Form 7200 Rev January Advance Payment of Employer Credits Due to COVID 19 2021

What is the Form 7200 Rev January Advance Payment of Employer Credits Due to COVID-19

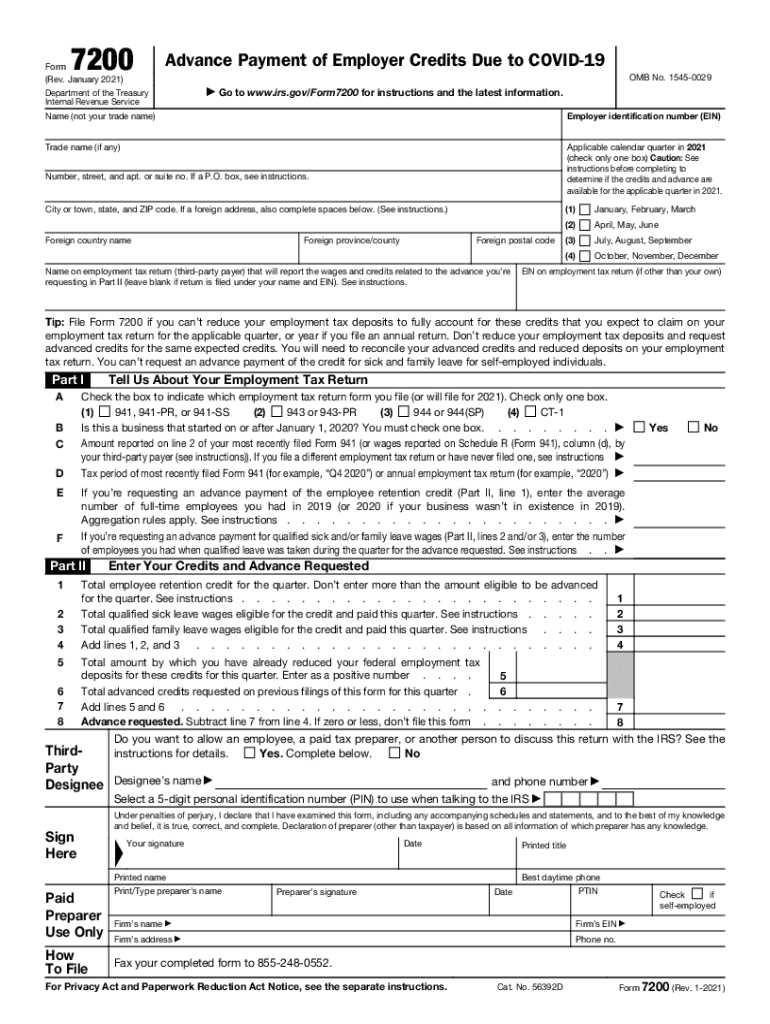

The Form 7200 is a tax document used by employers to request an advance payment of certain employer credits related to the COVID-19 pandemic. This includes credits for qualified sick leave wages, family leave wages, and employee retention credits as outlined by the IRS. The form allows eligible employers to receive these credits before filing their federal employment tax returns, providing immediate financial relief during challenging times.

How to Use the Form 7200 Rev January Advance Payment of Employer Credits Due to COVID-19

To effectively use Form 7200, employers must first determine their eligibility for the credits. Once eligibility is confirmed, the employer can complete the form by providing necessary information, including the number of employees, the amount of wages paid, and the specific credits being claimed. After filling out the form, it must be submitted to the IRS, typically via fax, to initiate the advance payment process.

Steps to Complete the Form 7200 Rev January Advance Payment of Employer Credits Due to COVID-19

Completing Form 7200 involves several key steps:

- Gather necessary information about your business, including your Employer Identification Number (EIN).

- Determine the total amount of qualified wages paid to employees for which you are claiming credits.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS via fax, as specified in the instructions.

Eligibility Criteria for the Form 7200 Rev January Advance Payment of Employer Credits Due to COVID-19

Eligibility for using Form 7200 is primarily based on the type of employer and the nature of the credits being claimed. Generally, employers must have experienced a significant decline in business operations due to COVID-19 or have qualified employees who are eligible for paid sick leave or family leave. Specific criteria may vary, so it is essential to consult IRS guidelines to ensure compliance.

Filing Deadlines / Important Dates for the Form 7200 Rev January Advance Payment of Employer Credits Due to COVID-19

Filing deadlines for Form 7200 are crucial for employers seeking timely financial assistance. Employers should submit the form as soon as they determine they qualify for the advance payment. The IRS recommends submitting Form 7200 in the same quarter in which the qualified wages are paid. Keeping track of these deadlines ensures that employers do not miss out on available credits.

Form Submission Methods (Online / Mail / In-Person)

Form 7200 must be submitted to the IRS via fax. The IRS does not accept this form through traditional mail or in-person submissions. Employers should ensure they have the correct fax number and confirm that their submission has been received to avoid delays in processing their advance payment requests.

Quick guide on how to complete form 7200 rev january 2021 advance payment of employer credits due to covid 19

Effortlessly Prepare Form 7200 Rev January Advance Payment Of Employer Credits Due To COVID 19 on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, as you can easily find the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 7200 Rev January Advance Payment Of Employer Credits Due To COVID 19 on any platform using airSlate SignNow's Android or iOS applications and simplify your document-driven tasks today.

Efficiently Edit and eSign Form 7200 Rev January Advance Payment Of Employer Credits Due To COVID 19 with Ease

- Find Form 7200 Rev January Advance Payment Of Employer Credits Due To COVID 19 and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive data using the features that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your delivery method for the form—via email, SMS, shareable link, or download it to your computer.

Eliminate concerns regarding lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and eSign Form 7200 Rev January Advance Payment Of Employer Credits Due To COVID 19 to ensure impeccable communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 7200 rev january 2021 advance payment of employer credits due to covid 19

Create this form in 5 minutes!

How to create an eSignature for the form 7200 rev january 2021 advance payment of employer credits due to covid 19

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a form 7200 fillable?

A form 7200 fillable is a digital version of the IRS Form 7200 that allows businesses to request an advance payment of employee retention credits. With airSlate SignNow, you can easily create, complete, and sign this form online, making it both convenient and efficient.

-

How does airSlate SignNow help with filling out form 7200?

airSlate SignNow provides an intuitive platform for filling out the form 7200 fillable. Users can navigate through the required fields effortlessly, ensuring accuracy and compliance while also allowing for easy digital signatures, which streamlines the process signNowly.

-

Is airSlate SignNow secure for submitting form 7200 fillable?

Yes, airSlate SignNow employs industry-standard encryption and secure storage to protect your data when using the form 7200 fillable. We prioritize your privacy and security, ensuring that all submitted forms are safe from unauthorized access.

-

What are the pricing options for using airSlate SignNow for form 7200 fillable?

airSlate SignNow offers affordable pricing plans that cater to different business needs when using the form 7200 fillable. Our pricing is designed to be cost-effective and scalable, allowing you to choose a plan that best fits your usage and budget.

-

Can I integrate airSlate SignNow with other software for processing the form 7200 fillable?

Absolutely! airSlate SignNow allows for seamless integrations with popular software tools, enabling you to automate your workflow when dealing with the form 7200 fillable. This integration capability helps eliminate manual entry and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the form 7200 fillable?

Using airSlate SignNow for the form 7200 fillable provides numerous benefits, including ease of use, time savings, and enhanced accuracy. The platform allows for quick access to templates, real-time collaboration, and a streamlined signing process that enhances overall productivity.

-

Can multiple users collaborate on the form 7200 fillable with airSlate SignNow?

Yes, airSlate SignNow supports collaboration on the form 7200 fillable, allowing multiple users to work on a single document simultaneously. This feature is particularly beneficial for teams, ensuring everyone stays aligned and can provide input in real time.

Get more for Form 7200 Rev January Advance Payment Of Employer Credits Due To COVID 19

Find out other Form 7200 Rev January Advance Payment Of Employer Credits Due To COVID 19

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy