Irs Form 843 2009

What is the IRS Form 843

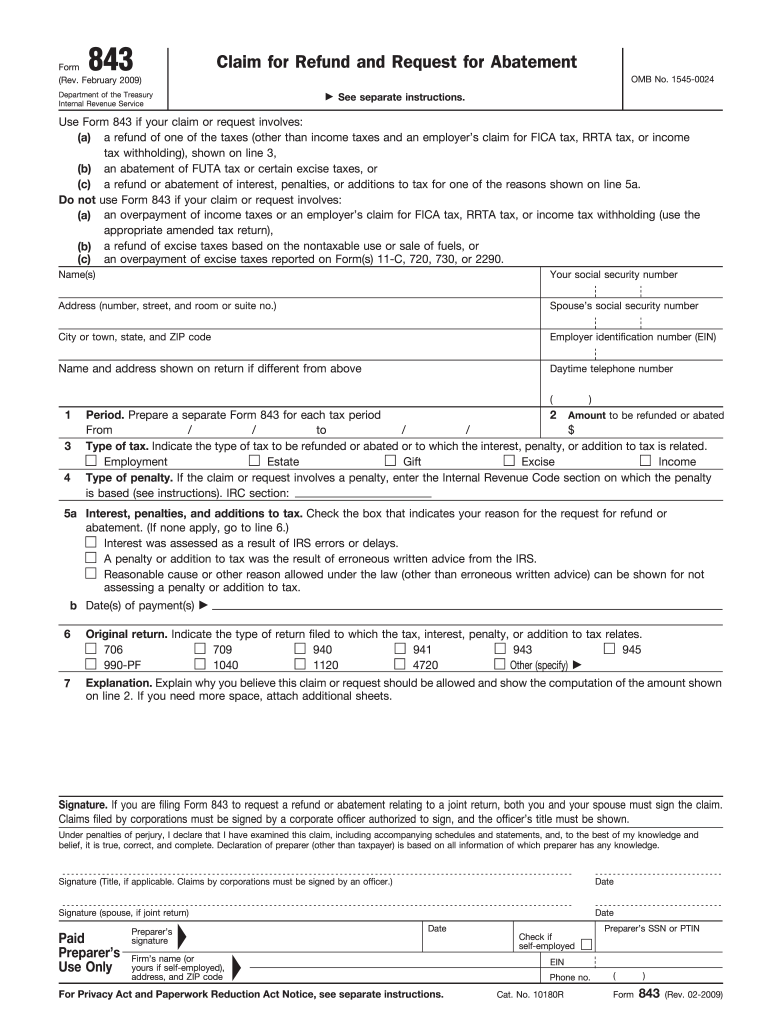

The IRS Form 843 is a tax form used by individuals and businesses to request a refund or abatement of certain taxes, penalties, or interest. This form is typically utilized when a taxpayer believes they have overpaid their taxes or when they are seeking relief from penalties imposed by the IRS. The form allows for a formal request to be made to the IRS for reconsideration of tax-related issues.

How to use the IRS Form 843

To use the IRS Form 843 effectively, taxpayers must complete the form accurately and provide all necessary information. This includes details such as the taxpayer's name, address, and taxpayer identification number. Additionally, the form requires a clear explanation of the reason for the request, including any relevant tax periods and amounts involved. It is essential to ensure that all information is correct to avoid delays in processing.

Steps to complete the IRS Form 843

Completing the IRS Form 843 involves several key steps:

- Download the form from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Specify the type of tax and the tax period related to your request.

- Provide a detailed explanation of why you are requesting a refund or abatement.

- Sign and date the form to certify its accuracy.

After completing the form, it should be submitted according to the instructions provided, either by mail or electronically, if applicable.

Legal use of the IRS Form 843

The IRS Form 843 is legally binding when completed and submitted in accordance with IRS guidelines. To ensure its legal validity, taxpayers must adhere to the specific requirements outlined by the IRS, including providing accurate information and necessary documentation. The form must be signed by the taxpayer or an authorized representative, ensuring that the request is legitimate and compliant with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 843 can vary depending on the nature of the request. Generally, taxpayers should submit the form within three years from the date of the original tax return filing or within two years from the date the tax was paid, whichever is later. It is important to be aware of these timelines to ensure that requests for refunds or abatements are considered by the IRS.

Required Documents

When submitting the IRS Form 843, certain documents may be required to support the request. These can include:

- Copies of tax returns for the relevant years.

- Documentation supporting the reason for the refund or abatement request.

- Any correspondence with the IRS related to the issue.

Providing thorough documentation can help facilitate a smoother review process by the IRS.

Form Submission Methods

The IRS Form 843 can be submitted via mail or electronically, depending on the specific circumstances and IRS guidelines. For most taxpayers, mailing the completed form to the appropriate IRS address is the standard method. Some taxpayers may have the option to submit the form electronically through IRS-approved software, which can streamline the process and reduce processing times.

Quick guide on how to complete irs 2009 form 843

Complete Irs Form 843 effortlessly on any gadget

Digital document management has garnered popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without holdups. Manage Irs Form 843 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Irs Form 843 effortlessly

- Locate Irs Form 843 and click Get Form to begin.

- Make use of the features we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to store your changes.

- Choose how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form browsing, or errors that require reprinting documents. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Alter and eSign Irs Form 843 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 2009 form 843

Create this form in 5 minutes!

How to create an eSignature for the irs 2009 form 843

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is Irs Form 843, and when should I use it?

Irs Form 843 is used to request a refund or abatement of certain taxes, penalties, or interest. You should use this form when you believe you have overpaid your taxes and need to rectify that with the IRS. Properly completing Irs Form 843 ensures your request is processed efficiently.

-

How can airSlate SignNow help with the Irs Form 843 submission?

airSlate SignNow provides users with the ability to easily fill out and eSign Irs Form 843 within a secure platform. With our intuitive interface, you can prepare your form digitally, allowing for hassle-free submission to the IRS. This streamlined process saves time and reduces errors, ensuring your request is submitted correctly.

-

What features does airSlate SignNow offer for Irs Form 843 processing?

Our platform offers features such as customizable templates, real-time collaboration, and secure eSigning capabilities for Irs Form 843. These tools make it easier to manage document workflows and ensure that all parties can review and approve the form promptly. Additionally, you can track the status of your form after submission.

-

Is airSlate SignNow affordable for businesses looking to submit Irs Form 843?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to submit Irs Form 843 and other documents. We provide various pricing plans to meet different organizational needs, ensuring you only pay for the features that benefit your operations. Our pricing structure aims to help businesses save money while maximizing efficiency.

-

Can I integrate airSlate SignNow with other software for processing Irs Form 843?

Absolutely! airSlate SignNow supports integration with various third-party applications that can enhance your document management for Irs Form 843. This ensures a seamless workflow by connecting with CRM systems, cloud storage, and other tools you may already be using, making document handling even more efficient.

-

What are the benefits of using airSlate SignNow for Irs Form 843?

Using airSlate SignNow for Irs Form 843 offers numerous benefits, including time savings, error reduction, and enhanced security for sensitive documents. Our platform allows for quick preparation and eSigning, enabling you to focus on other important tasks. Plus, you can rest assured that your data is protected with our state-of-the-art security features.

-

How long does it take for Irs Form 843 to be processed after submission?

The IRS typically processes Irs Form 843 requests within about 8 to 12 weeks, depending on their workload. Using airSlate SignNow may help expedite your internal processes, allowing you to submit the form quickly and easily. Keeping track of your submission through our platform can provide peace of mind during this waiting period.

Get more for Irs Form 843

- Hall individual income tax return hall individual income tax return form

- Pdf ftb 1564 franchise tax board cagov form

- Tennessee department of revenue letter tngov form

- Fae183 fampampe application for exeptionannual exemption renewal fae183 fampampe application for exeptionannual exemption form

- Solid waste and surcharge returns form

- Other taxes internal revenue service form

- Pdf form 5471 internal revenue service

- P503 department of the treasury internal revenue service form

Find out other Irs Form 843

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document