7004 Form 2011

What is the 7004 Form

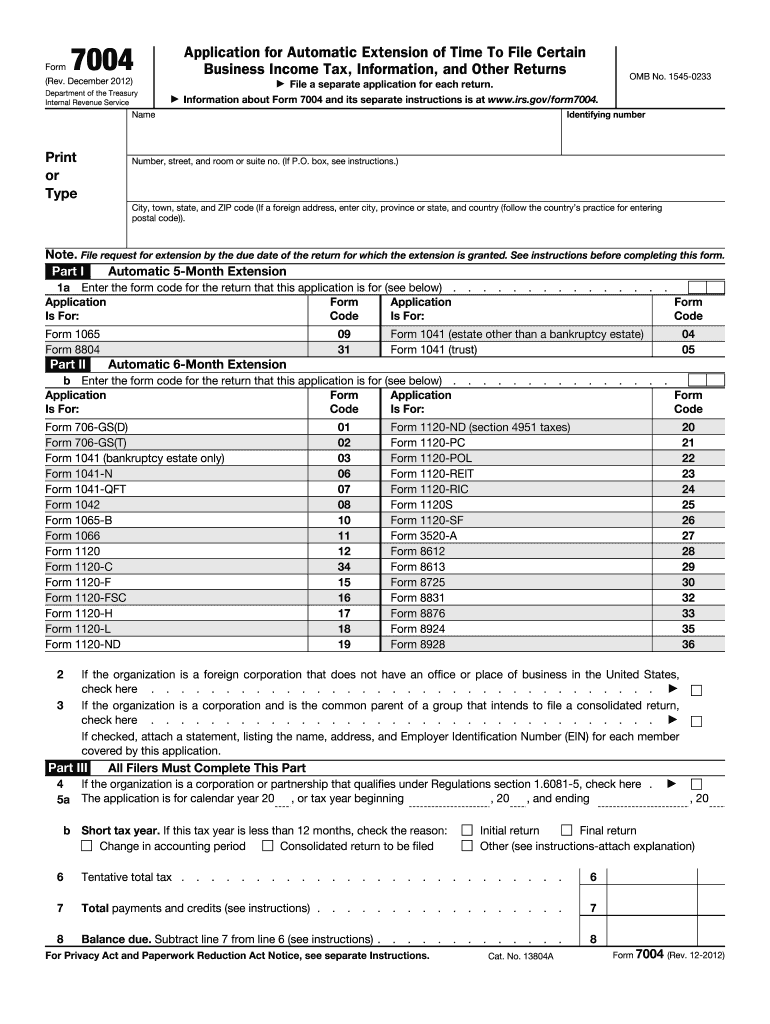

The 7004 Form is an application for an automatic extension of time to file certain business tax returns in the United States. This form is primarily used by corporations, partnerships, and certain other entities to request additional time to submit their tax documents to the Internal Revenue Service (IRS). By filing this form, businesses can gain an extension of up to six months, which can be crucial for ensuring accurate and complete tax filings.

How to use the 7004 Form

Using the 7004 Form involves several straightforward steps. First, identify the specific tax return for which you are requesting an extension. Next, accurately fill out the form with the required information, including your business name, address, and Employer Identification Number (EIN). After completing the form, submit it to the IRS by the original due date of your tax return. It is essential to ensure that the form is filed electronically or mailed to the correct address, as specified by the IRS guidelines.

Steps to complete the 7004 Form

Completing the 7004 Form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your business name, address, and EIN.

- Indicate the type of return for which you are requesting an extension.

- Provide the appropriate tax year for the extension.

- Sign and date the form, ensuring all information is accurate.

- Submit the form electronically or by mail to the IRS by the due date.

Legal use of the 7004 Form

The 7004 Form is legally recognized as a valid request for an extension of time to file specific business tax returns. When completed correctly and submitted on time, it provides legal protection against late filing penalties. It is important to comply with IRS regulations and ensure that the form is used only for its intended purpose to maintain its legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the 7004 Form are critical to avoid penalties. Generally, the form must be submitted by the original due date of the tax return for which the extension is being requested. For most corporations, this due date is the fifteenth day of the fourth month following the end of the tax year. For partnerships, it is the fifteenth day of the third month following the end of the tax year. Always verify specific deadlines for your business type and tax year with the IRS.

Form Submission Methods

The 7004 Form can be submitted through various methods. Businesses can file the form electronically using approved e-filing software or send a paper version by mail. It is essential to choose a submission method that complies with IRS requirements. Electronic filing is often faster and provides immediate confirmation of receipt, while mailing the form requires careful attention to ensure it is sent to the correct address and postmarked by the deadline.

Quick guide on how to complete 7004 2011 form

Effortlessly Prepare 7004 Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle 7004 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign 7004 Form with Ease

- Find 7004 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key parts of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign 7004 Form and maintain excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 7004 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 7004 2011 form

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is a 7004 Form and why is it important?

The 7004 Form is a crucial document that allows businesses to apply for an automatic extension of time to file certain business tax returns. It ensures that companies can comply with IRS requirements without being penalized for late submissions. Using the 7004 Form can help streamline your tax preparation process.

-

How can airSlate SignNow assist with the 7004 Form?

airSlate SignNow provides an easy-to-use platform for signing and sending the 7004 Form securely online. With our electronic signature capabilities, you can complete and file your 7004 Form conveniently, ensuring timely submissions and reducing paperwork hassles. This digital solution enhances efficiency and accuracy.

-

What are the costs associated with using airSlate SignNow for the 7004 Form?

The pricing for airSlate SignNow is competitive and offers various plans to fit your business needs. Depending on features and user count, plans may vary, but the cost-effectiveness can signNowly reduce expenses related to managing the 7004 Form and other documentation. Current promotions may also lower initial costs.

-

Does airSlate SignNow offer templates for the 7004 Form?

Yes, airSlate SignNow provides customizable templates for the 7004 Form, making it easy to prepare and send your tax documents. These templates ensure that all required fields are included, reducing the chances of errors. Additionally, you can save your completed form for future use.

-

How does electronic signing work for the 7004 Form?

Electronic signing with airSlate SignNow allows you to easily sign the 7004 Form online using a secure digital signature. The process is straightforward: just upload the form, add signatures, and send it off, all while maintaining compliance with IRS regulations. This ensures a fast and efficient way to finalize your documents.

-

Can I integrate airSlate SignNow with my existing accounting software for the 7004 Form?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing you to easily manage the 7004 Form alongside your other financial processes. This integration can streamline your workflow, making it simpler to handle tax documents and ensuring accurate filing.

-

What features does airSlate SignNow offer for managing the 7004 Form?

airSlate SignNow includes a variety of features designed to enhance the management of the 7004 Form, such as document tracking, audit trails, and secure storage. These features ensure that you can monitor the status of your form and maintain compliance records, adding an extra layer of security to your tax documentation process.

Get more for 7004 Form

- Request for unemployment insurance tax payment method form esd wa

- Vermont department of labor po box 189 montpelier vt labor vermont form

- Form 61 a

- Form 3adj

- Jobs utah gov form

- Employee performance evaluation for food service personnel wfisd

- Nephrostat acute dialysis services acute dialysis care form

- Hisd applitrack form

Find out other 7004 Form

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself