7200 2020

What is the 7200?

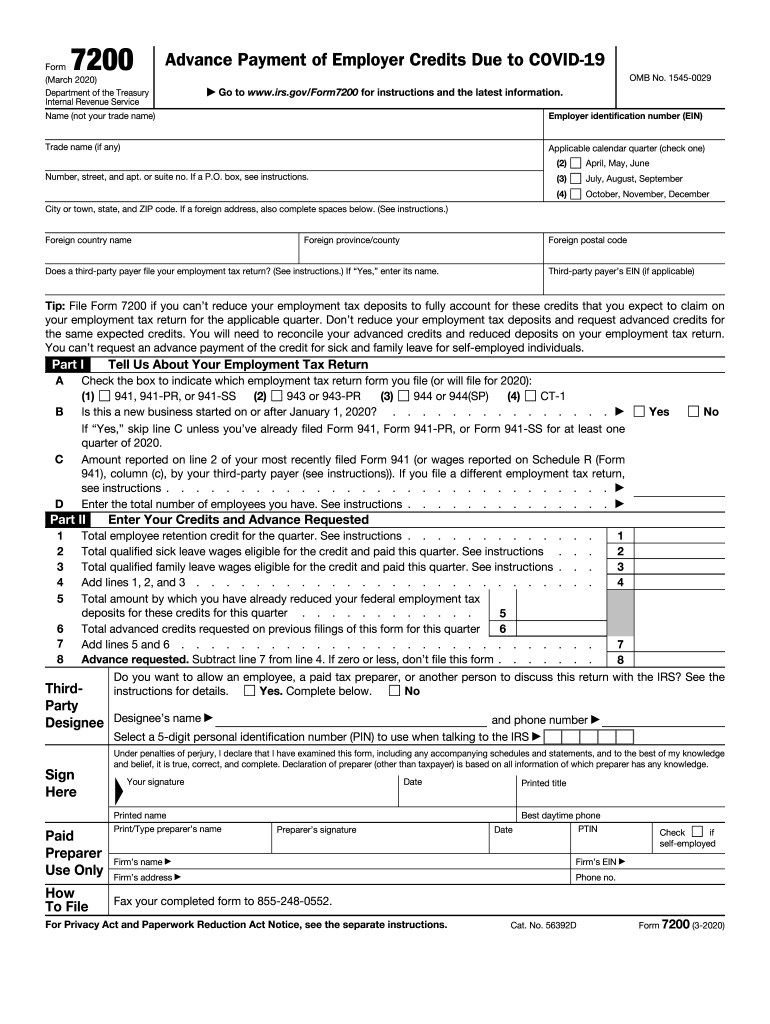

The 7200 form, officially known as the Advance Payment Employer Form 7200, is utilized by employers to request an advance payment of certain credits from the Internal Revenue Service (IRS). This form is particularly relevant for businesses seeking to claim tax credits related to employee retention and other payroll-related benefits. The IRS allows eligible employers to receive these advances to help manage cash flow during challenging financial periods, such as economic downturns or unexpected expenses.

How to use the 7200

Using the 7200 form involves several straightforward steps. First, employers must determine their eligibility for the advance payment based on the specific tax credits available. Next, they should accurately complete the form, providing necessary details such as the employer's identification number, the amount of advance requested, and the relevant credit being claimed. Once the form is filled out, employers can submit it electronically or via mail to the IRS, ensuring they keep a copy for their records.

Steps to complete the 7200

Completing the 7200 form requires careful attention to detail. Here are the essential steps:

- Gather required information, including your business's EIN and details about the credits you are claiming.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions to avoid delays in processing.

- Submit the completed form to the IRS through the preferred method, either electronically or by mail.

Legal use of the 7200

The legal use of the 7200 form is governed by IRS regulations. Employers must ensure they meet the eligibility criteria for the credits they are claiming and provide accurate information on the form. Misuse of the form, such as claiming credits for which the employer is not eligible, can lead to penalties and legal repercussions. It is crucial for employers to maintain compliance with all applicable tax laws and guidelines to avoid any issues.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 7200 form. These guidelines outline the eligibility requirements for employers, the types of credits that can be claimed, and the documentation needed to support the claims. Employers should familiarize themselves with these guidelines to ensure proper completion and submission of the form. Staying updated with any changes in IRS regulations is also essential for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 7200 form are crucial for employers to observe. The IRS typically sets specific dates by which the form must be submitted to qualify for the advance payment. Employers should keep track of these deadlines to ensure timely submission and avoid missing out on potential credits. It is advisable to regularly check the IRS website or consult with a tax professional for the most current information regarding filing dates.

Quick guide on how to complete 7200

Effortlessly Complete 7200 on Any Device

Digital document management has become widespread among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 7200 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign 7200 effortlessly

- Obtain 7200 and click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign 7200 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 7200

Create this form in 5 minutes!

How to create an eSignature for the 7200

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a form 7200 fillable and how can I access it?

A form 7200 fillable is an official IRS form used to request advance payments of the employee retention credit. You can access a form 7200 fillable through the airSlate SignNow platform, where you can easily fill it out, sign, and send it securely from anywhere.

-

How does airSlate SignNow simplify the form 7200 fillable process?

airSlate SignNow streamlines the form 7200 fillable process by providing a user-friendly interface that allows you to fill out the form quickly and accurately. With the ability to eSign documents digitally, you also save time and reduce the hassle of manual paperwork.

-

Are there any costs associated with using the form 7200 fillable on airSlate SignNow?

While signing up for airSlate SignNow comes with subscription fees, accessing and completing the form 7200 fillable is included in the service. Pricing is competitive and based on user needs, making it a cost-effective solution for businesses.

-

Can I integrate airSlate SignNow with other applications while filling out the form 7200 fillable?

Yes, airSlate SignNow offers a variety of integrations with popular applications that enhance your experience with the form 7200 fillable. You can seamlessly connect it with tools such as Google Drive, Dropbox, and many CRM systems to streamline your workflow.

-

What are the advantages of using airSlate SignNow for a form 7200 fillable?

Using airSlate SignNow for a form 7200 fillable allows you to ensure security, efficiency, and compliance. The platform allows for easy document management and fast eSigning, which helps prevent errors and expedites the submission process.

-

Is it safe to eSign the form 7200 fillable using airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security features to protect your data and documents. When you eSign the form 7200 fillable, you can trust that your information is safe and remains confidential throughout the process.

-

Can I track the status of my form 7200 fillable after sending it through airSlate SignNow?

Yes, airSlate SignNow offers tracking capabilities that allow you to monitor the status of your form 7200 fillable. You will receive notifications when your document is opened, viewed, signed, or completed, keeping you informed every step of the way.

Get more for 7200

Find out other 7200

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online