Form CPN 8 Irrevocable Funeral Trust Agreement for State

What is the irrevocable funeral trust form?

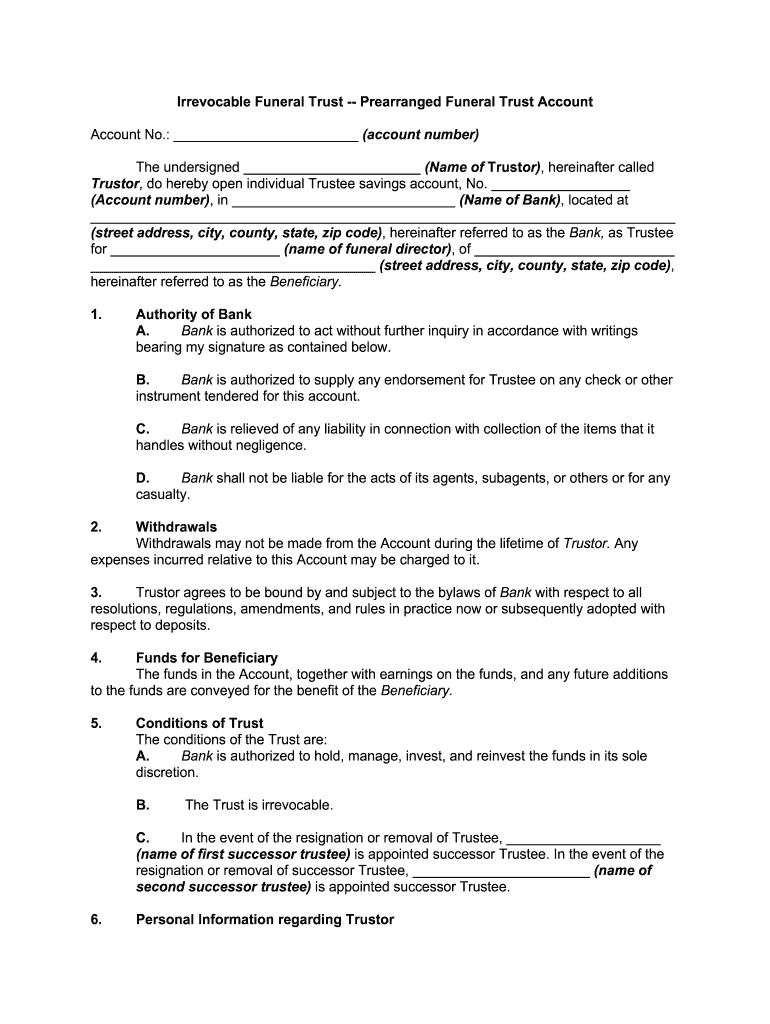

The irrevocable funeral trust form is a legal document designed to set aside funds for funeral expenses. This form establishes a trust account that cannot be altered or revoked once created, ensuring that the funds are dedicated solely for funeral costs. By using this form, individuals can prearrange their funeral services, alleviating the financial burden on their loved ones during a difficult time.

Key elements of the irrevocable funeral trust form

Several critical components define the irrevocable funeral trust form:

- Trustee Information: The form requires details about the appointed trustee, who will manage the trust funds.

- Beneficiary Designation: It specifies the individual or entity that will benefit from the trust, typically the funeral service provider.

- Funding Amount: The total amount designated for the funeral expenses must be clearly stated.

- Terms and Conditions: The form outlines the conditions under which the funds can be accessed and used.

- Signature Requirements: Signatures from the grantor and possibly witnesses are necessary to validate the document.

Steps to complete the irrevocable funeral trust form

Filling out the irrevocable funeral trust form involves several steps:

- Gather Required Information: Collect personal information, including names, addresses, and contact details for all parties involved.

- Specify Funding Amount: Determine the amount to be allocated for funeral expenses and ensure it meets the provider's requirements.

- Designate a Trustee: Choose a trustworthy individual or institution to oversee the trust.

- Review Terms: Carefully read the terms and conditions to understand the limitations and obligations of the trust.

- Sign the Form: Ensure all required signatures are obtained, including those of witnesses if necessary.

Legal use of the irrevocable funeral trust form

The irrevocable funeral trust form serves a vital legal purpose, ensuring that funds set aside for funeral expenses are protected from creditors and cannot be accessed for any other purpose. This legal framework helps families manage financial obligations related to end-of-life arrangements, providing peace of mind. Compliance with state laws governing trusts is essential for the form to be considered valid and enforceable.

Eligibility criteria for the irrevocable funeral trust form

Eligibility to create an irrevocable funeral trust typically includes:

- Being of legal age, which is generally eighteen years or older.

- Having the financial means to fund the trust adequately.

- Understanding the implications of creating an irrevocable trust, including the inability to alter or revoke the trust once established.

How to obtain the irrevocable funeral trust form

The irrevocable funeral trust form can be obtained through various channels:

- Funeral Service Providers: Many funeral homes offer the form as part of their preplanning services.

- Legal Professionals: Attorneys specializing in estate planning can provide the form and guidance on how to complete it.

- Online Resources: Some websites may offer downloadable versions of the form, ensuring it meets state-specific requirements.

Quick guide on how to complete form cpn 8 irrevocable funeral trust agreement for state

Complete Form CPN 8 Irrevocable Funeral Trust Agreement For State effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the appropriate format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form CPN 8 Irrevocable Funeral Trust Agreement For State on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form CPN 8 Irrevocable Funeral Trust Agreement For State effortlessly

- Obtain Form CPN 8 Irrevocable Funeral Trust Agreement For State and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, lengthy form navigation, or errors that require reprinting new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your preference. Alter and electronically sign Form CPN 8 Irrevocable Funeral Trust Agreement For State and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form cpn 8 irrevocable funeral trust agreement for state

How to create an eSignature for your Form Cpn 8 Irrevocable Funeral Trust Agreement For State online

How to make an eSignature for your Form Cpn 8 Irrevocable Funeral Trust Agreement For State in Google Chrome

How to make an eSignature for putting it on the Form Cpn 8 Irrevocable Funeral Trust Agreement For State in Gmail

How to create an eSignature for the Form Cpn 8 Irrevocable Funeral Trust Agreement For State straight from your smart phone

How to make an eSignature for the Form Cpn 8 Irrevocable Funeral Trust Agreement For State on iOS devices

How to generate an eSignature for the Form Cpn 8 Irrevocable Funeral Trust Agreement For State on Android OS

People also ask

-

What is an irrevocable funeral trust?

An irrevocable funeral trust is a financial arrangement designed to cover funeral expenses, ensuring that funds are set aside and cannot be altered or withdrawn. This type of trust protects assets from being counted for Medicaid eligibility, making it a strategic option for end-of-life planning.

-

How does an irrevocable funeral trust work?

An irrevocable funeral trust works by allowing individuals to set aside funds specifically for their funeral expenses. Once the trust is established and funded, it becomes permanent, meaning the terms cannot be changed, ensuring that the designated amount is available for funeral services when needed.

-

What are the benefits of using an irrevocable funeral trust?

The main benefits of using an irrevocable funeral trust include asset protection for Medicaid eligibility and peace of mind that funds will be available for your funeral. Additionally, it prevents burdening family members with financial responsibilities during a difficult time.

-

How much does an irrevocable funeral trust cost?

The cost of setting up an irrevocable funeral trust can vary depending on the funeral home or financial institution processing the trust. Generally, you can expect to pay for the funeral services in advance along with any administrative fees, but the overall investment can help save family members from future financial stress.

-

Can I customize an irrevocable funeral trust?

While you cannot change the terms of an irrevocable funeral trust once it is established, you can customize the initial arrangements and specify the funeral services desired. This includes choices such as burial or cremation, casket selection, and other services based on personal preferences.

-

Do I need a lawyer to set up an irrevocable funeral trust?

It's not strictly necessary to hire a lawyer to establish an irrevocable funeral trust, but it can be beneficial to consult with a professional familiar with trusts and estate planning. A legal expert can help ensure the trust is set up correctly and complies with state laws.

-

How do I fund an irrevocable funeral trust?

Funding an irrevocable funeral trust typically involves making a lump-sum payment to the trust account or through periodic contributions. The funds will be held in the trust and earmarked for future funeral expenses, providing security for your end-of-life plans.

Get more for Form CPN 8 Irrevocable Funeral Trust Agreement For State

Find out other Form CPN 8 Irrevocable Funeral Trust Agreement For State

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure