Schedule C Form 2014

What is the Schedule C Form

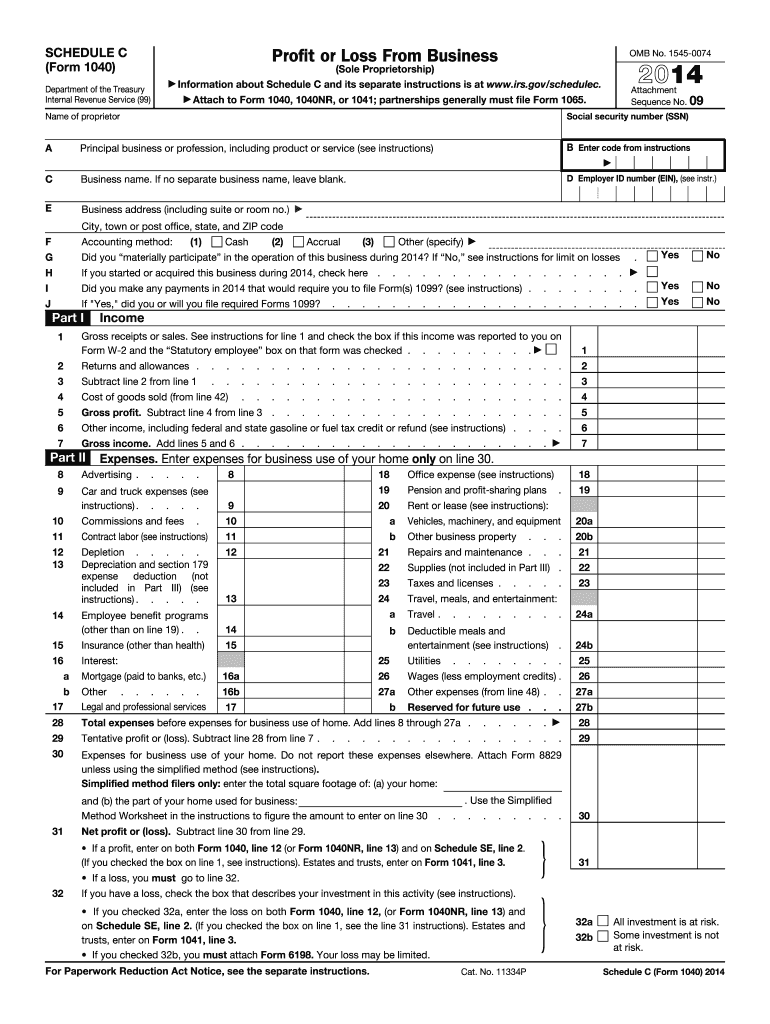

The Schedule C form, officially known as Form 1040 Schedule C, is used by self-employed individuals to report income or loss from their business. This form is essential for those who operate as sole proprietors, freelancers, or independent contractors. The information provided on Schedule C is then transferred to the individual's Form 1040, which is the standard income tax return form used by U.S. taxpayers. Understanding the purpose of Schedule C is crucial for accurately reporting earnings and ensuring compliance with IRS regulations.

Steps to Complete the Schedule C Form

Completing the Schedule C form involves several key steps to ensure accurate reporting of business income and expenses. Here is a simplified outline of the process:

- Gather Financial Records: Collect all relevant documents, including income statements, receipts for expenses, and any other financial records related to your business.

- Fill Out Business Information: Provide details about your business, including the name, address, and type of business activity.

- Report Income: Enter your total income from sales or services provided during the tax year.

- Deduct Expenses: List all allowable business expenses, such as advertising, utilities, and supplies. These deductions will reduce your taxable income.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss for the year.

- Complete Additional Sections: Depending on your business type, you may need to fill out additional sections related to vehicle use, cost of goods sold, or other specific areas.

Legal Use of the Schedule C Form

The Schedule C form is legally binding and must be completed accurately to avoid penalties. It is important to ensure that all information reported is truthful and reflects your actual business activities. The IRS requires that self-employed individuals maintain proper records to substantiate the income and expenses reported on this form. Failure to comply with IRS regulations can result in audits, fines, or other legal consequences.

Filing Deadlines / Important Dates

For most taxpayers, the Schedule C form is due on the same day as the individual income tax return, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Self-employed individuals may also need to make estimated tax payments throughout the year, with deadlines generally falling on the 15th of April, June, September, and January of the following year. Keeping track of these deadlines is crucial to avoid late fees and penalties.

Required Documents

To complete the Schedule C form accurately, certain documents are necessary. These include:

- Income Records: Documentation of all income earned from business activities, such as invoices and bank statements.

- Expense Receipts: Receipts for all business-related expenses, including utilities, rent, and supplies.

- Business License: A copy of any business licenses or permits required for your specific industry.

- Previous Year’s Tax Return: Reviewing last year’s return can provide helpful insights and ensure consistency.

Examples of Using the Schedule C Form

Schedule C is commonly used by various types of self-employed individuals. For instance, freelancers in fields such as graphic design or writing use this form to report income and expenses related to their projects. Similarly, small business owners, such as local retailers or service providers, utilize Schedule C to document their financial activities. Each example highlights the importance of accurately reporting income and expenses to comply with tax obligations.

Quick guide on how to complete schedule c 2014 form

Effortlessly Complete Schedule C Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle Schedule C Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Schedule C Form with Ease

- Find Schedule C Form and click Get Form to start.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Schedule C Form to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c 2014 form

Create this form in 5 minutes!

How to create an eSignature for the schedule c 2014 form

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a Schedule C Form and why do I need it?

The Schedule C Form is used by sole proprietors and single-member LLCs to report income or loss from their business. It is essential for accurately calculating your taxable income and ensuring compliance with IRS regulations. By utilizing airSlate SignNow, you can easily fill out and eSign your Schedule C Form, streamlining your tax preparation process.

-

How can airSlate SignNow help with my Schedule C Form?

airSlate SignNow offers an easy-to-use platform for creating, signing, and managing your Schedule C Form. With our eSigning capabilities, you can quickly send your completed forms to clients or partners for their signatures. This not only saves time but also ensures that you stay organized during tax season.

-

What features does airSlate SignNow offer for managing Schedule C Forms?

airSlate SignNow provides a variety of features tailored for managing your Schedule C Form, including customizable templates, secure eSigning, and cloud storage for easy access. You can also track the status of your documents and receive notifications when they are signed. This makes it simple to keep everything organized and on schedule.

-

Is airSlate SignNow affordable for small business owners needing to file a Schedule C Form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater specifically to small business owners who need to manage their Schedule C Form. With various subscription options, you can choose a plan that fits your budget while gaining access to all the essential features for document management and eSigning.

-

Can I integrate airSlate SignNow with other software I use for my Schedule C Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of popular business applications, enabling you to streamline your workflow while managing your Schedule C Form. Whether you use accounting software or customer relationship management tools, our integrations ensure that your documents are easily accessible and up-to-date.

-

What is the advantage of using airSlate SignNow for my Schedule C Form compared to traditional methods?

Using airSlate SignNow for your Schedule C Form provides signNow advantages over traditional methods, such as faster processing times and reduced paper usage. With electronic signatures, you can finalize your forms in minutes instead of days, helping you stay ahead during tax season and minimize stress.

-

How secure is my information when using airSlate SignNow for my Schedule C Form?

Security is a top priority at airSlate SignNow. When you use our platform to manage your Schedule C Form, your information is protected with advanced encryption and secure cloud storage. We comply with industry standards to ensure that your sensitive data remains confidential and safe from unauthorized access.

Get more for Schedule C Form

Find out other Schedule C Form

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free