Hub2 Lfg Com Urlscan Pro 148 159 161 102 Urlscan Io 2018-2026

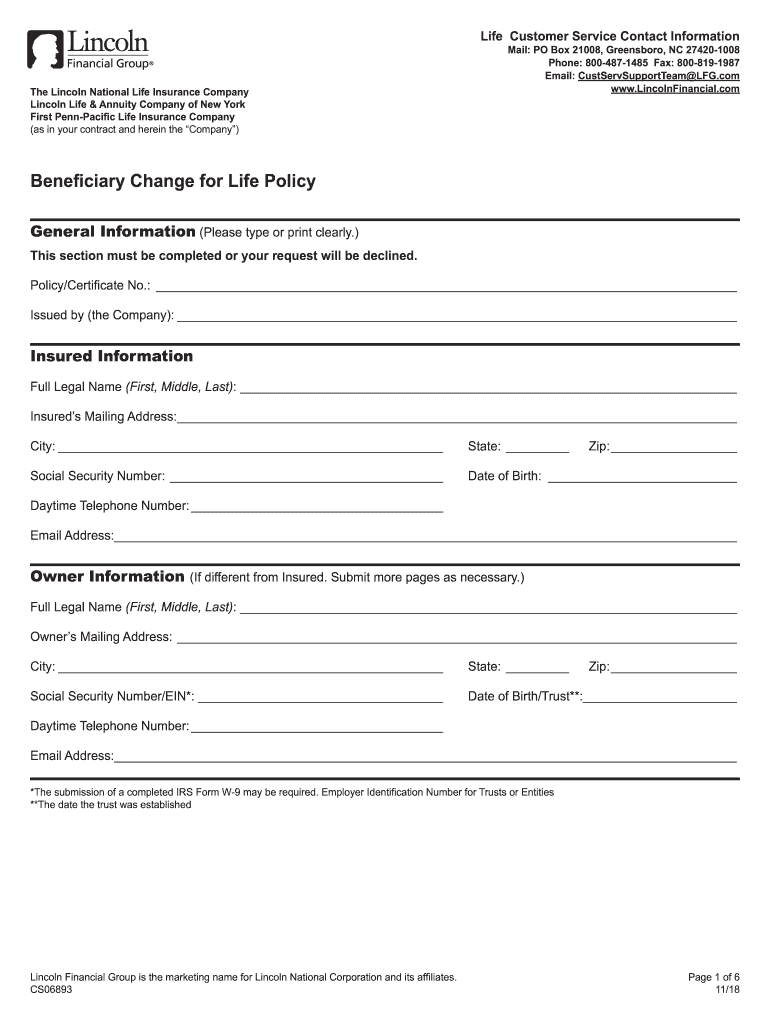

Understanding the Lincoln Life Beneficiary Form

The Lincoln Life Beneficiary Form is a crucial document used to designate beneficiaries for life insurance policies and other financial products. This form allows policyholders to specify who will receive the benefits in the event of their passing. Properly completing this form ensures that your wishes are honored and that the benefits are distributed according to your preferences. It is essential to understand the different sections of the form, including personal information, beneficiary details, and any specific instructions regarding the distribution of benefits.

Steps to Complete the Lincoln Life Beneficiary Form

Filling out the Lincoln Life Beneficiary Form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information, including your policy number and personal identification details.

- Identify your beneficiaries, including their full names, contact information, and relationship to you.

- Specify the percentage of benefits each beneficiary will receive, ensuring the total equals 100%.

- Review the form for accuracy, checking that all names and details are correctly spelled and up to date.

- Sign and date the form, ensuring compliance with any additional requirements set by Lincoln Financial Group.

Legal Validity of the Lincoln Life Beneficiary Form

To ensure that the Lincoln Life Beneficiary Form is legally valid, it must meet specific requirements. These include proper signatures, dates, and adherence to state laws regarding beneficiary designations. Using a reliable digital signing platform can enhance the legal standing of your form. It is important to keep a copy of the completed form for your records and to notify your beneficiaries about their designation to avoid confusion in the future.

Common Mistakes to Avoid When Completing the Form

Errors in the Lincoln Life Beneficiary Form can lead to complications in benefit distribution. Here are some common mistakes to avoid:

- Failing to update the form after major life events such as marriage, divorce, or the birth of a child.

- Not specifying the percentage of benefits for each beneficiary, which can lead to disputes.

- Using outdated forms or versions that may not be accepted by Lincoln Financial Group.

- Neglecting to sign and date the form, rendering it invalid.

Importance of Keeping Your Beneficiary Information Updated

Regularly reviewing and updating your beneficiary information is essential to ensure that your wishes are accurately reflected. Changes in personal circumstances, such as marriage or divorce, can significantly impact who you want to designate as a beneficiary. Keeping your Lincoln Life Beneficiary Form current helps prevent potential legal issues and ensures that your benefits are distributed according to your latest intentions.

How to Submit the Lincoln Life Beneficiary Form

Once the Lincoln Life Beneficiary Form is completed, it must be submitted according to Lincoln Financial Group's guidelines. This may include options for online submission, mailing the form to a designated address, or delivering it in person to a local office. Be sure to check the specific submission methods accepted by Lincoln Financial Group to ensure timely processing of your beneficiary designations.

Quick guide on how to complete hub2lfgcom urlscan pro 148159161102 urlscanio

Effortlessly Prepare Hub2 lfg com Urlscan Pro 148 159 161 102 Urlscan io on Any Device

Web-based document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Hub2 lfg com Urlscan Pro 148 159 161 102 Urlscan io on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related workflow today.

How to Modify and Electronically Sign Hub2 lfg com Urlscan Pro 148 159 161 102 Urlscan io with Ease

- Locate Hub2 lfg com Urlscan Pro 148 159 161 102 Urlscan io and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your document — via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Hub2 lfg com Urlscan Pro 148 159 161 102 Urlscan io and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hub2lfgcom urlscan pro 148159161102 urlscanio

Create this form in 5 minutes!

How to create an eSignature for the hub2lfgcom urlscan pro 148159161102 urlscanio

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is the Lincoln life beneficiary form?

The Lincoln life beneficiary form is a crucial document used to specify the beneficiaries of a life insurance policy. This form ensures that the correct individuals receive the policy benefits upon the policyholder's passing. Using airSlate SignNow to manage and eSign this form simplifies the process signNowly.

-

How can airSlate SignNow help with the Lincoln life beneficiary form?

airSlate SignNow allows you to easily create, send, and eSign the Lincoln life beneficiary form without hassle. Its user-friendly interface makes it simple for both policyholders and beneficiaries to complete and return the form quickly. This efficiency helps to ensure that your wishes are accurately documented.

-

Is there a cost associated with using airSlate SignNow for the Lincoln life beneficiary form?

AirSlate SignNow offers a cost-effective solution for handling documents, including the Lincoln life beneficiary form. Various pricing plans are available, allowing you to choose one that fits your business needs. You can start with a free trial to explore its features before committing.

-

What features does airSlate SignNow offer for managing the Lincoln life beneficiary form?

With airSlate SignNow, you gain access to features such as customizable templates, secure eSigning, and document tracking, specifically for the Lincoln life beneficiary form. These tools enhance the management of your documents and ensure all parties can easily sign from anywhere, anytime.

-

How secure is the airSlate SignNow platform for signing the Lincoln life beneficiary form?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption protocols to protect your sensitive information, including the Lincoln life beneficiary form. This ensures that your documents are safe and only accessible to authorized individuals.

-

Can I integrate airSlate SignNow with other applications for the Lincoln life beneficiary form?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline the process of managing the Lincoln life beneficiary form. This includes compatibility with CRMs, cloud storage services, and other business tools, enhancing your overall workflow.

-

What benefits does airSlate SignNow provide for the Lincoln life beneficiary form?

Using airSlate SignNow for the Lincoln life beneficiary form saves time and reduces paperwork. The platform ensures a smooth eSigning process, which minimizes errors and accelerates the completion of the document. This leads to faster processing of life insurance claims, benefiting all parties involved.

Get more for Hub2 lfg com Urlscan Pro 148 159 161 102 Urlscan io

- Sf 256 opm form

- Not need to answer these questions unless we display a valid office of management and budget omb control number form

- Direct writing company form

- Reducing this burden or any other aspects of this collection of information to general services administration regulatory

- Paperwork reduction act pra and fcc information

- Agency security classification management program data gsa form

- October 1 march 31 year form

- Semiannual report of payments accepted from a non gsa form

Find out other Hub2 lfg com Urlscan Pro 148 159 161 102 Urlscan io

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now