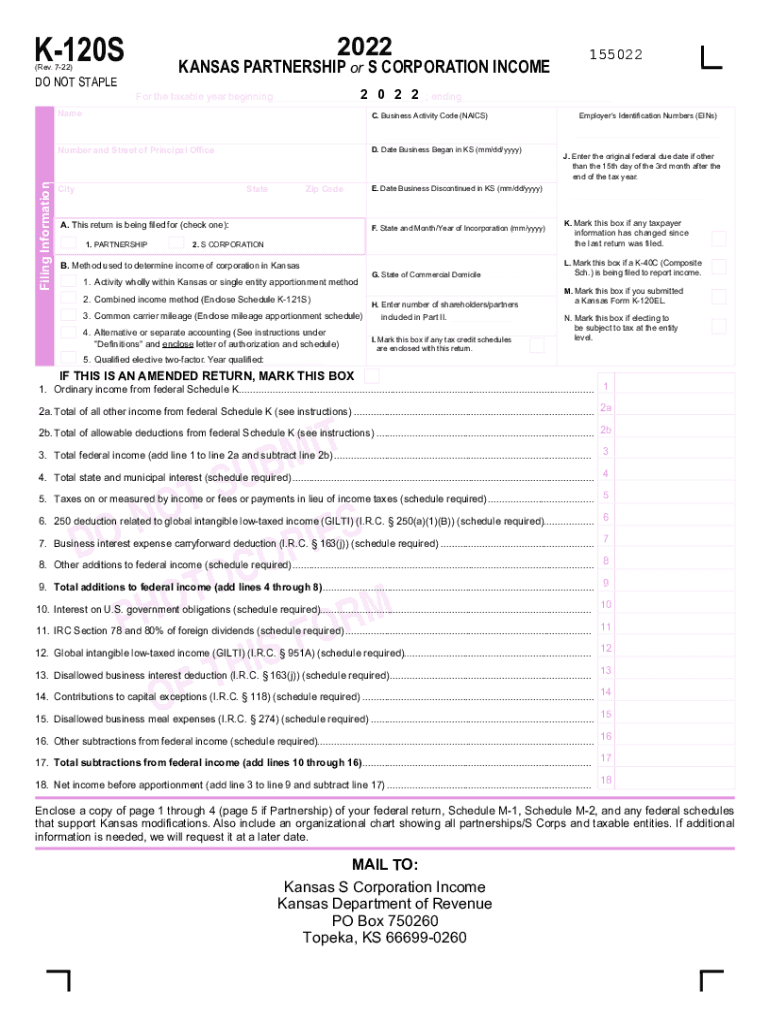

The Kansas K-120S is a crucial document for partnerships and S corporations operating in Kansas. It serves as the state income tax return for these entities. The instructions provided in the 2023 Kansas K-120S booklet detail how to accurately complete the form, ensuring compliance with state tax laws. This document outlines the necessary information required, including income, deductions, and credits specific to Kansas tax regulations.

Steps to Complete the Kansas K-120S Instructions 2023

Completing the Kansas K-120S involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Review the instructions carefully to understand the specific requirements for your entity type.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Double-check all entries for accuracy to avoid penalties or delays in processing.

- Submit the completed form by the designated deadline, either electronically or via mail.

Legal Use of the Kansas K-120S Instructions 2023

The Kansas K-120S instructions are legally binding documents that must be adhered to when filing state income taxes for partnerships and S corporations. Compliance with these instructions ensures that the entity meets its tax obligations and avoids potential legal issues. It is essential to follow the guidelines outlined in the booklet to maintain the validity of the submitted return.

Filing Deadlines for the Kansas K-120S Instructions 2023

Filing deadlines for the Kansas K-120S are critical for compliance. Typically, partnerships and S corporations must submit their returns by the 15th day of the third month following the end of their fiscal year. For most entities operating on a calendar year, this means the return is due on March 15, 2024. Extensions may be available, but they must be requested in advance and filed appropriately.

Required Documents for the Kansas K-120S Instructions 2023

To complete the Kansas K-120S, several documents are required:

- Federal Form 1065 or 1120S, as applicable.

- Schedule K-1 for each partner or shareholder.

- Financial statements detailing income and expenses.

- Any relevant supporting documentation for deductions or credits claimed.

Form Submission Methods for the Kansas K-120S Instructions 2023

The Kansas K-120S can be submitted through various methods:

- Electronically via the Kansas Department of Revenue's online portal.

- By mail, using the address specified in the instructions booklet.

- In-person at designated tax offices, if applicable.

Quick guide on how to complete 2022 partnership or s corporation income tax forms and instruction booklet rev 7 22

Prepare Partnership Or S Corporation Income Tax Forms And Instruction Booklet Rev 7 22 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without complications. Handle Partnership Or S Corporation Income Tax Forms And Instruction Booklet Rev 7 22 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Partnership Or S Corporation Income Tax Forms And Instruction Booklet Rev 7 22 with ease

- Obtain Partnership Or S Corporation Income Tax Forms And Instruction Booklet Rev 7 22 and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Partnership Or S Corporation Income Tax Forms And Instruction Booklet Rev 7 22 to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 partnership or s corporation income tax forms and instruction booklet rev 7 22

Create this form in 5 minutes!

How to create an eSignature for the 2022 partnership or s corporation income tax forms and instruction booklet rev 7 22

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the kansas 120s instructions 2023 for using airSlate SignNow?

The kansas 120s instructions 2023 provide a comprehensive guide to effectively utilizing airSlate SignNow's features for document signing. This includes step-by-step details on setting up your account, sending documents for signatures, and managing completions. Following these instructions will ensure a smooth workflow tailored to your business needs.

-

How much does airSlate SignNow cost for users looking for kansas 120s instructions 2023?

Pricing for airSlate SignNow varies depending on the plan chosen. Typically, there are monthly and annual subscription options available, allowing users to select based on their budget and needs. Utilizing the kansas 120s instructions 2023 ensures that you maximize your investment by understanding all features included in your plan.

-

What features are highlighted in the kansas 120s instructions 2023 for airSlate SignNow?

Key features detailed in the kansas 120s instructions 2023 include eSigning, document templates, bulk sending, and integrations with other applications. These features are designed to enhance efficiency and compliance, making document management simpler and more effective for businesses. Familiarizing yourself with these features will elevate your document workflow.

-

Are there any specific benefits tied to following the kansas 120s instructions 2023?

Following the kansas 120s instructions 2023 allows users to fully leverage airSlate SignNow's capabilities, leading to improved productivity and seamless communication. Additionally, users will reduce errors in document handling, which enhances compliance with legal standards. Ultimately, this leads to a more efficient document signing process.

-

Can the kansas 120s instructions 2023 help with document storage and organization?

Absolutely! The kansas 120s instructions 2023 emphasize the importance of using folders and templates within airSlate SignNow for better document organization. This systematic approach allows users to find, manage, and retrieve documents quickly, thus streamlining workflow and improving operational efficiency.

-

Does airSlate SignNow support integrations relevant to the kansas 120s instructions 2023?

Yes, airSlate SignNow integrates with various applications to enhance functionality as described in the kansas 120s instructions 2023. Examples include CRM systems, cloud storage solutions, and other document management tools. These integrations simplify document workflows and allow users to maintain a centralized system for managing their signatures.

-

How can I ensure my team understands the kansas 120s instructions 2023?

To ensure comprehensive understanding of the kansas 120s instructions 2023, consider conducting training sessions or sharing the guide via team communication platforms. Additionally, utilizing demo accounts for hands-on experience can signNowly enhance learning and facilitate smoother implementation of airSlate SignNow. Providing ongoing support will also encourage team confidence in using the platform.

Get more for Partnership Or S Corporation Income Tax Forms And Instruction Booklet Rev 7 22

- Oil gas mineral form

- Oil gas mineral 497327238 form

- Texas beneficiary 497327239 form

- Disclosure statement form 497327240

- Quitclaim deed from corporation to individual texas form

- Tx corporation search 497327242 form

- General warranty deed 497327243 form

- General warranty deed from trust to two individuals texas form

Find out other Partnership Or S Corporation Income Tax Forms And Instruction Booklet Rev 7 22

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT