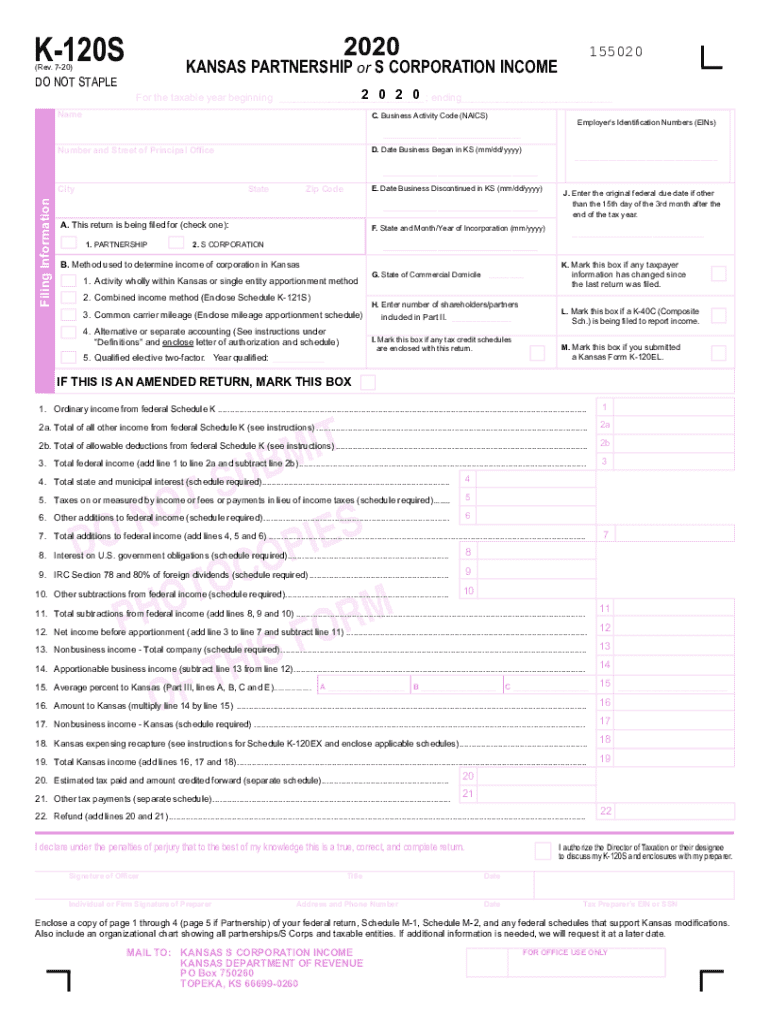

Partnership or S Corporation Income Tax Instruction Booklet Rev 8 20 Partnership or S Corporation Income Tax Instruction Booklet 2020

Understanding the Kansas K-120S Instructions 2018

The Kansas K-120S instructions provide essential guidelines for partnerships and S corporations filing their income tax returns in the state of Kansas. This document outlines the necessary steps to accurately complete the K-120S form, ensuring compliance with state tax regulations. It is crucial for businesses to understand these instructions to avoid errors that could lead to penalties or delays in processing.

Steps to Complete the Kansas K-120S Instructions 2018

Completing the Kansas K-120S form involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Carefully read through the K-120S instructions to understand the specific requirements for your business type.

- Fill out the form accurately, ensuring that all figures are correct and properly calculated.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline, either electronically or via mail, depending on your preference.

Filing Deadlines for the Kansas K-120S 2018

Timely filing of the Kansas K-120S is essential to avoid penalties. The general deadline for filing is the 15th day of the fourth month following the end of the tax year. For most businesses operating on a calendar year, this means the due date is April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

Key Elements of the Kansas K-120S Instructions 2018

The Kansas K-120S instructions include several critical elements that must be understood:

- Eligibility Criteria: Not all businesses qualify to file the K-120S; it is specifically for partnerships and S corporations.

- Required Documents: Ensure you have all necessary documentation, including income statements and other financial records.

- Disclosure Requirements: Certain disclosures must be made regarding income sources and distributions to partners or shareholders.

Legal Use of the Kansas K-120S Instructions 2018

The Kansas K-120S instructions are legally binding and must be followed to ensure compliance with state tax laws. Failure to adhere to these guidelines can result in penalties, including fines or additional taxes owed. It is advisable to consult a tax professional if there are uncertainties regarding the completion of the form or the implications of the instructions.

Obtaining the Kansas K-120S Instructions 2018

The Kansas K-120S instructions can be obtained from the Kansas Department of Revenue's official website or through authorized tax professionals. It is important to ensure that you are using the most current version of the instructions to avoid any discrepancies in your filing.

Quick guide on how to complete 2020 partnership or s corporation income tax instruction booklet rev 8 20 2020 partnership or s corporation income tax

Complete Partnership Or S Corporation Income Tax Instruction Booklet Rev 8 20 Partnership Or S Corporation Income Tax Instruction Booklet effortlessly on any platform

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage Partnership Or S Corporation Income Tax Instruction Booklet Rev 8 20 Partnership Or S Corporation Income Tax Instruction Booklet on any platform with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest way to modify and electronically sign Partnership Or S Corporation Income Tax Instruction Booklet Rev 8 20 Partnership Or S Corporation Income Tax Instruction Booklet with ease

- Obtain Partnership Or S Corporation Income Tax Instruction Booklet Rev 8 20 Partnership Or S Corporation Income Tax Instruction Booklet and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize critical sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome document searches, or mistakes that require reprinting copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Partnership Or S Corporation Income Tax Instruction Booklet Rev 8 20 Partnership Or S Corporation Income Tax Instruction Booklet to ensure excellent communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 partnership or s corporation income tax instruction booklet rev 8 20 2020 partnership or s corporation income tax

Create this form in 5 minutes!

How to create an eSignature for the 2020 partnership or s corporation income tax instruction booklet rev 8 20 2020 partnership or s corporation income tax

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What are the key features of the k 120s instructions 2018?

The k 120s instructions 2018 include streamlined eSigning capabilities, customizable templates, and robust security measures. This ensures that users can efficiently manage their document workflows while maintaining compliance with industry standards. Additionally, the user-friendly interface simplifies the signing process for both senders and recipients.

-

How does the pricing for k 120s instructions 2018 compare to other solutions?

The pricing for k 120s instructions 2018 is competitively positioned to provide value for businesses of all sizes. With affordable monthly plans available, organizations can choose a package that aligns with their document management needs. This cost-effective solution makes it easier for teams to implement eSigning without breaking the bank.

-

Can I integrate k 120s instructions 2018 with other software tools?

Yes, k 120s instructions 2018 offers integrations with popular software such as CRM systems, cloud storage platforms, and project management tools. This interoperability allows businesses to enhance their workflows and streamline document-related tasks. By integrating with existing tools, users can save time and increase productivity.

-

What benefits does the k 120s instructions 2018 provide for remote teams?

The k 120s instructions 2018 provides signNow benefits for remote teams by facilitating seamless eSigning from anywhere. Users can easily send and sign documents online without the need for physical presence, reducing delays in the workflow. This is especially important for organizations with distributed teams that require fast and efficient document processing.

-

Are there any mobile options for accessing k 120s instructions 2018?

Absolutely! The k 120s instructions 2018 are accessible on mobile devices through the airSlate SignNow app. This mobile support ensures that users can sign documents and manage their workflows on-the-go, increasing flexibility and responsiveness. The app maintains all the features of the desktop version, making it a versatile solution.

-

How secure is the k 120s instructions 2018 platform?

The k 120s instructions 2018 platform prioritizes security with advanced encryption protocols and compliance with legal standards. This ensures that all documents remain confidential and protected from unauthorized access. By using secure technology, businesses can trust airSlate SignNow to safeguard their sensitive data during electronic transactions.

-

Can I customize templates in k 120s instructions 2018?

Yes, users can fully customize templates within the k 120s instructions 2018 framework. This feature allows businesses to create branded and personalized documents that meet their specific requirements. Custom templates help enhance professionalism and reinforce brand identity in all communications.

Get more for Partnership Or S Corporation Income Tax Instruction Booklet Rev 8 20 Partnership Or S Corporation Income Tax Instruction Booklet

- Claim of lien by individual mechanics liens washington form

- Quitclaim deed by two individuals to corporation washington form

- Warranty deed from two individuals to corporation washington form

- Washington corporation 497429339 form

- Wa lien form

- Quitclaim deed from individual to corporation washington form

- Warranty deed from individual to corporation washington form

- Brief form template

Find out other Partnership Or S Corporation Income Tax Instruction Booklet Rev 8 20 Partnership Or S Corporation Income Tax Instruction Booklet

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form