Form Cm 2 1995

What is the Form Cm 2

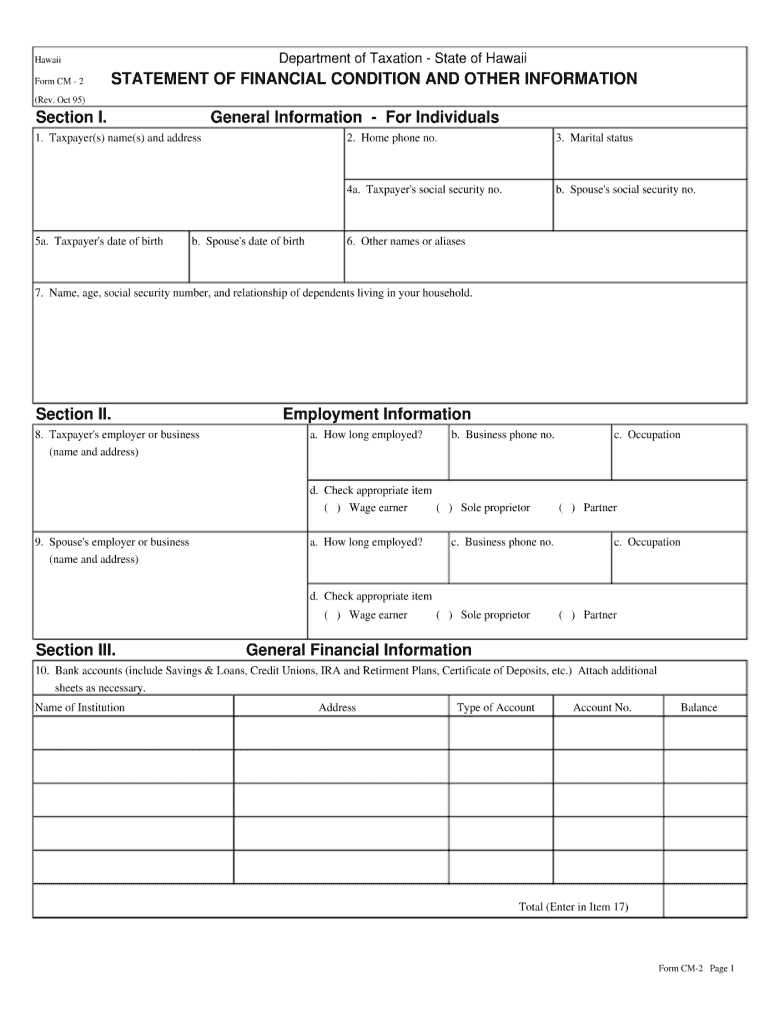

The Form Cm 2 is a specific document used for various administrative purposes, often related to tax reporting and compliance. This form is designed to collect essential information from individuals or businesses to ensure proper processing by relevant authorities. Understanding the purpose and requirements of the Form Cm 2 is crucial for accurate completion and submission.

How to use the Form Cm 2

Using the Form Cm 2 involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant personal or business information required for the form. Next, carefully fill out each section, ensuring that all fields are completed as needed. After completing the form, review it for any errors or omissions before signing. Finally, submit the form according to the specified submission methods.

Steps to complete the Form Cm 2

Completing the Form Cm 2 involves a systematic approach:

- Gather necessary documents, such as identification and financial records.

- Carefully read the instructions provided with the form.

- Fill in the required fields, ensuring accuracy and clarity.

- Review the completed form for any mistakes or missing information.

- Sign and date the form where required.

- Choose the appropriate submission method: online, by mail, or in person.

Legal use of the Form Cm 2

The legal use of the Form Cm 2 is governed by specific regulations and guidelines. It is essential to ensure that the form is filled out truthfully and accurately, as any discrepancies can lead to legal repercussions. Compliance with federal and state laws is necessary to validate the form's use, particularly in tax-related matters.

Filing Deadlines / Important Dates

Filing deadlines for the Form Cm 2 vary depending on the specific purpose of the form. It is important to be aware of these dates to avoid penalties or late fees. Generally, forms related to tax submissions have specific annual deadlines, while other forms may have different timelines based on the issuing authority. Always check the latest guidelines to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Form Cm 2 can be submitted through various methods, including:

- Online: Many forms can be submitted electronically through official websites, providing a quick and efficient option.

- Mail: Printed forms can be sent via postal service. Ensure that the correct address is used for submission.

- In-Person: Some forms may need to be submitted directly to a designated office. Check local requirements for details.

Quick guide on how to complete form cm 2

Your assistance manual on how to prepare your Form Cm 2

If you’re eager to learn how to finalize and submit your Form Cm 2, here are some brief instructions on how to simplify tax processing.

To begin, all you need to do is create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to edit, create, and complete your income tax forms with ease. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and return to modify details as necessary. Streamline your tax management with sophisticated PDF editing, eSigning, and intuitive sharing capabilities.

Follow the steps below to finish your Form Cm 2 in just minutes:

- Set up your account and start working on PDFs within a few minutes.

- Utilize our catalog to find any IRS tax document; browse through versions and schedules.

- Click Get form to access your Form Cm 2 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if needed).

- Examine your file and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing by mail can lead to mistakes in returns and delay reimbursements. Of course, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form cm 2

FAQs

-

How can I get a Vietnamese visa on arrival?

Holidays or spending vacation out somewhere in a foreign land is one of the ways majority of tourists love to spend at. Spending vacation in a faraway place brings refreshment from a monotonous life. But sometimes it is not possible to spend a great amount of money on a luxurious trip and so few places that fit in your budget seem good. Vietnam is among one such place that is attracting tourists day by day. So are you up for holidays and looking forward to spend some quality time with your friends or family on a trip to Vietnam?Vietnam Visa is required for most of the foreigners for entry and exit from the three international airports of Vietnam; Da Nang, Hanoi, and Ho Chi Minh City.But one thing that you might be wondering is how to get Visa on arrival. Continue reading to know how can apply for Visa on arrival for Vietnam.How to Apply for Vietnam Visa on Arrival:Things have been made much easier now for tourists as now you don’t need to bother about getting Visas before handed. Visa on arrival has made things much easier and worry free now. You just need to follow simple steps and instructions and you are done with the process.Visa on arrival application Form: Before departure tourists are advised to arrange for Vietnam Visa. For this they need to apply online for the “Approval Letter” first. Then they receive a letter by email, and then on their passports they get Visa stamped on arriving at Vietnam Airport. This is known as “Visa on Arrival”. You get the approval letter within two days.First you have to fill up the entry and exit form. You can complete the fill up process before arriving on Vietnam’s International airport to save time. Click the link here “Visa form” to download the PDF form and then take a print out to fill up. For photo requirements see the document notes.Tourist/Business Visa: First fill out this easy ‘’application form” online. For this you will need to know at which airport you will be arriving and also the arrival date.Next through online only you will have pay the servicing fee for Visa.Then within next two days after this you will receive an email of the official Approval Letter of Vietnam Visa, issued by the Immigration Department of Vietnam.Then download and print the Approval letter. According to noted instruction on the letter arrange two (4x6) cm photos of yourself.Then bring all of these photos, Approval Letter, and the stamping fee of the Government along with any other necessary documents and passport with on your Vietnam trip.Once you arrive at the destination on your allotted Vietnam airport, you have the show the approval letter and the photo at the Immigration office.Pick up Visa at the Airport: On landing you will get to see Visa on Arrival office or landing visa counter. Then hand over the passport, copy of the approval letter, and one stamp size photo of yours.Stamping fee that you need to pay is 25 for single entry, and for multiple entry $50. Then you get back your passport along with Visa.This is how you can get Visa on arrival for Vietnam. Once all the procedures are done enjoy a lovely trip to Vietnam. The process area easy and smooth so no worries just follow the above instruction carefully and go through them as it is said, fill up the form correctly and you are all done.

-

How do you make a perfectly round burger? This has puzzled me for years, and still can’t get it.

I have collected a nested set of leftover plastic lids in one of my kitchen drawers. The largest one was saved from one of those 32 ounce containers of cashews. Or mixed nuts. No matter, as it’s a big lid of about 4.25 inches or 11 cm, and is a perfect size for a burger that shrinks to fit the usual burger bun. The smaller lids are for the occasions I’m feelin’ kitchen frisky and step up to the extra time to make baby burgers or sliders as named by some folks. Who needs a burger press when you can virtuously up-cycle a plastic lid?Now I betcha you’re wondering how a lid is going to work without making a mess. Most of the time I’m making burgers ahead and freezing them because I’m processing a grocery deal on bulk ground beef. Fix it and freeze it!The burger mixture is divided usually into “quarter pounders” or 5 parts from a pound if I’m stretching the meat. 8 parts if I’m heading toward baby burgers. A square of clear wrap near 3x’s the lid width is nested into the lid. The pressed ball of ground meat is then flattened firmly into the lid to fill out to the edges and a small indentation is pressed at center for less swelling later during grilling. Sometimes I need to add a little or take a little of the mix if the lid, also functioning as a measure, shows the ground meat portion isn’t quite sufficient or too much. A quick yank on the edges of the wrap pulls the new patty out of the lid form leaving no mess behind. The excess wrap is then folded over the top and smoothed to cover, then placed on a cookie sheet to freeze hard. Later, the individually wrapped patties are stacked into a labeled ’n dated freezer zip bag and tucked into our chest freezer.The patties are near perfect in a round, but, more importantly, they’re very even in thickness meaning they’ll cook for the same amount of time. Hard-pressed to about 1/2 inch, deeply chilled or frozen, they hold together well and end up with the crispy edges I love. Bon appetit!

-

How do I get a tourist Visa for Vietnam if I am an Indian?

A2A.Indian passport holders need a visa to visit Vietnam. But you do not need to visit the embassy for a visa. Here is how to do it.Firstly, you need to get a Vietnam visa approval letter from one of the immigration approved travel agents like Vietnam-Visa. This can be done online by visiting their website.After you have applied for the visa approval letter online, in two or three days the travel agency will email you a letter from immigration department. You have to print that letter at home and when you signNow the airport in Vietnam, you need to show this letter along with your passport and the application form. A stamping fee is charged depending on the type of visa you applied for.Do remember that, officially this type of Vietnam online visa is not Vietnam visa on arrival nor is it called Vietnam e-visa.https://www.addsomecurry.com/a-s...A Vietnam tourist visa is required for all Indian passport holders visiting Vietnam on leisure trip regardless of length of their stay in the country.The very first option to obtain a valid tourist visa to Vietnam for Indian citizens is to obtain a Vietnam Visa on Arrival which has been preferred by a lot of travelers around the world for its convenience, simplicity, fast processing and time saving.Holders of this kind of visa are allowed to enter Vietnam through any of 5 international airports in Hanoi, Hai Phong, Da Nang, Khanh Hoa and Ho Chi Minh City.With this option, travelers will need to apply online to get a Visa Approval Letter beforehand and then get visa stamped upon their arrival at Vietnam airport.01. Submit Application02. Get Approval Letter Via Email03. Get Visa Stamped upon ArrivalVisit this site for online application, Detailed Guide To Get Vietnam Visa For Citizens Of India

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How perfect is roundness in a neutron star?

That a neutron star has a fractal like surface is extremely unlikely, due to the extreme gravitational potentials that exist. The surface gravity may be approaching [math]10^{11} g[/math]. It's high enough that general relativistic corrections matter in fact, making the gravity even stronger. The gravitational redshift at the surface probably approaches 10%.Delicate self-similar scale invariant structures such as fractals simply could not hold up against such strong gravity. Small structures would tend to break under the gravity - since the higher surface to volume ratio makes them weaker and favours them breaking and then piling up on top of each other, thus reducing the overall height and increasing the binding energy.Yet neutron stars are probably not completely round, which is to say, they are not completely spherical. But the scale along the circumference at the surface of the largest deviations from sphericity must be very large, and the elevations also small.The first few meters up to the first few hundred meters of the surface of a neutron star consist almost certainly of a highly degenerate electron gas containing a one component plasma of finite nuclei that are however completely ionized by high temperature and pressure.Densities in the upper crust would be on the order of [math]10^{13}\text{gm/cm^3}[/math], so that atomic nuclei would occupy less volume than the total. As one goes deeper and deeper into the crust, which might extend to a kilometer or so deep, those nuclei would be expected to become larger and larger on average and more neutron rich, and free neutrons would begin to fill the space between the nuclei. At the bottom of the crust, probably on the order of 1 km or so inside the star, densities would approach [math]10^{14} \text{gm/cm^3}[/math], so that nuclei would be taking most of the space.It is thought that the nuclei may form a crystalline structure in the crust with a basic body centered cubic structure, which minimizes Coulomb repulsion between the positively charged nuclei. But this is to some extent a guess. Pressure and density are clearly enormously high making any estimates of the breaking strain of such a solid crystalline crust extremely uncertain. But the breaking strain of the crust is what determines the maximum possible deviation from sphericity, that is from the equality of all three moments of inertia of the star, by comparison with the gravitational strain.Theoretical estimates of various kinds have been done, and some suggest that the overall asphericity of a neutron star might approach as much as a 2-3 parts in a million.This would mean for a canonical neutron star radius of 20 km that the "mountains" might approach as much as 5 cm in height. These mountains would be enormously large at their bases in comparison to the size of the neutron star so it would be more like an overall deformation of the shape away from spherical than a tiny little bump a few cm high and a few cm wide.On smaller scales, right near the very surface of the crust, the state of the matter could be different than deep in the crust and it's conceivable that there could be tiny ripples there on much smaller scales, with heights topping out at 5 mm or so. But these would not signNowly affect the asphericity.It has been hypothesized that the sudden shifts in pulsar frequencies that are sometimes observed, are the result of the collapse of such "mountains" in the crust, causing neutron star "quakes" that change the moments of inertia of the star and thus affect its rotation.But the modelling of this physics is so tough that I do not believe it can be said that the phenomena are really understood.

Create this form in 5 minutes!

How to create an eSignature for the form cm 2

How to make an electronic signature for your Form Cm 2 in the online mode

How to generate an electronic signature for the Form Cm 2 in Google Chrome

How to create an eSignature for signing the Form Cm 2 in Gmail

How to generate an eSignature for the Form Cm 2 right from your mobile device

How to generate an eSignature for the Form Cm 2 on iOS

How to create an eSignature for the Form Cm 2 on Android devices

People also ask

-

What is Form Cm 2 and how does it work with airSlate SignNow?

Form Cm 2 is a specific document format that can be easily created, edited, and signed using airSlate SignNow. Our platform allows users to upload Form Cm 2, customize it to their needs, and send it for electronic signature, streamlining the signing process and enhancing document management.

-

Is there a cost associated with using Form Cm 2 in airSlate SignNow?

Yes, while airSlate SignNow offers a range of pricing plans, using Form Cm 2 is included within these plans. We provide various subscription options that cater to different business needs, ensuring you get the best value when using Form Cm 2 for your document signing.

-

What features does airSlate SignNow offer for Form Cm 2?

airSlate SignNow offers several features for Form Cm 2, including customizable templates, automated workflows, and secure cloud storage. You can also track the status of your Form Cm 2 in real-time, ensuring that you’re always up to date on the signing process.

-

How can I integrate Form Cm 2 with other applications using airSlate SignNow?

Integrating Form Cm 2 with other applications is simple with airSlate SignNow. Our platform supports multiple integrations with popular software like Google Drive, Salesforce, and Zapier, allowing you to streamline your document workflows and enhance productivity.

-

What are the benefits of using airSlate SignNow for Form Cm 2?

Using airSlate SignNow for Form Cm 2 provides numerous benefits, including faster turnaround times for documents and enhanced security features. Additionally, you can reduce paper usage and save on printing costs, making your business more eco-friendly and efficient.

-

Can I customize Form Cm 2 templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize Form Cm 2 templates to fit your specific needs. You can add branding elements, modify fields, and create a personalized signing experience for your recipients.

-

Is airSlate SignNow compliant with legal standards for Form Cm 2?

Yes, airSlate SignNow is fully compliant with electronic signature laws, making it a legally binding solution for Form Cm 2. Our platform adheres to regulations such as the ESIGN Act and UETA, ensuring your signed documents are enforceable.

Get more for Form Cm 2

- Columbia southern university transcript form

- Tsc id form

- Thsca annually awards ten 10 2000 scholarships to children of active thsca members who are graduating seniors form

- Usm request tuition remission form

- Community hours form 2017pdf raymond amp tirza martin high martinhs elisd

- The student this is done in accordance with the family educational rights and privacy act ferpa form

- Fax620 form

- Bowie state university registrarpdffillercom 2015 2019 form

Find out other Form Cm 2

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History