Form 7200 Rev April Internal Revenue Service 2021-2026

What is the Form 7200?

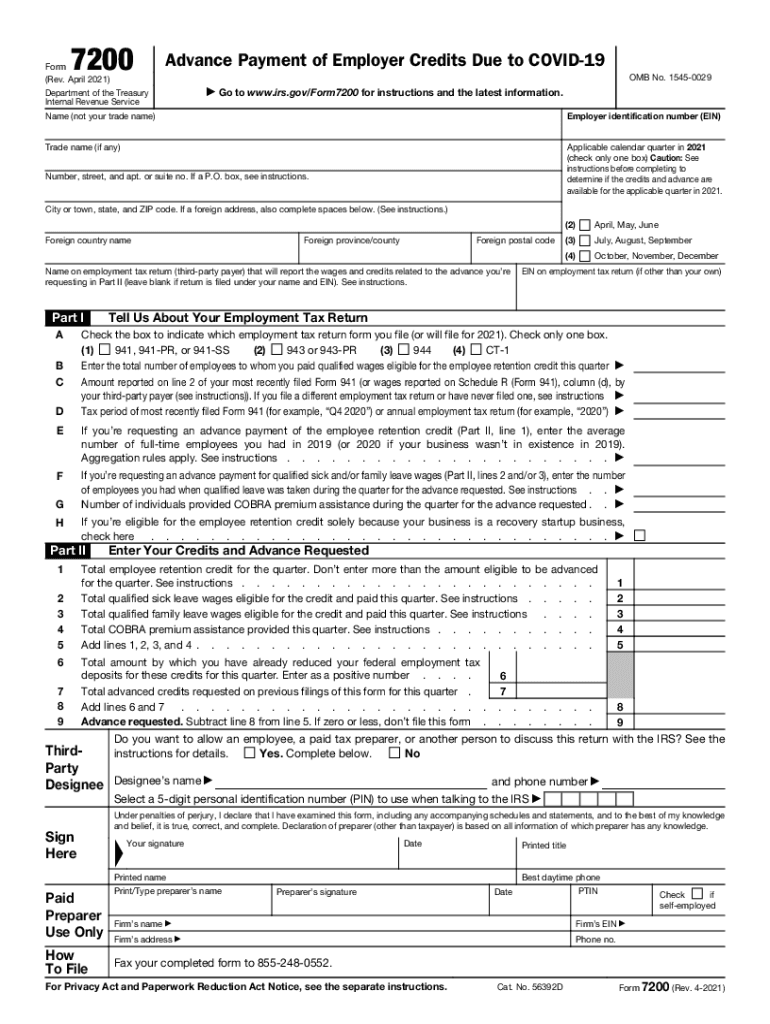

The Form 7200, officially titled "Advance Payment of Employer Credits Due to COVID-19," is a document provided by the Internal Revenue Service (IRS) for employers to request advance payments of certain tax credits. These credits are designed to assist businesses affected by the COVID-19 pandemic, specifically the 2021 employer credit and the 2021 advance payment credit. The form allows eligible employers to receive funds upfront rather than waiting for their tax returns to be processed, ensuring they have the necessary cash flow to support their operations during challenging times.

How to use the Form 7200

Using the Form 7200 involves several key steps. Employers must first determine their eligibility for the credits available under the form. Once eligibility is confirmed, they can fill out the form with pertinent information, including their business details and the amount of credit they are claiming. After completing the form, employers can submit it to the IRS, either electronically or via mail, depending on their preference. It is important to keep records of the submission and any correspondence with the IRS regarding the form.

Steps to complete the Form 7200

Completing the Form 7200 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Employer Identification Number (EIN) and details about the credits you are claiming.

- Fill out the form, ensuring all fields are completed accurately to avoid delays.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS, either online through an approved e-filing service or by mailing a printed copy.

- Retain a copy of the submitted form for your records, along with any confirmation of submission.

Legal use of the Form 7200

The legal use of the Form 7200 is governed by IRS regulations, which outline the eligibility criteria and requirements for claiming advance payments. Employers must ensure that they are using the form in accordance with these regulations to avoid potential penalties. The form is legally binding once submitted, and any false claims can result in serious repercussions, including fines or audits. It is essential for businesses to maintain compliance with all IRS guidelines when utilizing this form.

Eligibility Criteria

To qualify for the credits available through Form 7200, employers must meet specific eligibility criteria. Generally, this includes being an employer that has been adversely affected by the COVID-19 pandemic. Criteria may vary based on the type of credit being claimed, such as the 2021 employer credit or the 2021 advance payment credit. Employers should carefully review the IRS guidelines to ensure they meet all necessary conditions before completing the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 7200 are crucial for employers to keep in mind. The IRS typically sets specific dates for when the form must be submitted to qualify for advance payments. Employers should stay informed about these deadlines, as missing them can result in lost opportunities for financial assistance. It is advisable to regularly check the IRS website or consult with a tax professional to ensure compliance with all filing timelines.

Quick guide on how to complete form 7200 rev april 2021 internal revenue service

Effortlessly Prepare Form 7200 Rev April Internal Revenue Service on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without delay. Handle Form 7200 Rev April Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign Form 7200 Rev April Internal Revenue Service

- Locate Form 7200 Rev April Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides for that specific purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal value as a traditional handwritten signature.

- Verify all information and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 7200 Rev April Internal Revenue Service to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 7200 rev april 2021 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 7200 rev april 2021 internal revenue service

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

The best way to create an e-signature for a PDF file on Android

People also ask

-

What is airSlate SignNow, and how does it relate to the 7200 solution?

airSlate SignNow is a user-friendly platform designed for sending and eSigning documents efficiently. The 7200 solution offers businesses cost-effective ways to manage their document signing processes while ensuring compliance and security.

-

How much does airSlate SignNow cost if I access the 7200 features?

The pricing for airSlate SignNow that includes the 7200 features is competitively set to fit various budgets. You can choose from several subscription plans that range in price depending on the specific functionalities you need, ensuring great value for your investment.

-

What key features are included in the airSlate SignNow 7200 package?

The 7200 package includes essential features such as customizable templates, secure signing processes, and cloud storage integration. These features ensure that businesses can streamline their document management and enhance productivity.

-

What benefits can I expect by using the airSlate SignNow 7200 solution?

Using the 7200 solution enables businesses to save time and reduce costs by automating document workflows. Additionally, it enhances team collaboration and improves customer interactions through efficient eSigning capabilities.

-

Can airSlate SignNow integrate with other software using the 7200 service?

Yes, airSlate SignNow supports integrations with various third-party software and applications when utilizing the 7200 service. This allows businesses to tailor their workflows and connect the tools they rely on for increased efficiency.

-

How secure is the airSlate SignNow 7200 solution for document management?

The airSlate SignNow 7200 solution prioritizes security by utilizing advanced encryption and compliance with industry standards. This ensures that all documents are handled safely, protecting sensitive information throughout the signing process.

-

Is it easy to use airSlate SignNow, especially with the 7200 features?

Absolutely! The airSlate SignNow platform, including its 7200 features, is designed with user-friendliness in mind. Users of all technical levels can easily navigate the interface, allowing for a smooth experience in sending and signing documents.

Get more for Form 7200 Rev April Internal Revenue Service

- Roofing contractor package colorado form

- Electrical contractor package colorado form

- Sheetrock drywall contractor package colorado form

- Flooring contractor package colorado form

- Trim carpentry contractor package colorado form

- Fencing contractor package colorado form

- Hvac contractor package colorado form

- Landscaping contractor package colorado form

Find out other Form 7200 Rev April Internal Revenue Service

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple