Form 843 2010

What is the Form 843

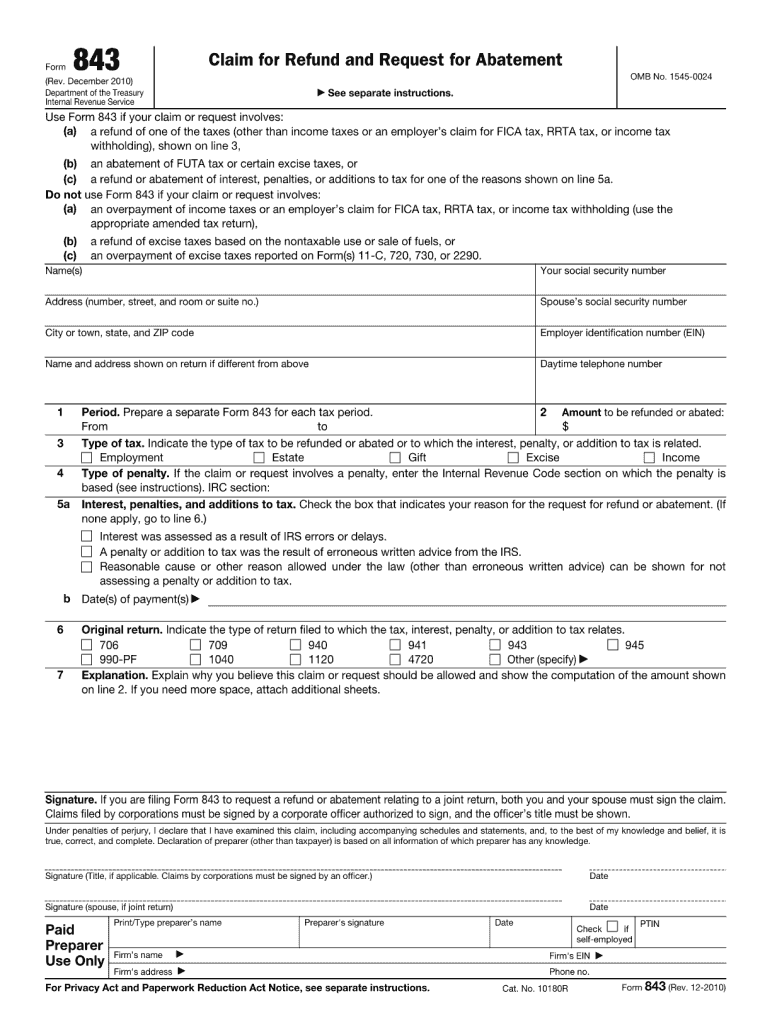

The Form 843 is a tax form used by taxpayers in the United States to claim a refund or request an abatement of certain taxes, penalties, or interest. This form is typically utilized for specific situations such as overpayment of taxes or requests for relief from penalties due to reasonable cause. Understanding the purpose and application of Form 843 is essential for ensuring compliance with IRS regulations and for effectively managing tax obligations.

How to use the Form 843

To use Form 843, taxpayers must first determine their eligibility for filing the form based on their specific tax situation. The form must be filled out accurately, providing all required information, including the taxpayer's identification details and the reason for the refund or abatement request. Once completed, the form should be submitted to the appropriate IRS office, following the guidelines provided for the specific tax type involved.

Steps to complete the Form 843

Completing Form 843 involves several key steps:

- Gather necessary information, including taxpayer identification and details about the tax in question.

- Clearly state the reason for the refund or abatement request in the designated section.

- Provide any supporting documentation that may strengthen the case for your request.

- Review the form for accuracy and completeness before submission.

- Submit the form to the appropriate IRS address based on the type of tax involved.

