Irs Schedule E Form 2013

What is the Irs Schedule E Form

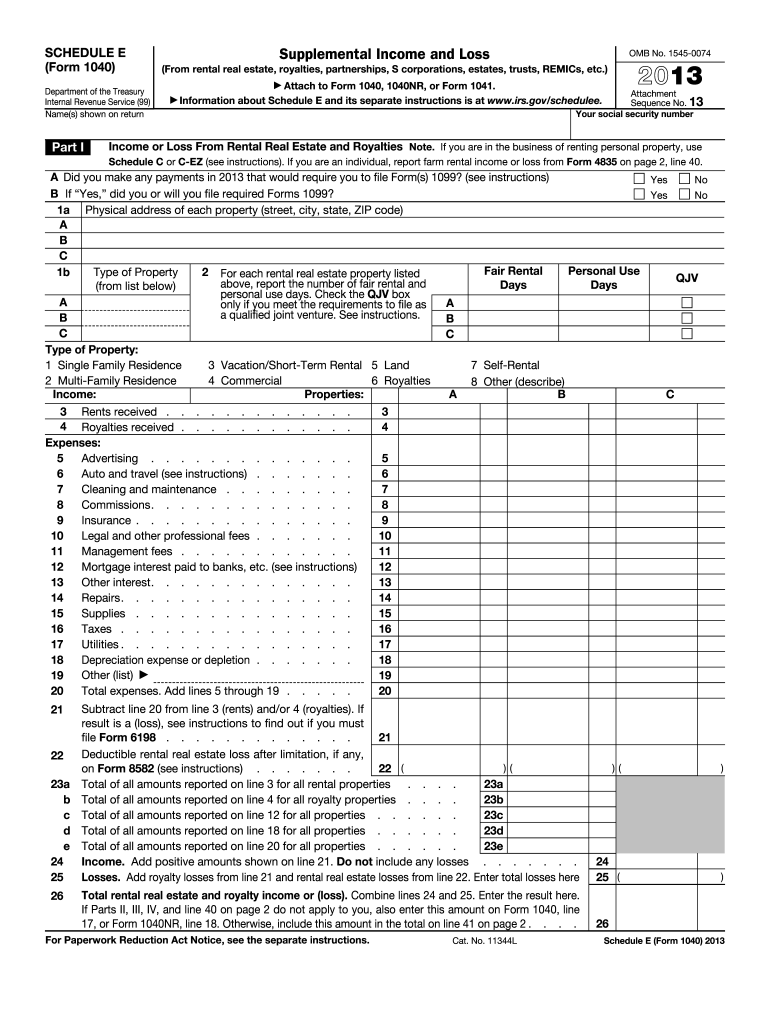

The Irs Schedule E Form is a tax document used by individuals in the United States to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. This form is essential for taxpayers who earn income from these sources, as it allows them to detail their earnings and any associated expenses. By accurately completing this form, taxpayers can ensure they are compliant with IRS regulations while maximizing their potential deductions.

How to use the Irs Schedule E Form

Using the Irs Schedule E Form involves several steps. Taxpayers must first gather all relevant financial information related to their rental properties or other income sources. This includes income received, expenses incurred, and any depreciation calculations. Once this information is compiled, taxpayers can fill out the form by entering the required details in the appropriate sections. It is important to ensure that all figures are accurate and that the form is signed before submission to the IRS.

Steps to complete the Irs Schedule E Form

Completing the Irs Schedule E Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and expense receipts.

- Fill out the taxpayer information section, including name, address, and Social Security number.

- Report income from each rental property or source on the designated lines.

- List all deductible expenses, such as repairs, maintenance, and property management fees.

- Calculate the total income or loss from all sources.

- Sign and date the form before submitting it to the IRS.

Key elements of the Irs Schedule E Form

The Irs Schedule E Form contains several key elements that are crucial for accurate reporting. These include:

- Property Information: Details about each rental property, including address and type.

- Income Section: Spaces to report rental income, royalties, and other earnings.

- Expenses Section: Areas to list deductible expenses related to property management and maintenance.

- Depreciation: A section for calculating depreciation on rental properties.

Filing Deadlines / Important Dates

It is essential for taxpayers to be aware of the filing deadlines associated with the Irs Schedule E Form. Typically, the form must be submitted by April fifteenth of the year following the tax year being reported. If taxpayers require additional time to file, they may request an extension, which generally provides an additional six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The Irs Schedule E Form can be submitted through various methods, providing flexibility for taxpayers. These methods include:

- Online Filing: Many taxpayers choose to file electronically using tax software, which can streamline the process and reduce errors.

- Mail: Taxpayers can print the completed form and send it to the appropriate IRS address based on their location.

- In-Person: While less common, some taxpayers may opt to deliver their forms directly to an IRS office.

Quick guide on how to complete irs schedule e 2013 form

Complete Irs Schedule E Form effortlessly across any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Irs Schedule E Form on any device using airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The simplest method to modify and eSign Irs Schedule E Form with ease

- Locate Irs Schedule E Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or blackout sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Schedule E Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs schedule e 2013 form

Create this form in 5 minutes!

How to create an eSignature for the irs schedule e 2013 form

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the Irs Schedule E Form used for?

The Irs Schedule E Form is primarily used to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and other sources. Understanding this form is essential for accurately filing your tax return and ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with the Irs Schedule E Form?

airSlate SignNow simplifies the process of preparing and signing the Irs Schedule E Form by providing an easy-to-use digital platform. Users can quickly fill out, sign, and send their forms securely without the need for printing or scanning.

-

Is airSlate SignNow cost-effective for eSigning the Irs Schedule E Form?

Yes, airSlate SignNow offers a cost-effective solution tailored to businesses and individuals needing to eSign documents like the Irs Schedule E Form. Our competitive pricing plans ensure you get value while meeting your document signing needs efficiently.

-

What features does airSlate SignNow offer for completing the Irs Schedule E Form?

airSlate SignNow provides features such as customizable templates, real-time tracking of document status, and multi-party signing. These tools make it easy to manage critical documents like the Irs Schedule E Form seamlessly.

-

Are there integrations available with airSlate SignNow for filing the Irs Schedule E Form?

Absolutely, airSlate SignNow integrates with popular accounting and tax software, streamlining the filing process for the Irs Schedule E Form. These integrations facilitate automatic data transfer, signNowly reducing error-prone manual entries.

-

What security measures does airSlate SignNow take when handling the Irs Schedule E Form?

airSlate SignNow employs advanced security measures such as end-to-end encryption and GDPR compliance to protect sensitive information when handling documents like the Irs Schedule E Form. Your data's security and privacy are our top priorities.

-

Can I store my completed Irs Schedule E Form on airSlate SignNow?

Yes, airSlate SignNow allows users to securely store completed documents, including the Irs Schedule E Form, within the platform. This feature ensures you have easy access to your files whenever needed, aiding in better organization.

Get more for Irs Schedule E Form

Find out other Irs Schedule E Form

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile