K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 2018

What is the K-59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17

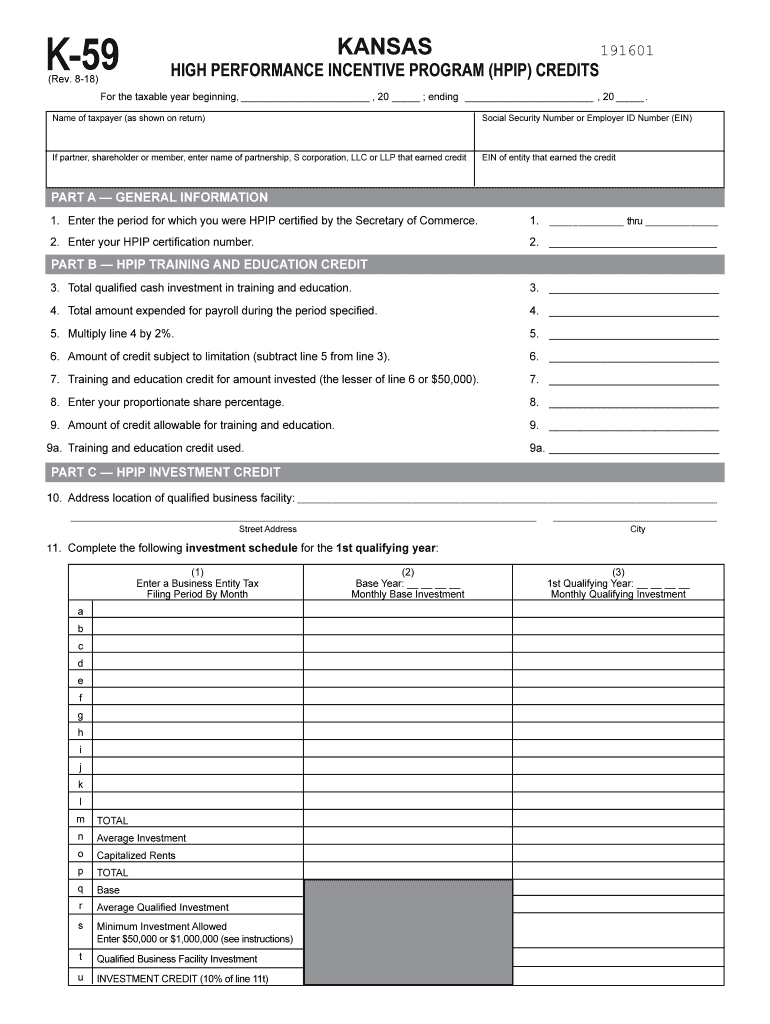

The K-59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 is a tax credit program designed to encourage businesses in Kansas to invest in high-performance facilities and create jobs. This program provides financial incentives to eligible companies that meet specific criteria, such as making significant capital investments and creating new jobs in the state. The credits can be applied against Kansas income tax liabilities, effectively reducing the overall tax burden for participating businesses.

How to use the K-59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17

To utilize the K-59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17, businesses must first determine their eligibility based on the program's guidelines. Once eligibility is confirmed, companies can complete the K-59 form, providing necessary details about their investment and job creation efforts. This form must be submitted to the Kansas Department of Commerce for review. Upon approval, businesses can claim the credits on their state tax returns, thereby benefiting from reduced tax liabilities.

Steps to complete the K-59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17

Completing the K-59 form involves several key steps:

- Gather necessary documentation, including financial statements and proof of job creation.

- Fill out the K-59 form with accurate information regarding your business and the investment made.

- Submit the completed form to the Kansas Department of Commerce for approval.

- Once approved, retain a copy for your records and use the credits on your Kansas income tax return.

Eligibility Criteria

Eligibility for the K-59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 requires businesses to meet specific criteria. Companies must be engaged in certain industries, such as manufacturing or technology, and must demonstrate a commitment to creating new jobs and investing in high-performance facilities. Additionally, the business must meet minimum investment thresholds and job creation targets as outlined by the program.

Legal use of the K-59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17

The K-59 form is legally binding when completed and submitted according to the established guidelines. To ensure compliance, businesses must adhere to the regulations set forth by the Kansas Department of Commerce. This includes providing accurate information and maintaining records of all related transactions. Utilizing an electronic signature solution can enhance the legal validity of the submission, ensuring that all signatures meet the necessary legal standards.

Required Documents

When completing the K-59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17, businesses need to prepare several documents:

- Financial statements demonstrating the investment made.

- Proof of job creation, such as employment contracts or payroll records.

- Any additional documentation requested by the Kansas Department of Commerce.

Quick guide on how to complete k 59 kansas high performance incentive program hpip credits rev 10 17

Easily Prepare K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 on Any Device

Digital document management has gained popularity among enterprises and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 across any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Alter and Electronically Sign K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17

- Locate K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 to ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 59 kansas high performance incentive program hpip credits rev 10 17

Create this form in 5 minutes!

How to create an eSignature for the k 59 kansas high performance incentive program hpip credits rev 10 17

How to make an electronic signature for the K 59 Kansas High Performance Incentive Program Hpip Credits Rev 10 17 in the online mode

How to make an electronic signature for the K 59 Kansas High Performance Incentive Program Hpip Credits Rev 10 17 in Google Chrome

How to make an electronic signature for putting it on the K 59 Kansas High Performance Incentive Program Hpip Credits Rev 10 17 in Gmail

How to create an electronic signature for the K 59 Kansas High Performance Incentive Program Hpip Credits Rev 10 17 straight from your smartphone

How to generate an electronic signature for the K 59 Kansas High Performance Incentive Program Hpip Credits Rev 10 17 on iOS devices

How to create an eSignature for the K 59 Kansas High Performance Incentive Program Hpip Credits Rev 10 17 on Android devices

People also ask

-

What is the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17?

The K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 is a state-sponsored initiative designed to support businesses by providing tax credits for qualifying investments. These credits aim to encourage economic growth and enhanced job creation in Kansas. By participating in HPIP, businesses can signNowly reduce their tax burden while contributing to state development.

-

How can businesses benefit from the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17?

Businesses utilizing the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 can enjoy various benefits, including substantial tax savings and improved cash flow. By qualifying for these credits, companies can reinvest saved funds into their operations, ultimately fostering growth and competitiveness. This program is especially advantageous for businesses involved in expansion, modernization, or creating jobs.

-

What are the eligibility requirements for the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17?

To be eligible for the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17, businesses must meet specific criteria set by the Kansas Department of Commerce. Key requirements typically include making signNow capital investments and creating a certain number of new jobs. It is essential for businesses to carefully review their qualifications prior to applying.

-

How does the application process work for the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17?

The application process for the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 involves several steps, including completing an initial application form. Businesses must provide detailed information on their investment plans and projected job creation. Once submitted, the application is reviewed by the Kansas Department of Commerce, and upon approval, businesses can claim their credits.

-

What types of investments qualify for the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17?

Qualifying investments for the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 generally include expenditures on new equipment, building construction, or improvements made to existing facilities. These investments must directly contribute to enhancing business performance and creating jobs. It’s crucial for businesses to ensure that their investments align with program requirements.

-

Are there any costs associated with the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17?

While there are no direct fees for applying to the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17, businesses may incur costs related to preparing the application and any necessary documentation. Additionally, engaging professionals to assist with the application process may involve service fees. However, these costs are often outweighed by the potential tax credits that businesses can receive.

-

Can businesses combine the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 with other incentives?

Yes, businesses can often combine the benefits of the K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17 with other state or federal incentives. This stacking of incentives can signNowly amplify the financial advantages available to eligible businesses. It is advisable to consult with a tax professional to explore all available options.

Get more for K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17

- Phi mu reference form phimu org msstate

- 139 r form

- Mississippi form immunization

- Boston mutual life insurance company group disability claim missouriwestern form

- Police statement form

- Absence excuse form student health services the ohio state shc osu

- Forklift supervisor evaluation form

- Recipe form lima osu

Find out other K 59 Kansas High Performance Incentive Program HPIP Credits Rev 10 17

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template