Legal use of the Form 843

The legal use of Form 843 is governed by IRS guidelines, which stipulate that the form must be used for legitimate claims related to tax refunds or abatements. It is crucial for taxpayers to ensure that their requests are based on valid grounds, such as overpayment or reasonable cause for penalties. Filing the form in accordance with IRS regulations helps avoid potential legal issues and ensures a smoother resolution process.

Filing Deadlines / Important Dates

When filing Form 843, it is important to be aware of relevant deadlines. Generally, taxpayers must submit the form within three years from the date they filed their original return or within two years from the date they paid the tax, whichever is later. Missing these deadlines may result in the denial of the refund or abatement request, so timely submission is essential for successful processing.

Required Documents

To support a request made on Form 843, taxpayers may need to provide various documents, including:

- Proof of tax payment, such as receipts or bank statements.

- Documentation supporting the reason for the refund or abatement, like correspondence with the IRS or evidence of reasonable cause.

- Any relevant tax returns or forms that pertain to the claim.

Form Submission Methods (Online / Mail / In-Person)

Form 843 can be submitted through various methods, depending on the taxpayer's preference and the specific IRS guidelines. Typically, the form can be mailed to the appropriate IRS address listed in the instructions. In some cases, taxpayers may also have the option to submit the form electronically through IRS e-filing services, though this may vary based on the nature of the request. In-person submissions are generally not recommended unless specifically required.

Quick guide on how to complete 2010 form 843

Complete Form 843 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage Form 843 on any device with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign Form 843 with minimal effort

- Find Form 843 and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional handwritten signature.

- Verify all the information and click on the Done button to save your updates.

- Choose your method of delivering the form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about misplaced or lost documents, cumbersome form navigation, or errors that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Edit and eSign Form 843 and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 843

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 843

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 843 and how can airSlate SignNow help with it?

Form 843 is a request for the abatement or refund of certain taxes. With airSlate SignNow, you can easily create, send, and eSign Form 843, making the process efficient and secure. Our platform ensures that all your tax documents are handled seamlessly, saving you time and reducing paperwork.

-

Is airSlate SignNow a cost-effective solution for managing Form 843?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 843 and other documents. Our pricing plans are designed to fit businesses of all sizes while providing robust features that streamline the eSignature process. You'll find that investing in our service pays off through increased efficiency and reduced administrative costs.

-

What features does airSlate SignNow offer for Form 843 processing?

airSlate SignNow includes several features that enhance the processing of Form 843, such as customizable templates, automated workflows, and real-time tracking. These tools help ensure that your forms are completed accurately and promptly, facilitating a smoother filing process. Additionally, our intuitive interface makes it easy for anyone to manage their forms.

-

Can I integrate airSlate SignNow with other applications for Form 843 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM and document management systems, which can enhance your workflow for Form 843. This integration allows you to automate processes and create a more comprehensive solution for managing your documents, improving overall efficiency.

-

How secure is airSlate SignNow for handling sensitive documents like Form 843?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and compliance with industry standards to protect sensitive documents like Form 843. You can trust that your data is safe with us, allowing you to focus on completing your forms without worrying about security bsignNowes.

-

Can I track the progress of my Form 843 using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your Form 843. This feature allows you to see when the document is sent, viewed, and signed, giving you peace of mind and control over the process. You’ll receive notifications to keep you updated every step of the way.

-

What are the benefits of using airSlate SignNow for Form 843?

Using airSlate SignNow for Form 843 offers numerous benefits, including faster processing times, reduced errors, and improved collaboration. Our platform simplifies the eSigning process, making it easier for all parties involved to complete the necessary paperwork. Additionally, going digital helps reduce clutter and enhance the overall workflow.

Get more for Form 843

- Please print this form and include with your shipment

- Stockton ports agree to partnership with pscballpark digest form

- Knights of columbus form 1295

- Application form palau national communications corporation

- Rodent surgical record by cage research a to z form

- Fatcahelp501internal revenue service form

- Ushpa safe pilot award application us hang gliding and ushpa form

- Phonak repair form

Find out other Form 843

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself