Loss of Income Form 2010-2026

What is the loss of income form?

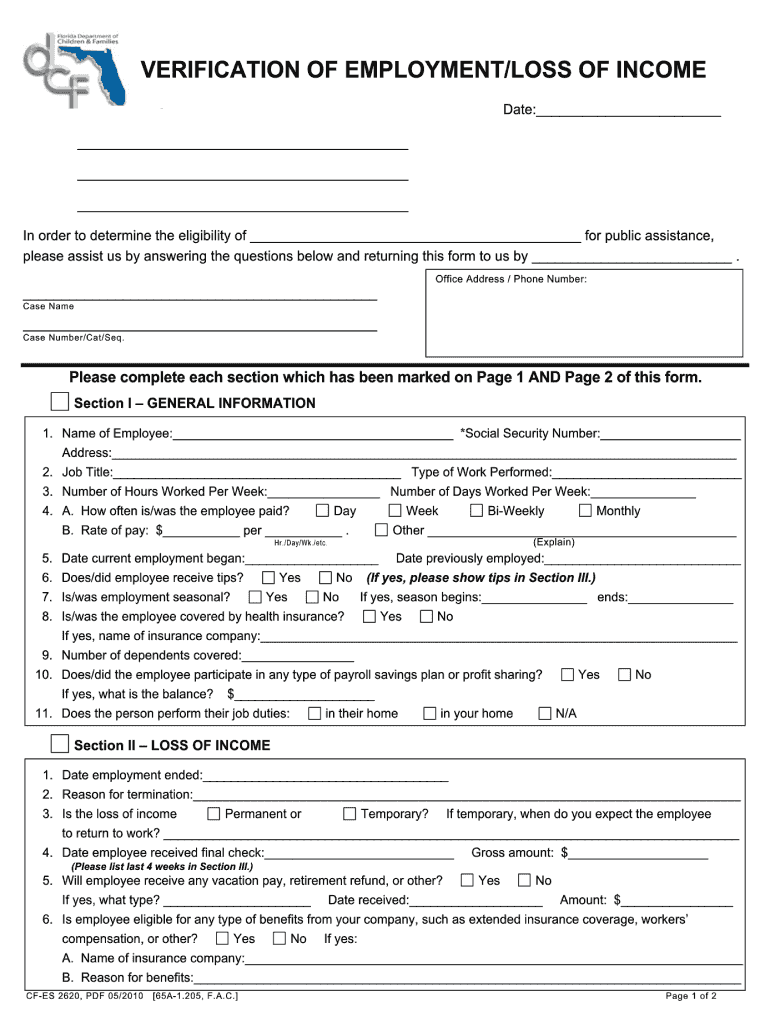

The loss of income form is a crucial document used to provide proof of lost earnings due to various circumstances, such as job loss, illness, or other qualifying events. This form is often required by insurance companies, government agencies, or financial institutions to assess eligibility for benefits or assistance. It typically includes details about the individual’s employment history, income levels, and the reasons for the loss of income.

How to use the loss of income form

Using the loss of income form involves several key steps. First, gather all necessary information, including your employment details, income statements, and any relevant documentation that supports your claim. Next, accurately fill out the form, ensuring that all sections are completed and that the information provided is truthful and up-to-date. Once completed, submit the form to the appropriate entity, such as your employer, an insurance provider, or a government office, following their specific submission guidelines.

Steps to complete the loss of income form

Completing the loss of income form requires careful attention to detail. Begin by entering your personal information, including your name, address, and contact details. Next, provide your employment history, specifying your job title, employer's name, and dates of employment. Include your income details, such as your salary or hourly wage, and document the reasons for your income loss. Be sure to review the form for accuracy before signing and dating it. If required, attach supporting documents that validate your claim.

Key elements of the loss of income form

Several key elements must be included in the loss of income form to ensure its effectiveness. These elements typically encompass:

- Personal information: Full name, address, and contact details.

- Employment history: Job title, employer's name, and employment dates.

- Income details: Salary or hourly wage, along with any additional income sources.

- Reason for income loss: A clear explanation of the circumstances leading to the loss.

- Supporting documentation: Any relevant documents that substantiate your claim.

Legal use of the loss of income form

The loss of income form is legally recognized when it is filled out correctly and submitted to the appropriate parties. It serves as a formal declaration of income loss and can be used in legal proceedings or claims for benefits. To ensure its legal standing, the form must comply with relevant laws and regulations, including those related to employment and financial assistance. Proper documentation and signatures are essential to validate the form's authenticity.

Examples of using the loss of income form

There are various scenarios in which the loss of income form may be utilized. For instance, an individual who has been laid off may use the form to apply for unemployment benefits. A self-employed person who has experienced a significant drop in business due to unforeseen circumstances may also submit the form to their insurance provider for compensation. Additionally, the form can be used when applying for loans or financial assistance to demonstrate the impact of income loss on financial stability.

Quick guide on how to complete loss of income form

Handle Loss Of Income Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to easily access the needed form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Loss Of Income Form on any device using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

How to edit and electronically sign Loss Of Income Form with ease

- Locate Loss Of Income Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a standard handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether it be via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Edit and electronically sign Loss Of Income Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loss of income form

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is a loss of income letter?

A loss of income letter is a formal document that outlines the financial impact of losing income due to unforeseen circumstances, such as job loss or business interruption. It serves as evidence for claims to insurance companies or legal entities. Creating a solid loss of income letter is essential for securing compensation.

-

How can airSlate SignNow help with creating a loss of income letter?

airSlate SignNow simplifies the process of creating a loss of income letter by providing customizable templates and easy editing features. Users can quickly fill out necessary details and send the document for eSignature to relevant parties. This makes the task efficient and legally acceptable.

-

Is there a cost associated with using airSlate SignNow for a loss of income letter?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. The cost of sending a loss of income letter through the platform includes access to its full range of features, ensuring maximum efficiency and minimum hassle. You can choose a plan that best suits your budget and usage.

-

Can I track the status of my loss of income letter sent through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your loss of income letter. You will be notified when the document is opened, signed, and completed, ensuring you are always informed about the progress.

-

What integrations does airSlate SignNow offer for a loss of income letter?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. This means you can easily import data or documents to create a comprehensive loss of income letter. These integrations enhance productivity and workflow efficiency.

-

Can I create multiple loss of income letters with airSlate SignNow?

Yes, airSlate SignNow allows users to create multiple loss of income letters with ease. You can duplicate templates or customize different letters for various situations, ensuring that all your documentation is tailored to the specific requirements of each case.

-

What are the security measures for loss of income letters on airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption and secure storage for your loss of income letters. You can rest assured that your sensitive information is protected. Additionally, the platform complies with industry standards to safeguard your documents.

Get more for Loss Of Income Form

- Enclosed are a program description and application materials for the u form

- Office of engineering section 80 contract services po box form

- Fillable online travel state your medical examination form

- For naccas use only form

- Academic transcriptrecords request form educational

- Sebi pacl refund application form fill online printable

- Sample applicant form

- Extenuating circumstances form ec1

Find out other Loss Of Income Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe