Form 7004 2016

What is the Form 7004

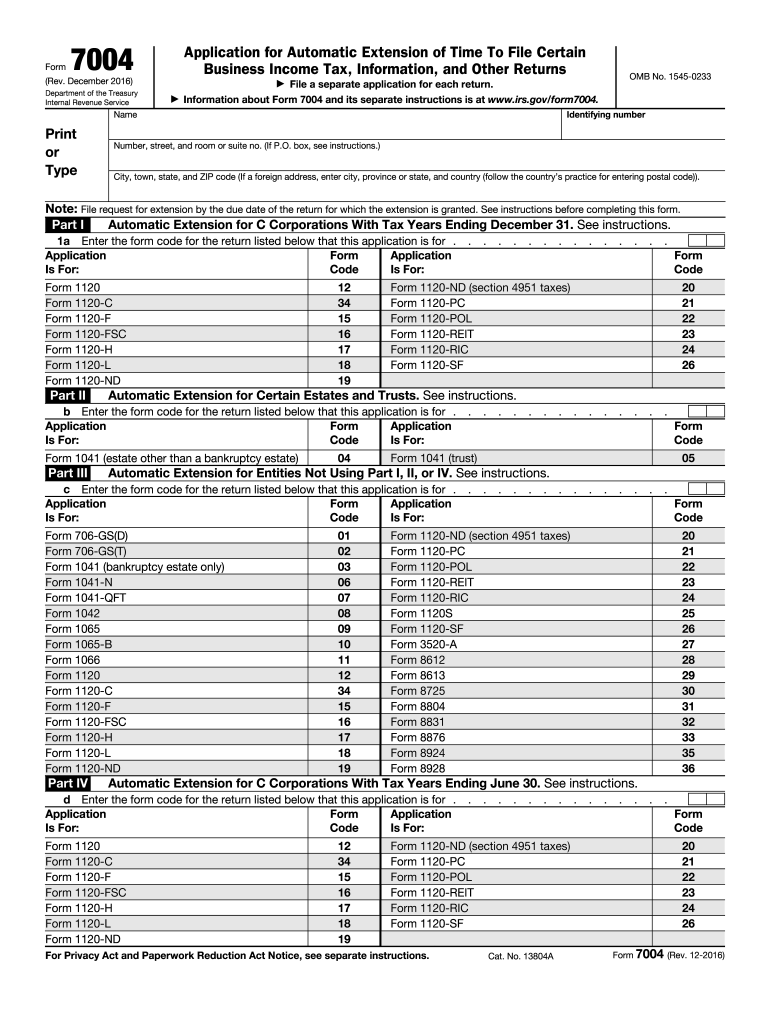

The Form 7004 is an application used by businesses to request an automatic extension of time to file certain business tax returns. This form is crucial for corporations, partnerships, and certain other entities that operate within the United States. By submitting Form 7004, taxpayers can extend their filing deadline for up to six months, allowing them additional time to prepare their tax documents without incurring late filing penalties.

How to use the Form 7004

Using Form 7004 involves several key steps. First, ensure that you are eligible to file this form based on your business entity type. Next, gather the necessary information, including your business name, address, and Employer Identification Number (EIN). Complete the form accurately, indicating the type of return for which you are requesting an extension. Finally, submit the completed form to the appropriate IRS address, either electronically or by mail, depending on your preference and the specific requirements of your business type.

Steps to complete the Form 7004

Completing Form 7004 requires careful attention to detail. Begin by filling out your business information, including the name and address as it appears on your tax return. Next, provide your EIN or Social Security Number if applicable. Indicate the type of tax return for which you are requesting an extension, ensuring you select the correct box. If you are submitting the form electronically, follow the prompts provided by your e-filing software. After reviewing all entries for accuracy, submit the form before the original tax return due date to avoid penalties.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with Form 7004. Generally, the form must be submitted by the original due date of the tax return you are extending. For most businesses, this means the form is due on the fifteenth day of the fourth month after the end of your tax year. For calendar year taxpayers, this typically falls on April 15. Filing Form 7004 on time ensures that you receive the full extension without incurring late fees.

Legal use of the Form 7004

Form 7004 is legally binding when completed and submitted according to IRS regulations. To ensure its legal validity, it must be filled out accurately and submitted on time. The form serves as a formal request for an extension, and failure to file it correctly can result in penalties. It is important to maintain documentation of your submission, including any electronic confirmation or postal receipts, to provide proof of timely filing if needed.

Key elements of the Form 7004

Key elements of Form 7004 include the business's name, address, and EIN, as well as the specific type of tax return for which the extension is being requested. Additionally, the form requires the signature of an authorized person, which may include a partner, member, or corporate officer. Each section must be completed with accurate information to ensure the request is processed smoothly by the IRS.

Quick guide on how to complete form 7004 2016

Complete Form 7004 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a sustainable alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents promptly without delays. Manage Form 7004 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 7004 with ease

- Obtain Form 7004 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 7004 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 7004 2016

Create this form in 5 minutes!

How to create an eSignature for the form 7004 2016

How to create an electronic signature for the Form 7004 2016 online

How to generate an electronic signature for the Form 7004 2016 in Chrome

How to make an eSignature for putting it on the Form 7004 2016 in Gmail

How to create an electronic signature for the Form 7004 2016 straight from your mobile device

How to create an eSignature for the Form 7004 2016 on iOS devices

How to generate an electronic signature for the Form 7004 2016 on Android devices

People also ask

-

What is Form 7004 and why do I need it?

Form 7004 is an application for an automatic extension of time to file certain business tax returns. If your business needs additional time to prepare its tax return, filing Form 7004 can help avoid late penalties and give you the necessary time to gather documentation. Using airSlate SignNow, you can easily eSign and submit Form 7004 electronically, streamlining your filing process.

-

How can airSlate SignNow help with filing Form 7004?

airSlate SignNow provides a user-friendly platform to prepare and eSign Form 7004 quickly and securely. With our solution, you can fill out the form digitally, add signatures, and send it directly to the IRS without the hassle of printing and mailing. This not only saves time but also ensures that your Form 7004 is submitted accurately.

-

What are the pricing options for airSlate SignNow when filing Form 7004?

airSlate SignNow offers flexible pricing plans to cater to different business needs. Whether you are a small business or a larger enterprise, our plans provide cost-effective solutions for managing documents like Form 7004. You can choose a plan that suits your needs and enjoy unlimited eSigning without hidden fees.

-

Is airSlate SignNow secure for signing Form 7004?

Yes, airSlate SignNow prioritizes the security of your documents, including Form 7004. We use advanced encryption and security protocols to protect your sensitive information during the signing process. You can confidently eSign and manage your documents knowing that they are safe and secure.

-

Can I integrate airSlate SignNow with other applications for filing Form 7004?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This makes it easy to access and manage your Form 7004 along with other important documents in one place, enhancing your productivity and workflow.

-

What features does airSlate SignNow offer for managing Form 7004?

airSlate SignNow offers a range of features for managing Form 7004, including customizable templates, in-app messaging, and status tracking. You can easily create and store templates for Form 7004 and collaborate with your team in real-time. These features make the process of filing and tracking your extension request hassle-free.

-

How quickly can I complete Form 7004 using airSlate SignNow?

Using airSlate SignNow, you can complete Form 7004 in just a few minutes. The intuitive interface allows you to fill out the form quickly, and with the electronic signature feature, you can finalize it without delay. This efficiency helps you meet your filing deadlines comfortably.

Get more for Form 7004

- Fill in the blank eoh form

- New jersey residential real estate sales disclosure statement form

- Kansas name affidavit of buyer form

- K ok ki kcom form

- Transfer on death deed form

- Massachusetts limited power of form

- Online bill of sale boat idaho form

- Minnesota commercial rental lease application questionnaire form

Find out other Form 7004

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien