Rev 1667 2017-2026

What is the Rev 1667

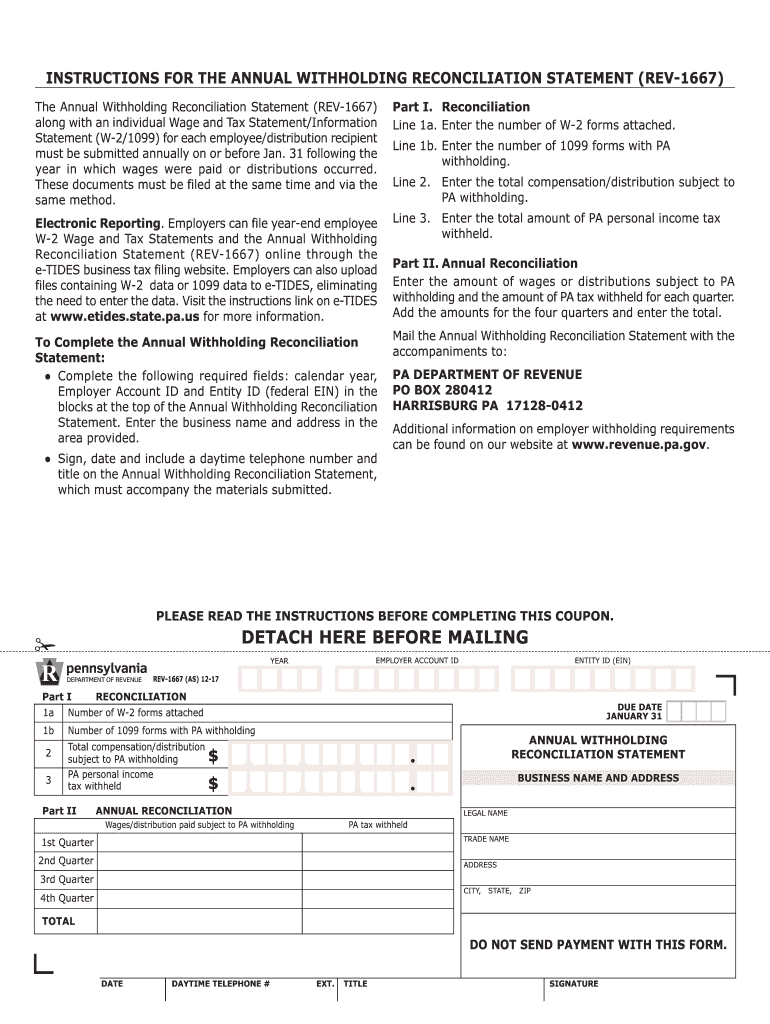

The Rev 1667 form is a crucial document used in Pennsylvania for reporting state income tax withholding. It serves as a reconciliation form for employers to summarize the total amount of state income tax withheld from employees' wages during the tax year. This form is essential for ensuring compliance with Pennsylvania tax regulations and helps facilitate accurate tax reporting for both employers and employees.

How to use the Rev 1667

Using the Rev 1667 form involves several straightforward steps. Employers must gather all necessary payroll records to determine the total state income tax withheld. Once the data is compiled, employers fill out the Rev 1667, ensuring all required fields are accurately completed. After filling out the form, it should be submitted to the Pennsylvania Department of Revenue by the specified deadline to avoid any penalties.

Steps to complete the Rev 1667

Completing the Rev 1667 form requires careful attention to detail. Here are the steps to follow:

- Collect payroll records for the entire tax year.

- Calculate the total amount of state income tax withheld from each employee's wages.

- Fill in the employer information, including name, address, and tax identification number.

- Enter the total withholding amounts in the designated sections of the form.

- Review the completed form for accuracy.

- Submit the form to the Pennsylvania Department of Revenue by the deadline.

Legal use of the Rev 1667

The Rev 1667 form must be used in accordance with Pennsylvania state tax laws. It is legally required for employers to file this form if they withhold state income tax from employees. Failure to submit the form can result in penalties, including fines and interest on unpaid taxes. Ensuring compliance with the legal requirements surrounding the Rev 1667 is essential for maintaining good standing with state tax authorities.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Rev 1667 form. Typically, the form is due by the last day of January following the end of the tax year. It is crucial to submit the form on time to avoid penalties. Employers should also keep track of any changes in deadlines announced by the Pennsylvania Department of Revenue, as these can vary from year to year.

Who Issues the Form

The Rev 1667 form is issued by the Pennsylvania Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among employers and taxpayers. Employers can obtain the form directly from the department's website or through official state tax publications to ensure they are using the most current version.

Penalties for Non-Compliance

Non-compliance with the Rev 1667 filing requirements can lead to significant penalties. Employers who fail to file the form by the deadline may incur fines, which can accumulate over time. Additionally, interest may be charged on any unpaid tax amounts. It is essential for employers to understand these potential consequences and take proactive steps to ensure timely and accurate filing of the Rev 1667 form.

Quick guide on how to complete rev 1667

Complete Rev 1667 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the correct form and securely keep it online. airSlate SignNow equips you with the essential tools to create, edit, and electronically sign your documents promptly without any delays. Manage Rev 1667 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to edit and electronically sign Rev 1667 with ease

- Obtain Rev 1667 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Rev 1667 and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rev 1667

Create this form in 5 minutes!

How to create an eSignature for the rev 1667

How to create an electronic signature for the Rev 1667 in the online mode

How to make an electronic signature for your Rev 1667 in Chrome

How to generate an eSignature for signing the Rev 1667 in Gmail

How to make an eSignature for the Rev 1667 right from your mobile device

How to generate an electronic signature for the Rev 1667 on iOS devices

How to generate an electronic signature for the Rev 1667 on Android OS

People also ask

-

What is Rev 1667 and how does it relate to airSlate SignNow?

Rev 1667 is a comprehensive solution offered by airSlate SignNow that enables businesses to send and eSign documents efficiently. This feature enhances workflow automation by allowing users to manage documents easily and securely, ensuring that all signing processes are streamlined and user-friendly.

-

How does Rev 1667 improve the eSigning process?

Rev 1667 improves the eSigning process by providing a seamless interface for users to send, sign, and receive documents without hassle. With its intuitive design, airSlate SignNow ensures that users can complete transactions quickly, reducing turnaround times and enhancing productivity across organizations.

-

What are the pricing options for Rev 1667 with airSlate SignNow?

airSlate SignNow offers competitive pricing for Rev 1667, allowing businesses of all sizes to benefit from its features. You can choose from various subscription plans that cater to different needs, ensuring that you get the best value for your investment in document management and eSigning.

-

What features are included in Rev 1667?

Rev 1667 includes a robust set of features such as customizable templates, in-person signing, and document tracking. These features enable users to tailor their eSigning experience according to their specific needs, making airSlate SignNow a versatile solution for businesses.

-

Is Rev 1667 suitable for small businesses?

Yes, Rev 1667 is highly suitable for small businesses looking for an affordable and efficient eSigning solution. With its user-friendly interface and scalable pricing plans, airSlate SignNow provides small businesses with the tools they need to manage their documents effectively.

-

Can Rev 1667 integrate with other software?

Absolutely! Rev 1667 by airSlate SignNow integrates seamlessly with various software applications, enhancing your existing workflows. Whether you're using CRM tools, project management software, or cloud storage solutions, airSlate SignNow can connect with them to streamline your document processes.

-

What benefits does Rev 1667 provide for businesses?

Rev 1667 offers several benefits, including faster document turnaround times, improved compliance, and enhanced security. By leveraging airSlate SignNow, businesses can ensure that their document transactions are not only efficient but also secure and legally binding.

Get more for Rev 1667

Find out other Rev 1667

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself