The Educational Improvement Tax Credit for Dummies Form

What is the Educational Improvement Tax Credit for Dummies Form

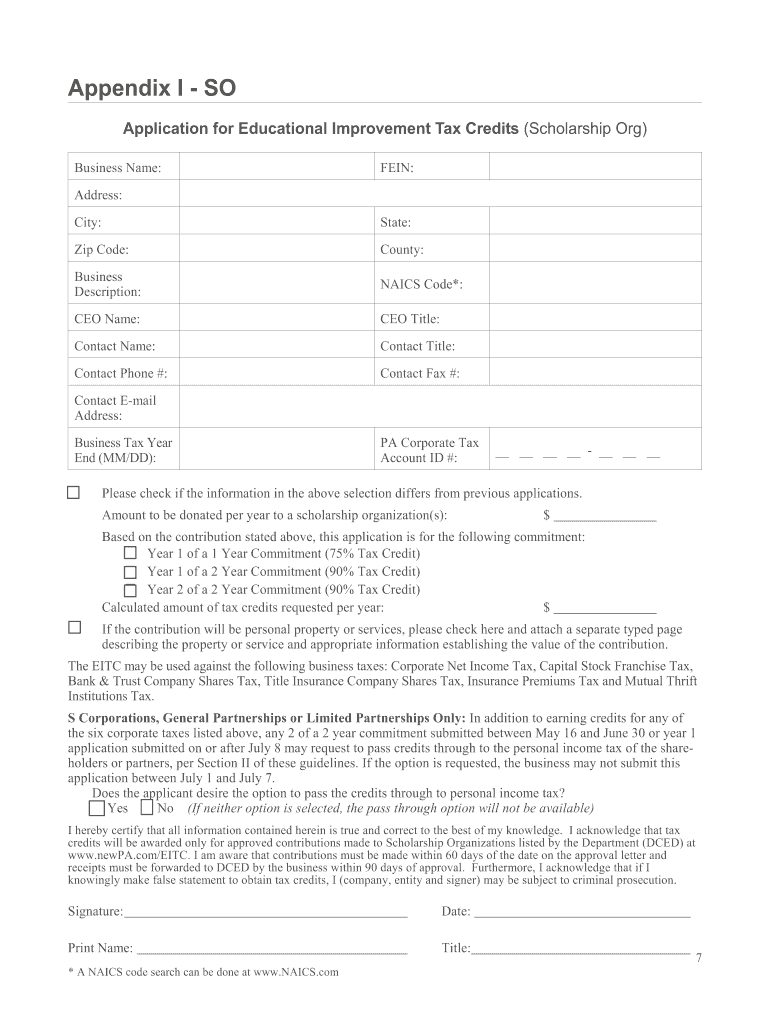

The Educational Improvement Tax Credit for Dummies form is a specific tax form designed to help taxpayers in the United States understand and apply for educational tax credits. This form simplifies the process of claiming credits available for contributions made to educational institutions. By providing clear guidelines and a structured format, it assists taxpayers in navigating the complexities of educational tax credits, ensuring they can take full advantage of available financial benefits.

How to Use the Educational Improvement Tax Credit for Dummies Form

Using the Educational Improvement Tax Credit for Dummies form involves several straightforward steps. First, gather all necessary information related to your contributions to educational institutions. Next, carefully fill out the form, ensuring that all required fields are completed accurately. It is important to follow the instructions provided with the form to avoid errors that could delay processing. Once completed, review the form for accuracy before submitting it to the appropriate tax authority.

Steps to Complete the Educational Improvement Tax Credit for Dummies Form

Completing the Educational Improvement Tax Credit for Dummies form can be broken down into several key steps:

- Gather necessary documentation, including proof of contributions and personal identification information.

- Fill out personal details, such as your name, address, and Social Security number.

- Document the amount contributed to eligible educational institutions.

- Review the eligibility criteria to ensure compliance with the requirements.

- Double-check all entries for accuracy before submission.

Legal Use of the Educational Improvement Tax Credit for Dummies Form

The Educational Improvement Tax Credit for Dummies form is legally recognized when it is completed and submitted in accordance with applicable tax laws. To ensure its legal validity, it must be filled out accurately and submitted by the designated deadlines. Utilizing a reliable electronic signature solution, like signNow, can enhance the form's legal standing by providing a secure and compliant method for signing documents electronically.

Eligibility Criteria

To qualify for the Educational Improvement Tax Credit, taxpayers must meet specific eligibility criteria. Generally, this includes being a resident of the state where the credit is offered and having made contributions to qualified educational institutions. Additionally, the contributions must meet minimum thresholds set by state regulations. It is essential to review these criteria carefully to ensure compliance and maximize potential tax benefits.

Required Documents

When completing the Educational Improvement Tax Credit for Dummies form, certain documents are required to support your application. These typically include:

- Proof of contributions, such as receipts or bank statements.

- Personal identification documents, including your Social Security number.

- Any additional forms or documentation specified by state tax authorities.

Form Submission Methods

The Educational Improvement Tax Credit for Dummies form can be submitted through various methods, depending on state guidelines. Common submission options include:

- Online submission via state tax authority websites.

- Mailing a physical copy of the form to the designated tax office.

- In-person submission at local tax offices, if available.

Quick guide on how to complete the educational improvement tax credit for dummies form

Complete The Educational Improvement Tax Credit For Dummies Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle The Educational Improvement Tax Credit For Dummies Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign The Educational Improvement Tax Credit For Dummies Form effortlessly

- Obtain The Educational Improvement Tax Credit For Dummies Form and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Select key sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, by email, SMS, or via a shareable link, or download it onto your computer.

Eliminate the issues of lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Revise and eSign The Educational Improvement Tax Credit For Dummies Form and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What tax form do I have to fill out for the money I made on Quora?

For 2018, there is only form 1040. Your income is too low to file. Quora will issue you a 1099 Misc only if you made over $600

Create this form in 5 minutes!

How to create an eSignature for the the educational improvement tax credit for dummies form

How to create an electronic signature for the The Educational Improvement Tax Credit For Dummies Form online

How to make an eSignature for your The Educational Improvement Tax Credit For Dummies Form in Chrome

How to generate an electronic signature for signing the The Educational Improvement Tax Credit For Dummies Form in Gmail

How to generate an eSignature for the The Educational Improvement Tax Credit For Dummies Form straight from your mobile device

How to create an electronic signature for the The Educational Improvement Tax Credit For Dummies Form on iOS devices

How to generate an electronic signature for the The Educational Improvement Tax Credit For Dummies Form on Android devices

People also ask

-

What is The Educational Improvement Tax Credit For Dummies Form?

The Educational Improvement Tax Credit For Dummies Form is a simplified document designed to help taxpayers understand and apply for the Educational Improvement Tax Credit. This form guides users through the necessary steps to take advantage of tax benefits related to educational improvements in their state.

-

How can I use The Educational Improvement Tax Credit For Dummies Form with airSlate SignNow?

You can easily upload The Educational Improvement Tax Credit For Dummies Form to airSlate SignNow for quick eSigning and document sharing. Our platform ensures that your form is securely signed and stored, simplifying the process of managing your educational tax credits.

-

Is there a cost associated with using The Educational Improvement Tax Credit For Dummies Form on airSlate SignNow?

While The Educational Improvement Tax Credit For Dummies Form itself is free, using airSlate SignNow requires a subscription. Our pricing is competitive and designed to provide cost-effective solutions for businesses needing to send and eSign documents efficiently.

-

What features does airSlate SignNow offer for The Educational Improvement Tax Credit For Dummies Form?

AirSlate SignNow provides features such as customizable templates, automated reminders, and secure storage for The Educational Improvement Tax Credit For Dummies Form. These tools streamline your workflow, making it easier to manage and submit your forms on time.

-

Are there any integrations available for The Educational Improvement Tax Credit For Dummies Form?

Yes, airSlate SignNow offers integrations with various platforms to enhance the usability of The Educational Improvement Tax Credit For Dummies Form. You can connect with popular applications like Google Drive, Dropbox, and CRM systems, ensuring seamless document management.

-

What are the benefits of using airSlate SignNow for The Educational Improvement Tax Credit For Dummies Form?

Using airSlate SignNow for The Educational Improvement Tax Credit For Dummies Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps you complete and submit your forms faster while keeping your sensitive information protected.

-

Can I track the status of The Educational Improvement Tax Credit For Dummies Form once sent?

Absolutely! With airSlate SignNow, you can track the status of The Educational Improvement Tax Credit For Dummies Form in real-time. You’ll receive notifications when your document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for The Educational Improvement Tax Credit For Dummies Form

- Form epv generation guidelines software developer specifications

- Please see item description for information needed

- Quick guide united overseas bank form

- Arizona department of revenue releases important 2019 taxpayer form

- Autoriza o para concess o de passaporte para form

- Affidavit of support and financial statement the university of memphis form

- Point of care test analyst application amp checklist mhds nv form

- Farmington high school guest dance pass homecoming form

Find out other The Educational Improvement Tax Credit For Dummies Form

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application