Form 8990

What is the Form 8990

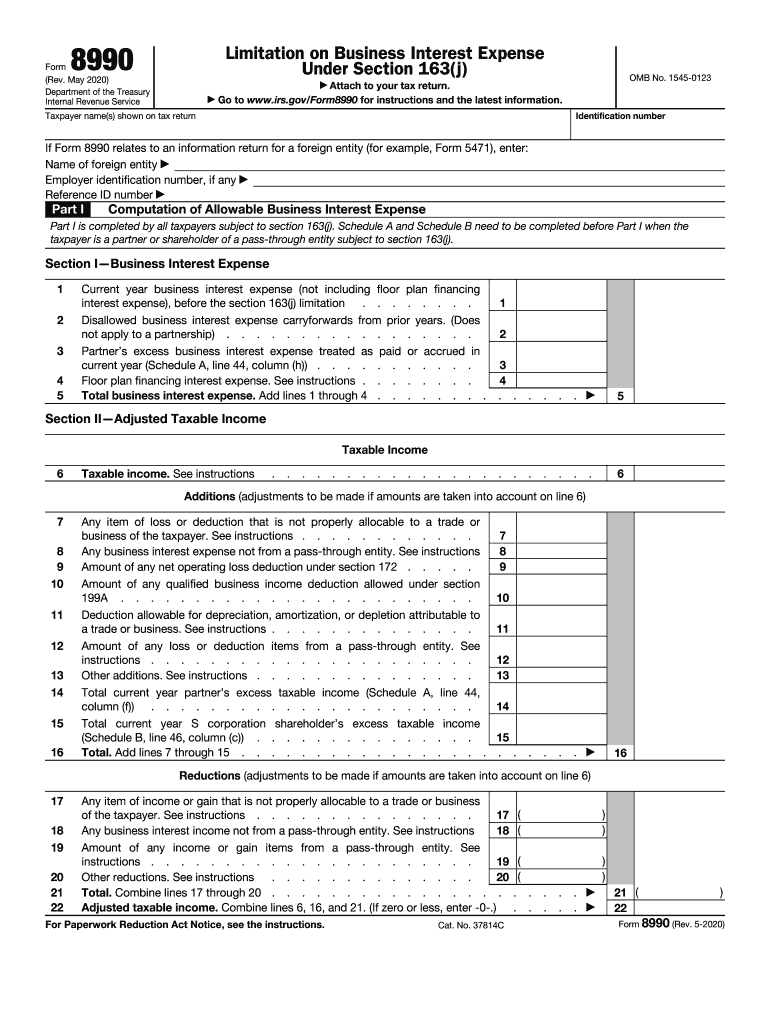

The Form 8990, officially known as the IRS Form 8990, is a tax form used to report the application of the limitation on business interest expense deductions. This form is particularly relevant for businesses that have incurred interest expenses and need to calculate the allowable deduction under the Tax Cuts and Jobs Act. Understanding the purpose of Form 8990 is crucial for compliance with federal tax regulations.

How to use the Form 8990

Using Form 8990 involves several steps to ensure accurate reporting of interest expenses. First, gather all relevant financial documents, including income statements and balance sheets. Next, complete the form by providing necessary details about your business and the interest expenses incurred. It is essential to follow the specific instructions outlined by the IRS to avoid errors that could lead to penalties. Once completed, the form should be submitted with your tax return, ensuring that all calculations are accurate and in compliance with IRS guidelines.

Steps to complete the Form 8990

Completing Form 8990 requires careful attention to detail. Here are the key steps:

- Gather necessary financial records, including previous tax returns and interest expense documentation.

- Fill in your business information, including the name, address, and Employer Identification Number (EIN).

- Calculate your business interest expense and any adjustments required under the section 163(j) limitations.

- Complete the relevant sections of the form, ensuring all calculations are accurate.

- Review the form for completeness and accuracy before submission.

Legal use of the Form 8990

The legal use of Form 8990 is governed by IRS regulations, which stipulate that businesses must accurately report their interest expenses to comply with tax laws. Failure to use the form correctly can result in penalties or disallowance of interest expense deductions. It is important to ensure that all information provided is truthful and complete, as the IRS may audit submitted forms. Utilizing a reliable eSignature solution, such as signNow, can help ensure that your completed Form 8990 is securely signed and stored, maintaining compliance with legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for Form 8990 align with the overall tax return deadlines for businesses. Generally, the form must be submitted by the due date of your tax return, including any extensions. For most corporations, this is typically April fifteenth of the following year. However, partnerships and S corporations may have different deadlines. It's crucial to stay informed about any changes to tax laws or filing dates to ensure timely submission and avoid penalties.

Required Documents

To complete Form 8990 accurately, certain documents are required. These include:

- Financial statements detailing income and expenses.

- Documentation of interest expenses incurred during the tax year.

- Previous tax returns for reference, particularly if adjustments are necessary.

- Any supporting documentation related to business operations that may impact interest expense calculations.

Who Issues the Form

The Form 8990 is issued by the Internal Revenue Service (IRS). It is a mandatory form for businesses that wish to report their interest expense deductions accurately under the current tax laws. The IRS provides guidelines and instructions for completing the form, which can be found on their official website or through authorized tax professionals.

Quick guide on how to complete form 8990

Prepare Form 8990 effortlessly on any gadget

Online document management has become favored among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the appropriate form and securely preserve it online. airSlate SignNow provides all the resources you require to create, alter, and electronically sign your documents quickly without delays. Manage Form 8990 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to alter and electronically sign Form 8990 effortlessly

- Find Form 8990 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Form 8990 and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8990

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is Form 8990 and how is it used?

Form 8990 is a tax form used by businesses to report their interest expense limitations under the Tax Cuts and Jobs Act. By filing Form 8990, companies can determine the allowable interest expense deductions for the year, which can signNowly impact their tax liability.

-

How can airSlate SignNow help with Form 8990 submissions?

With airSlate SignNow, you can easily create, manage, and eSign Form 8990 and other essential documents. Our user-friendly platform streamlines the process of preparing tax forms, ensuring that you can quickly send and receive completed forms securely.

-

Is there a cost associated with using airSlate SignNow for Form 8990?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Our plans are affordable, enabling you to efficiently prepare and eSign Form 8990 without breaking the bank.

-

What are the main features of airSlate SignNow for managing Form 8990?

airSlate SignNow provides features such as customizable templates, secure document storage, and real-time tracking for Form 8990 submissions. These features ensure that your tax forms are completed accurately and are easily accessible when needed.

-

Can I integrate airSlate SignNow with other software for Form 8990 preparation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, allowing you to streamline your workflow when preparing Form 8990. This integration helps reduce errors and saves you time during tax season.

-

What benefits does airSlate SignNow offer for tax professionals dealing with Form 8990?

Tax professionals can benefit from airSlate SignNow's collaborative features, which allow multiple users to work on Form 8990 concurrently. Additionally, our secure eSigning capabilities enhance client communication and speed up the review process.

-

How does airSlate SignNow ensure the security of my Form 8990 documents?

airSlate SignNow employs industry-leading security measures to protect your Form 8990 and other sensitive documents. We use encryption, secure access controls, and compliance with data protection regulations to ensure your information is safe.

Get more for Form 8990

- Ks form application 2018 2019

- Kansas department of revenue w 2 and 1099 frequently asked form

- K 41 fiduciary income tax return rev 7 18fillable fiducairy tax form

- K 59 kansas high performance incentive program hpip credits rev 10 17

- Visio verification of depositvsd psers state pa form

- Do not file this return if tax was 100 withheld on form

- Mn form instructions 2018 2019

- 2019 mwr reciprocity exemptionaffidavit of residency form

Find out other Form 8990

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast