Form W 3ss 2013

What is the Form W-3SS

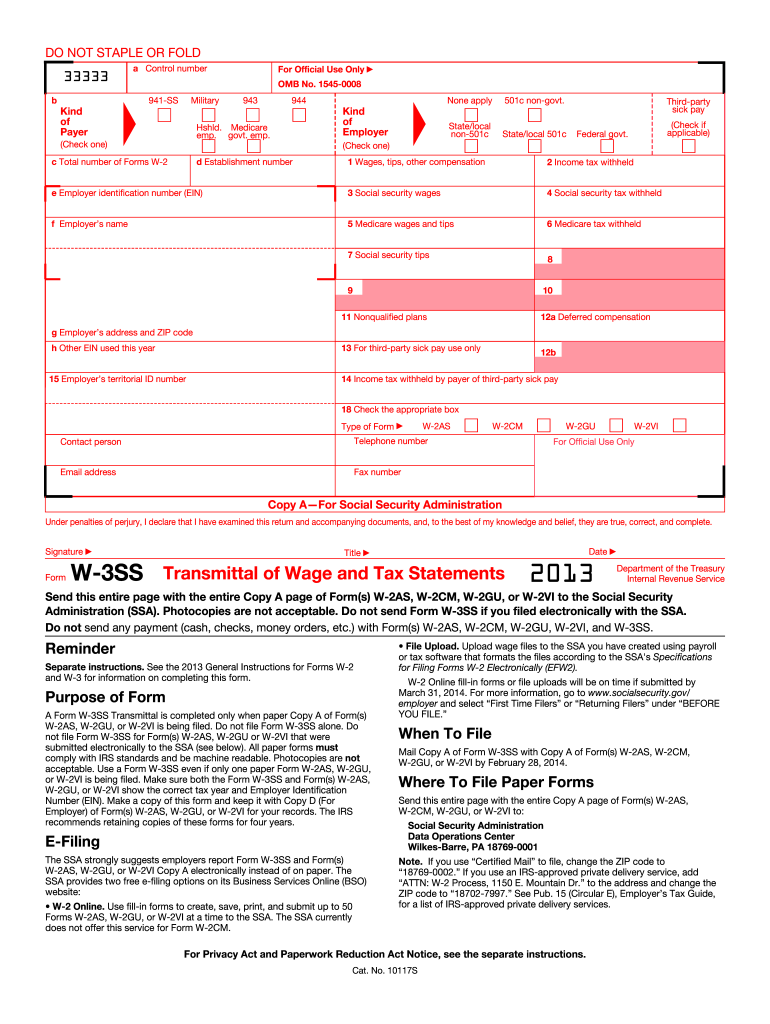

The Form W-3SS is a transmittal form used by employers to report income, withholding, and other tax information related to non-resident aliens. This form is specifically designed for use with Form 1042-S, which is issued to report payments made to foreign persons. The W-3SS serves as a summary of all Forms 1042-S filed by an employer for the tax year, ensuring that the IRS receives accurate information regarding the payments made to non-resident aliens.

How to use the Form W-3SS

Using the Form W-3SS involves several steps. First, employers must complete Form 1042-S for each non-resident alien to report the income paid and any taxes withheld. Once all Forms 1042-S are prepared, the employer fills out the W-3SS, summarizing the total amounts reported. This summary form is then submitted to the IRS along with the individual Forms 1042-S. It is important to ensure that all information is accurate and complete to avoid penalties or delays in processing.

Steps to complete the Form W-3SS

Completing the Form W-3SS requires careful attention to detail. Follow these steps:

- Gather all Forms 1042-S for the tax year.

- Fill out the W-3SS with your employer information, including name, address, and Employer Identification Number (EIN).

- Summarize the total income and withholding amounts from all Forms 1042-S.

- Double-check the accuracy of all entries to ensure compliance with IRS regulations.

- Submit the completed W-3SS along with all Forms 1042-S to the IRS by the designated deadline.

Legal use of the Form W-3SS

The Form W-3SS must be used in accordance with IRS guidelines to ensure its legal validity. Employers are required to file this form if they have paid income to non-resident aliens and must report that income and any withholding. Failure to file the W-3SS or to provide accurate information can result in penalties. It is crucial for employers to stay informed about the legal requirements surrounding this form to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-3SS are critical for compliance. Generally, the form must be submitted to the IRS by March 15 of the year following the tax year in which the payments were made. Employers should also be aware of any specific state requirements that may apply. Keeping track of these deadlines helps avoid penalties and ensures timely reporting of income and withholding.

Penalties for Non-Compliance

Employers who fail to file the Form W-3SS or submit inaccurate information may face significant penalties. The IRS imposes fines for late filings, which can increase the longer the form is overdue. Additionally, incorrect information may lead to further scrutiny and potential audits. It is essential for employers to adhere to filing requirements to mitigate these risks.

Quick guide on how to complete 2013 form w 3ss

Effortlessly prepare Form W 3ss on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Form W 3ss from any device using airSlate SignNow Android or iOS applications and enhance your document-related processes today.

How to modify and electronically sign Form W 3ss with ease

- Locate Form W 3ss and click Get Form to commence.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that aim.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Form W 3ss to ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form w 3ss

Create this form in 5 minutes!

How to create an eSignature for the 2013 form w 3ss

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

Get more for Form W 3ss

- Lengthamp39 under 20amp39 20amp39 to 32amp39 over 32amp39 ctgov ct form

- Dealer off highway vehicle purchase affidavit coloradogov colorado form

- How to change your business name with the state form

- Form sa296

- Mod p form

- Dld 130 form

- Cit 0001 e application for citizneship certificate for adults and minors proof of citizenship under section 3 of the form

- Information sheet how to apply for cpp survivors pension and childrens benefit

Find out other Form W 3ss

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement