Pennsylvania W2 2015

What is the Pennsylvania W-2?

The Pennsylvania W-2 is a tax form that employers in Pennsylvania are required to issue to their employees. This form reports an employee's annual wages and the taxes withheld from their paychecks throughout the year. It is essential for employees to accurately file their state income tax returns. The Pennsylvania W-2 includes critical information such as the employee's Social Security number, the employer's identification details, and the total amount of state income tax withheld. Understanding this form is crucial for both employees and employers to ensure compliance with state tax laws.

How to use the Pennsylvania W-2

Using the Pennsylvania W-2 involves several steps. First, employees should receive their W-2 from their employer by the end of January each year. Once received, employees should verify that all information is correct, including personal details and income amounts. This form is then used to complete the Pennsylvania state income tax return. Employees will need to input the information from the W-2 into their tax software or paper forms to calculate their tax liability or refund. Proper use of the W-2 ensures accurate reporting and compliance with state tax regulations.

Steps to complete the Pennsylvania W-2

Completing the Pennsylvania W-2 involves a straightforward process. Employers must gather the necessary information about each employee, including their full name, address, and Social Security number. Next, they need to calculate the total wages paid to each employee and the amount of state income tax withheld. This information is then entered into the appropriate sections of the W-2 form. After completing the form, employers must provide copies to their employees and submit the required information to the Pennsylvania Department of Revenue, ensuring that all deadlines are met to avoid penalties.

Key elements of the Pennsylvania W-2

The Pennsylvania W-2 contains several key elements that are vital for both employees and employers. These include:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Employer's name, address, and identification number.

- Wages and Tips: Total wages earned by the employee during the tax year.

- Tax Withheld: Amount of state income tax withheld from the employee's paychecks.

Each of these elements plays a significant role in ensuring accurate tax reporting and compliance with Pennsylvania tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Pennsylvania W-2 are crucial for both employers and employees to keep in mind. Employers must provide W-2 forms to their employees by January 31 of each year. Additionally, employers must submit W-2 forms to the Pennsylvania Department of Revenue by the last day of February if filing by paper, or by March 31 if filing electronically. Employees should aim to file their state income tax returns by April 15 to avoid any late fees or penalties. Staying aware of these deadlines helps ensure compliance and timely processing of tax returns.

Penalties for Non-Compliance

Failure to comply with Pennsylvania W-2 filing requirements can result in significant penalties for employers. These penalties may include fines for late filing, incorrect information, or failure to provide W-2 forms to employees. The Pennsylvania Department of Revenue may impose a penalty of up to $500 for each W-2 form that is not filed correctly or on time. Additionally, employees who do not receive their W-2 forms may face challenges in filing their tax returns accurately, potentially leading to delays and further penalties. Understanding these consequences emphasizes the importance of timely and accurate filing.

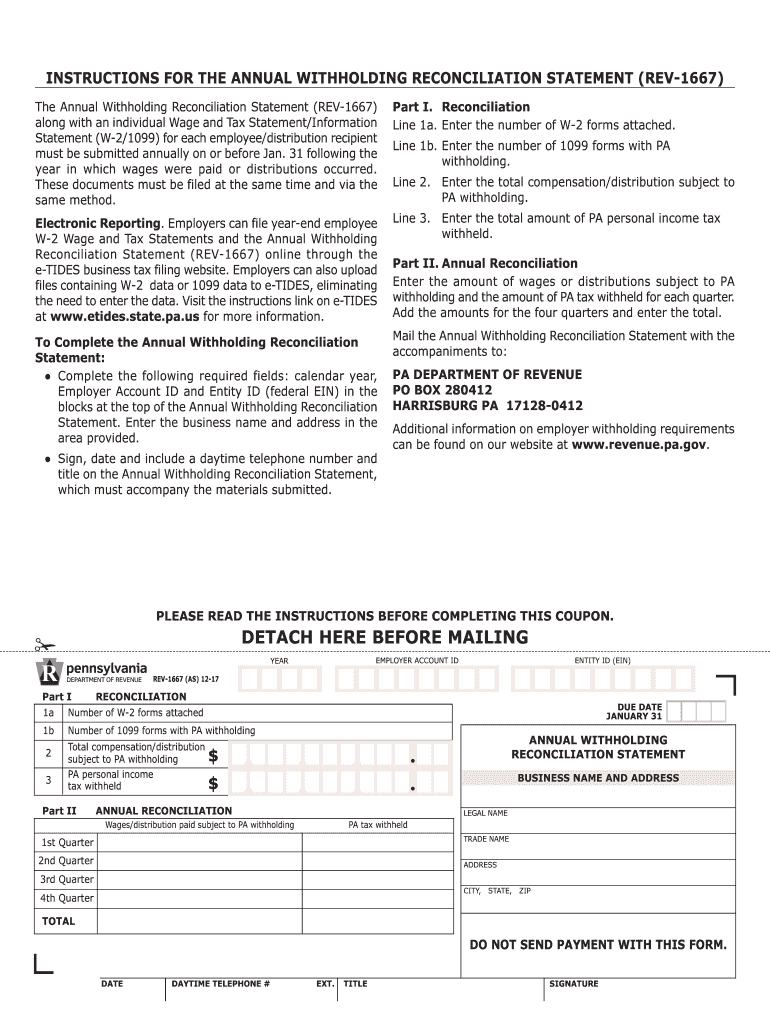

Quick guide on how to complete rev 1667 2015 2019 form

Effortlessly Complete Pennsylvania W2 on Any Device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Pennsylvania W2 on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related processes today.

The Easiest Way to Modify and eSign Pennsylvania W2 with Ease

- Locate Pennsylvania W2 and click on Get Form to begin.

- Make use of the tools provided to fill out your document.

- Highlight important sections of the document or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Pennsylvania W2 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rev 1667 2015 2019 form

Create this form in 5 minutes!

How to create an eSignature for the rev 1667 2015 2019 form

How to make an electronic signature for your Rev 1667 2015 2019 Form in the online mode

How to make an eSignature for the Rev 1667 2015 2019 Form in Chrome

How to generate an eSignature for putting it on the Rev 1667 2015 2019 Form in Gmail

How to make an eSignature for the Rev 1667 2015 2019 Form right from your smart phone

How to create an electronic signature for the Rev 1667 2015 2019 Form on iOS devices

How to generate an eSignature for the Rev 1667 2015 2019 Form on Android devices

People also ask

-

What is the rev 1667 form pa and how is it used?

The rev 1667 form pa is a tax document used in Pennsylvania for various purposes, including income tax reporting. It allows individuals and businesses to correctly document and file their state taxes. Understanding how to fill out this form correctly is essential for ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the rev 1667 form pa?

airSlate SignNow provides a user-friendly platform to easily prepare, send, and eSign the rev 1667 form pa securely. Our digital signature technology ensures that your documents are legally compliant, speeding up the process of filing and reducing the hassle of paperwork. You can store and manage your documents efficiently within our platform.

-

Is there a cost associated with using airSlate SignNow for the rev 1667 form pa?

Yes, airSlate SignNow offers various pricing plans tailored to fit your needs, whether you are an individual or a business preparing the rev 1667 form pa. Our plans are affordable and provide a comprehensive solution for managing your document signing processes. You can choose a plan that best meets your volume of document needs.

-

What features does airSlate SignNow offer for managing the rev 1667 form pa?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time tracking for the rev 1667 form pa. Additionally, you can collaborate with multiple parties and automate document workflows, making it easier to manage tax forms efficiently. These features enhance productivity and reduce turnaround times.

-

Can I integrate airSlate SignNow with other software for filing the rev 1667 form pa?

Yes, airSlate SignNow seamlessly integrates with various software tools, making it simpler to file the rev 1667 form pa. You can connect our platform with CRM systems, accounting software, and other applications, streamlining your workflow. This integration capability enables you to manage all aspects of your document signing and filing efficiently.

-

What are the benefits of using airSlate SignNow for the rev 1667 form pa?

Using airSlate SignNow for the rev 1667 form pa offers numerous benefits, such as improved efficiency, enhanced security, and time savings. The platform allows for quick eSigning and sharing of documents while maintaining compliance with legal standards. These advantages help you focus on your core business tasks rather than administrative paperwork.

-

How secure is airSlate SignNow when dealing with the rev 1667 form pa?

airSlate SignNow prioritizes security with advanced encryption methods and compliance with leading industry standards, ensuring that your rev 1667 form pa and other documents are safe. We implement rigorous security measures to protect your sensitive information during the signing process. You can confidently use our platform knowing that your data is well-protected.

Get more for Pennsylvania W2

- Form ps 3811

- Us postal service login siteuspscom sitegov form

- Dependent verification worksheet chapman university chapman form

- Cheyney university transcripts form

- Grade of wn reversal application the jay stop jstop jjay cuny form

- Medical accommodation form

- Auditing classes at cuny seniors form

- Camera report template form fill out and sign printable pdf template

Find out other Pennsylvania W2

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation