Fillable Pay Stub PDF Form

What is the Fillable Pay Stub PDF

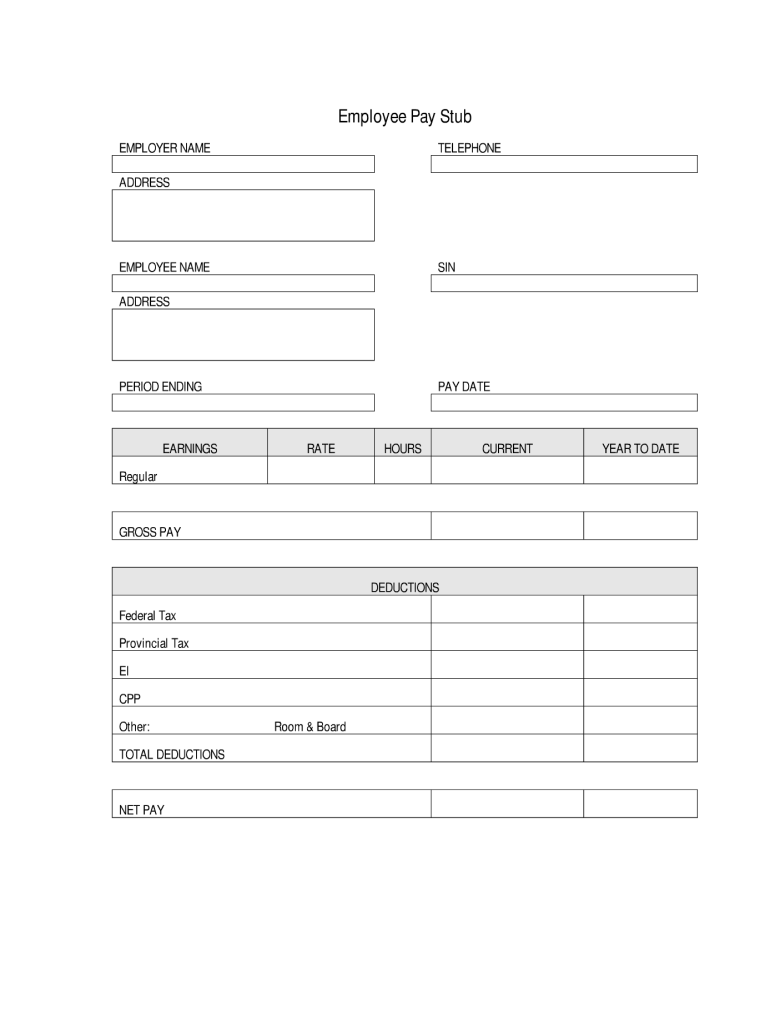

The fillable pay stub PDF is a digital document designed to provide a detailed breakdown of an employee's earnings for a specific pay period. This document typically includes information such as gross pay, deductions, and net pay. It serves as an essential record for both employers and employees, ensuring transparency in payment processes. The fillable format allows users to enter specific data directly into the PDF, making it easy to customize for different employment situations.

How to Use the Fillable Pay Stub PDF

To use the fillable pay stub PDF, start by downloading the template from a reliable source. Open the PDF in a compatible viewer that supports form filling. Enter the required information, including employee details, pay period dates, and financial figures. Ensure accuracy in all entries, as this document may be used for various purposes, such as loan applications or tax filings. After completing the form, save it securely for future reference or distribution.

Steps to Complete the Fillable Pay Stub PDF

Completing the fillable pay stub PDF involves several straightforward steps:

- Open the PDF template in your preferred PDF editor.

- Input the employee's name and identification details.

- Fill in the pay period dates to indicate the duration of the earnings.

- Enter gross pay, which includes salary, bonuses, and other compensation.

- List all deductions, such as taxes and insurance premiums.

- Calculate and enter the net pay, which is the amount the employee takes home after deductions.

Review all entries for accuracy before saving or printing the document.

Key Elements of the Fillable Pay Stub PDF

Understanding the key elements of a fillable pay stub PDF is crucial for both employers and employees. Important components include:

- Employee Information: Name, address, and identification number.

- Employer Information: Company name and contact details.

- Pay Period: Start and end dates for the payment cycle.

- Gross Pay: Total earnings before deductions.

- Deductions: Itemized list of all withholdings, including taxes and benefits.

- Net Pay: Final amount after all deductions.

These elements ensure that the pay stub is comprehensive and meets legal requirements.

Legal Use of the Fillable Pay Stub PDF

The fillable pay stub PDF is legally recognized as a valid document for various purposes. Employers are required to provide pay stubs to employees as a record of earnings and deductions. This document can be used by employees to verify income for housing applications, loan approvals, and tax filings. It's important to ensure that all information is accurate and complies with state and federal regulations to avoid any legal issues.

Examples of Using the Fillable Pay Stub PDF

There are numerous scenarios where a fillable pay stub PDF can be beneficial:

- When applying for a rental agreement, landlords often require proof of income.

- Financial institutions may request pay stubs during the loan application process.

- Employees may need to provide pay stubs for tax preparations or audits.

These examples highlight the importance of maintaining accurate and accessible pay stub records.

Quick guide on how to complete pay stubs form

Discover how to navigate the Fillable Pay Stub Pdf completion with this simple guide

Submitting and verifying forms online is gaining traction and becoming the preferred choice for a diverse range of clients. It provides many benefits over outdated printed documents, including convenience, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can locate, modify, sign, optimize, and send your Fillable Pay Stub Pdf without being hindered by endless printing and scanning. Follow this brief guide to begin and complete your form.

Follow these steps to obtain and complete Fillable Pay Stub Pdf

- Begin by clicking on the Get Form button to open your document in our editor.

- Pay attention to the green label on the left identifying mandatory fields to ensure you don’t miss them.

- Utilize our advanced features to annotate, modify, approve, secure, and enhance your document.

- Protect your file or transform it into a fillable form using the tools on the right panel.

- Review the document and look for any mistakes or inconsistencies.

- Click DONE to complete your edits.

- Rename your document or leave it unchanged.

- Choose the storage option for saving your document, send it via USPS, or click the Download Now button to get your document.

If Fillable Pay Stub Pdf isn’t what you were searching for, you can explore our broad selection of pre-uploaded templates that you can complete with ease. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

-

How much do I need to prove that I can support myself in the US when I win a DV lottery?

There is no fixed amount of money you must have access to, to be a successful DV winner and visa holder. The immigrant should show ownership of property and assets, a job offer in the US, or that the immigrant is already living legally in the United States with a job that pays a sufficient income, in order to overcome the public charge ground of inadmissibility. For example, you may submit:a job offer letter from a US employer, or pay stubs from existing employment in the US.copies of bank statements showing current balance, or preferably a bank statement showing annual deposits and withdrawals as well as current balance, and how the money will be transferred to the US.copies of land deeds or other evidence of real estate ownership, along with any mortgage statements showing the amount of remaining debtcopies of documents showing ownership of insurance policiesevidence of other income, such as from investments or royalties.Having a Sponsor Sign Form I-134 Affidavit of SupportIf the immigrants' sources of financial support are not sufficient on their own, one possibility is to find a US sponsor to fill out an Affidavit of Support on Form I-134, issued by U.S. Citizenship and Immigration Services (USCIS).

-

Real Estate in New York City: How can a foreigner rent an apartment in NY without a credit score?

You should provide the following, no credit score or tax returns needed:- Employment verification letter- Two recent pay stubs that verify the salary claims in the EV letter- Two most recent bank statements that show a reasonable amount of cash- Photo ID in the form of a passport or visaGenerally, the above should be plenty, but it does depend on the landlord.The landlord will likely have you fill out a W8 form, as well - common with foreign renters.You may also be able to use a corporate guarantor service like Insurent. Not all landlords accept them, due to certain constraints or preferences, but worth checking.Some landlords will accept a full year's payment up-front; however, this can only be done in free market buildings (rent stabilized buildings have some rules against this). Even in free market buildings, it's up to the landlord whether or not to accept full payment, additional security, or some form of back rent up-front.When emailing brokers / leasing offices, make sure to inquire about their international leasing policies, so you don't risk wasting any time on buildings that have strict or unreasonable policies.Good luck and welcome to New York!

-

My employer made me fill out a w-9 he pays me by the hour and with holds taxes from me this isn't legal is it either he needs to have me fill out a w2 or not with hold taxes am I correct about this?

Think of the W-9 as a vehicle between a pay provider or a vendor and an independent contractor. When a W-9 is involved, we typically do not use the terms "employer" or "employee". Rather we use the terms vendor and independent contractor. If you have filled out a W-9, then the person paying for labor sees the worker as an independent contractor, not an employee. In this case you get a 1099-MISC and not a Form W-2 at the end of the year. (People and companies that pay for labor often prefer to pay workers as independent contractors, instead of as employees, because the payor does not have to pay employment taxes or provide other benefits.) If you fail to fill out and provide a completed W-9 when one is requested of you, then the person paying for labor is required to hold back part of the pay to the independent contractor (mandatory back up withholding). However, if you have provided a signed W-9 back to the person paying you, then you are correct, the payor should not be withholding anything (unless you have more than one single status as a worker for this company?) If you have filled out and returned only a W-9 to the person who pays you, and know for sure you have not also filled out a W-4 (to be treated as an employee and later receive a W-2), and you can also produce paycheck stubs that show withholding for Social Security and Medicare, state taxes (FICA, MED, etc.), then you should raise this issue with your tax preparer and ask if you should consider filing a Form SS-8 when you complete your tax return. Better yet, print out and bring a Form SS-8 into work now, and ask to speak with someone in human resources, personnel, or the accounting office at the company about that Form SS-8. An SS-8 form should sufficiently scare the bejesus out of the company. If some foul play is at work here, the concern over a Form SS-8 will make people sit up and pay attention. If it is something else (like some of your work is as an employee and other more independent projects are paid out to contractors instead of employees,) then an SS-8 will still be effective... the person paying for labor will go out of their way to then be as clear as possible in explaining their actions. Two final thoughts: 1) Remember, it does not matter what they are doing or not doing, or whether it is legal or questionable. It only matters what you can demonstrate or prove. If you don't get real, live paychecks or at least a stub or advice of deposit that shows withholding, then it will be difficult for you to demonstrate what has or is happening. 2) Sit with a professional tax preparer this coming tax season - and just pay for the service. If you've never seen or filled out a Form SS-8 before, now is not the time to venture it on your own. I can probably figure out how to change the oil in my car by myself. I go to a mechanic for an oil change for a reason.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

I am 17, and my parents are going to kick me out on my 18th birthday in August to make me homeless. What do I do? I don’t have a driver’s license or a bank account. My parents say that I cannot find a job but that I am “free” to do so once I leave.

I am one of 3 sons, and we were all told from as young as I can remember, “You have until you’re 18 to live here and eat my food and use my utilities. As long as you live here, you will obey my rules. My house, my things, my kids, my rules.” This was not my parents’ position just to “make me homeless”. Homelessness was not their intent. Us boys achieving independence and self-reliance was the intent.My parents lived through the Great Depression and World War II. My Dad was a B-29 bombardier in the Korean War, but before that he was one of 14 children of a tobacco farmer (and moonshiner), and that meant that he had to work hard for every meal he ate. My Granddaddy was a little, wiry, freakishly strong, backbreaking worker of a man. Daddy always told us (and so did his siblings) that the young un’s were Mama’s until theywere big enough to hold a hoe and shovel, at which point they became Granddaddy’s labor force. Granddaddy would often say he couldn’t afford to hire help, so he just made it instead.My Mom is a first-generation American, the daughter of Itish immigrants who fled Ireland due to the depths of poverty and hopelessness turn-of-the-century Irishmen endured. Hours in Irish fields were just as long and hard as what my Dad grew up in, and my Mom’s folks knew there was no future for them at home. Irish children died of hunger routinely or were basically sold off to various ‘labour houses’ to perform backbreaking manual labor for pennies a week. Upon arriving in the US in 1910, in Birmingham, Alabama, my grandparents found work of the same type as in Ireland: crop gathering, mining, menial household chores-type work wherever it could be found.Feeding a family in those conditions was a tribulation. It was very common for children to strike out on their own as young as 15. My Mom stayed at home with her folks until at 18, she met my Dad on leave in 1956 in Pensacola, Florida, where she was visiting cousins, picking strawberries and tomatoes for 2¢ a bushel. My Dad joined the Air Force by lying about his age to get in, in 1949 at the age of 15, to get off the farm and “make some real money”—the princely sum of $82 per month! And free medical and dental, and even paid vacation. Unheard-of in 1949 on the shale flats and hills of rural Tennessee tobacco country. By 1956, Daddy had gone from an Airman 2 to an O-1 bombardier from 1951–53 (battlefield promotion) and back down to WO-4 after the war when he reclassed as an Air Policeman, for which he was paid $399 per month. They married in 1959 after he got out of the Air Force. He took his GI Bill and went to flight school and electronics school, eventually becoming a commercial-rated pilot and an Electrical Engineer just as the Space Race shifted into warp drive. He landed at NASA and TRW Space Systems (from which he retired after 33 years).Mom had no education beyond high school and secretary school, working as a store clerk, a farmer’s market secretary, a Ma Bell telephone operator, a doctor’s receptionist, a medical bookkeeper, and even a Census taker, collections agent, and construction secretary. She finally fetched up at DCAA and retired as a Federal auditor.Even after such a life, my Daddy found himself to be restless—he often said he didn’t know what to do with himself, living at 3113 Leftwich Street, Huntsville, Alabama in 1965. Their house had a small back yard, too small for livestock or gardening, so in 1969, he found a delapidated old farm in Lincoln, Tennessee, and that’s where I lived until 1976, when I absconded to the military.Theirs was a rags-to-JCPenney-clothes story, and every chapter was written in sweat and tears. My brothers and I were raised on a feeder farm by hard-working, no-nonsense people who were themselves the children of hard-working, no-nonsense people.Being shown the door at NLT 18 may seem cruel to the modern generation (of Americans) who’ve never once had to scrape potatoes out of the earth with their bare hands (like me and my family did), or catch a cow that didn’t want to be caught, or pluck chickens or gut fish, or scrub the bristles off a hog’s hide just to have supper.My parents took me to the Lincoln County Health Department when I was 14 to get my work permit, and they found me my first job—minimum wage of $1.65 per hour (not $2.00, because it was a restaurant…an ice cream shop). I had to give every cent to them for room and board and gas to and from the Hyde Out. If I was lucky, I kept $2–3 for myself.I couldn’t wait to be 18 and get the hell out of there! I mean, I literally couldn’t wait—I joined the Navy at 17 (with Daddy’s blessing and Mom’s not knowing until it was too late to stop it).For many people of my generation, getting kicked out at 18 was a liberation. It was very hard to live at home with the endless labors of being a farmer’s child.I vowed that my eventual children would not be raised so close to the dirt that they had to dig it out from under their fingernails every night. I vowed that my eventual kids would not have to go fishing after school to have meat for supper. Once I was finished with military service, I bought a place in the country to raise my kids on…but it is no farm—feeder, truck, commercial, or otherwise. Just some acreage 20 miles from my job where I can plant tomatoes, onions, and hot peppers, where I don’t hear sirens every single day, or have neighbors 30 feet away, but guess what I told my kids?“You have until you’re 18 to live here and eat my food and use my utilities. As long as you live here, you will obey my rules. My house, my things, my kids, my rules.”I also told them, “You think I’m hard on you, but I never wake you up at 3:00AM to feed the cows, chickens, and hogs and bring in firewood and eggs before you go to school. I don’t make you cut firewood or 12 rows of okra (okra cutting is torture), or bend your back picking bush beans. I never make you clean rabbits or deer for the freezer. I don’t make you sit out back and shuck corn and shell peas for 10 hours. You two have got. It. Made. I make you mow the lawn and pick up your dirty clothes. I make you load the dishwasher. I make you brush your teeth. I make you bring the garbage cans up. I make you do your homework. I’m a bastard, aren’t I?”I made them study and work hard on schooly things because I had already figured out that kids their ages would be adults left behind without college degrees. My hard work and theirs allowed both to attend and graduate the University of Alabama. They’ve done quite well for themselves, and I never have to give either one a cent. I went back to school myself, though not UA because of cost, taking 8 years of night school and correspondence courses to earn my own degrees).None of this was easy, not for any of us.Life is hard. It takes work.And you have to start young.Your parents are doing you a favor. They are not saying to you, “Get out, we hate your guts,” they are saying to you, “Get out and make your own way, and you must start young.”You must adopt the proper attitude: this is for your own good, and only you can see to your own good. Who stays with Mom and Dad til he’s 30 has crippled his own independence and gumption. Get-up-and-go. Drive. Ambition.If you have none, you become a leech rather than a worker bee.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How long does it take for Goldman Sachs’ background check?

When I was at Goldman Sachs, the background check would take from 5 to 7 business days. The firm can expedite background checks in urgent cases and get a preliminary approval sooner if need be.One way to help expedite your background check is to provide supporting documents that will verify your prior employment (offer letters and last paychecks), college degrees (transcripts) and wages (pay stubs and W2). These pieces to the background check will take longer and with these supporting documents can give confidence to clear you quicker.Some reasons I have seen for delays in background checks include: 1) issues with credit report, 2) Issues with the criminal report, 3) misrepresentation on your background check document as compared to your resume and 4) difficulty verifying your prior employment, compensation and college degrees.The background check at Goldman Sachs is quite rigorous. I highly recommend that you are thorough and detailed in completing your background check when applying to Goldman Sachs. Don't lie on the background or even fudge a date or a past salary. If you have a gap in your employment, you must note it with the reason. Additionally, your resume must match exactly. Make sure you submit your resume directly to your recruiter as the official document. Sometimes when you are working with an agency or vendor, they may collapse your employment or rework your resume to make it look better. This can cause issues with verification and possibly cause you to fail the background check.If you are at the background check stage, you have already landed the job. Don't lose it because you were sloppy filling out a form or left out a gap in your employment or over estimated your compensation or didn't actually graduate from college. It is worth noting that the background check company does not care that you took time off or what you got paid. They care that you completed the documents with integrity and that it is a true reflection of your past experiences.

Create this form in 5 minutes!

How to create an eSignature for the pay stubs form

How to generate an eSignature for the Pay Stubs Form online

How to generate an eSignature for your Pay Stubs Form in Chrome

How to create an eSignature for putting it on the Pay Stubs Form in Gmail

How to create an electronic signature for the Pay Stubs Form from your mobile device

How to generate an electronic signature for the Pay Stubs Form on iOS devices

How to create an electronic signature for the Pay Stubs Form on Android devices

People also ask

-

What is a Fillable Pay Stub Pdf?

A Fillable Pay Stub Pdf is a digital document that allows employees to easily enter their payment details into a standardized template. This type of PDF ensures that the pay stub includes all necessary information such as hours worked, deductions, and taxes. With airSlate SignNow, you can create or modify Fillable Pay Stub Pdfs effortlessly, streamlining the payroll process.

-

How can I create a Fillable Pay Stub Pdf with airSlate SignNow?

Creating a Fillable Pay Stub Pdf with airSlate SignNow is simple and user-friendly. Just upload your existing pay stub template or use our customizable options to design your own. Once you have your template ready, you can easily add fillable fields for your employees to complete.

-

Is there a cost to use the Fillable Pay Stub Pdf feature?

airSlate SignNow offers competitive pricing for its services, including the Fillable Pay Stub Pdf feature. You can choose from various plans that best fit your business needs, ensuring you get great value for your investment. Check our pricing page for more details on available plans and features.

-

What are the benefits of using a Fillable Pay Stub Pdf?

Using a Fillable Pay Stub Pdf enhances accuracy and efficiency in payroll processing. It minimizes errors associated with manual entry and ensures that employees receive clear and professional pay documentation. Additionally, it saves time and resources, allowing your team to focus on other important tasks.

-

Can I integrate Fillable Pay Stub Pdf with other software?

Yes, airSlate SignNow supports seamless integrations with various payroll and accounting software. This allows you to easily manage your Fillable Pay Stub Pdfs alongside your existing systems, improving workflow and data accuracy. Check our integrations page for a full list of compatible applications.

-

Are Fillable Pay Stub Pdfs secure?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Fillable Pay Stub Pdfs. We use advanced encryption methods to protect sensitive information and ensure that only authorized personnel can access the data. Your peace of mind is our priority.

-

Can I customize my Fillable Pay Stub Pdf template?

Yes, you can fully customize your Fillable Pay Stub Pdf template using airSlate SignNow’s intuitive design tools. Modify fields, adjust layouts, and add your company branding to ensure the pay stubs reflect your business identity while meeting all legal requirements.

Get more for Fillable Pay Stub Pdf

Find out other Fillable Pay Stub Pdf

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later