Form 7004 2008

What is the Form 7004

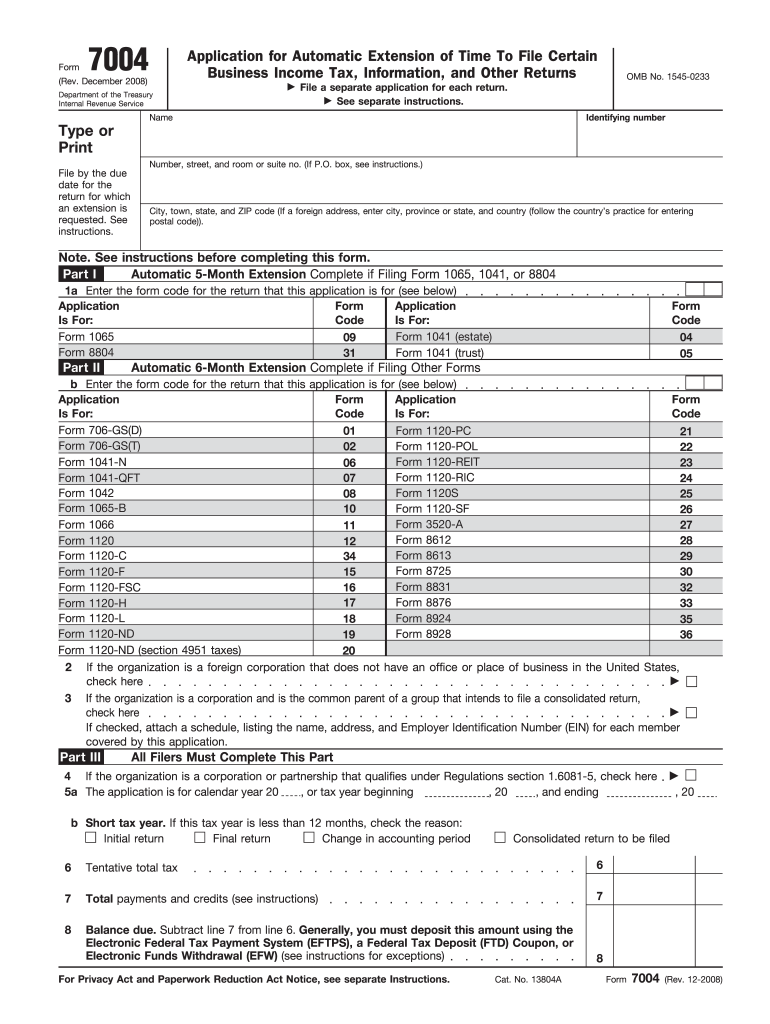

The Form 7004 is an application used by businesses to request an automatic extension of time to file certain tax returns. This form is primarily utilized by corporations and partnerships that require additional time to prepare their tax documents. By submitting Form 7004, taxpayers can secure an extension of up to six months, allowing them to gather necessary financial information without incurring late filing penalties.

How to use the Form 7004

Using Form 7004 involves several straightforward steps. First, ensure that you are eligible to file this form, as it is specifically designed for certain business entities. Next, fill out the required sections, including your business name, address, and the type of tax return for which you are requesting an extension. After completing the form, you can submit it electronically or by mail, depending on your preference and the guidelines set by the IRS.

Steps to complete the Form 7004

Completing Form 7004 requires careful attention to detail. Begin by entering your business information accurately. Then, indicate the type of return you are extending, such as Form 1120 for corporations or Form 1065 for partnerships. Ensure that you check the box for the specific tax year and provide your Employer Identification Number (EIN). After reviewing the form for accuracy, submit it through the appropriate channels, either electronically via IRS e-file or by mailing a paper copy to the designated address.

Filing Deadlines / Important Dates

The deadline for submitting Form 7004 typically aligns with the original due date of the tax return you are extending. For most corporations, this is the fifteenth day of the fourth month following the end of their tax year. For partnerships, the deadline is the fifteenth day of the third month after the tax year ends. It is crucial to submit Form 7004 on time to avoid penalties and ensure that you receive the full extension period.

Legal use of the Form 7004

Form 7004 is legally recognized as a valid request for an extension of time to file tax returns. To ensure compliance, it is important to adhere to IRS guidelines and submit the form within the specified deadlines. The form must be completed accurately to avoid any issues with the IRS. Additionally, electronic submissions must meet specific technical requirements to be considered valid.

Required Documents

When filing Form 7004, you do not need to submit additional documents with the form itself. However, it is advisable to have your financial records and any relevant tax documents on hand to ensure that you can complete your tax return accurately once the extension period is over. Keeping organized records will facilitate a smoother filing process when the time comes to submit your return.

Penalties for Non-Compliance

Failing to file Form 7004 on time can result in significant penalties. If you do not submit the form by the deadline, you may face late filing fees, which can accumulate over time. Additionally, if you do not file your tax return by the extended deadline, the IRS may impose further penalties based on the amount of tax owed. It is essential to adhere to the deadlines to avoid these financial repercussions.

Quick guide on how to complete 2008 form 7004

Effortlessly Prepare Form 7004 on Any Device

The management of online documents has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Manage Form 7004 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Form 7004 with Ease

- Find Form 7004 and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 7004 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 form 7004

Create this form in 5 minutes!

How to create an eSignature for the 2008 form 7004

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is Form 7004 and how does it work?

Form 7004 is a tax form used by businesses to apply for an automatic extension of time to file certain business income tax returns. With airSlate SignNow, completing and eSigning Form 7004 is streamlined, allowing you to easily manage your tax extensions. By utilizing our platform, you can ensure timely submissions and maintain compliance without hassle.

-

Can I use airSlate SignNow to fill out Form 7004 remotely?

Yes, airSlate SignNow allows you to fill out Form 7004 remotely from any device with internet access. This feature ensures you can work on your tax extensions anytime, anywhere. Our user-friendly interface makes the process simple and efficient, saving you valuable time.

-

What are the pricing options for using airSlate SignNow for Form 7004?

airSlate SignNow offers various pricing plans tailored to your business needs, which include options for individuals, small teams, and larger enterprises. Each plan provides access to essential features for handling Form 7004 and other documents securely. For detailed pricing information and a free trial, visit our website.

-

Are there any benefits to using airSlate SignNow for tax forms like Form 7004?

Using airSlate SignNow to manage Form 7004 comes with several benefits, including enhanced efficiency, cost savings, and improved security. Our digital platform allows for quick eSignature collection, reducing the time spent on traditional paperwork. Additionally, your documents are stored securely, ensuring compliance and peace of mind.

-

Can airSlate SignNow integrate with other software for Form 7004 management?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and business software, enhancing your ability to manage Form 7004 effectively. This integration allows for automatic data import, making it easier to populate the form accurately. Check our integration options to see which tools your business can connect with.

-

Is it secure to use airSlate SignNow for completing Form 7004?

Yes, airSlate SignNow prioritizes the security of your documents, including Form 7004. Our platform uses advanced encryption and security protocols to ensure your sensitive tax information is protected. You can confidently complete and eSign your forms, knowing that your data is safe with us.

-

How does eSigning Form 7004 work with airSlate SignNow?

eSigning Form 7004 with airSlate SignNow is straightforward. Once you complete the form, simply add the necessary eSignature fields and invite the required signers to review and sign. The process is quick, allowing you to finalize your tax extension with minimal effort.

Get more for Form 7004

- Notice of option for recording illinois form

- Illinois documents form

- Essential legal life documents for baby boomers illinois form

- Agent authority form

- Successor agent form

- Co agents certification and acceptance of authority illinois form

- Essential legal life documents for newlyweds illinois form

- Illinois legal documents 497306448 form

Find out other Form 7004

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer