Form 7004 2012

What is the Form 7004

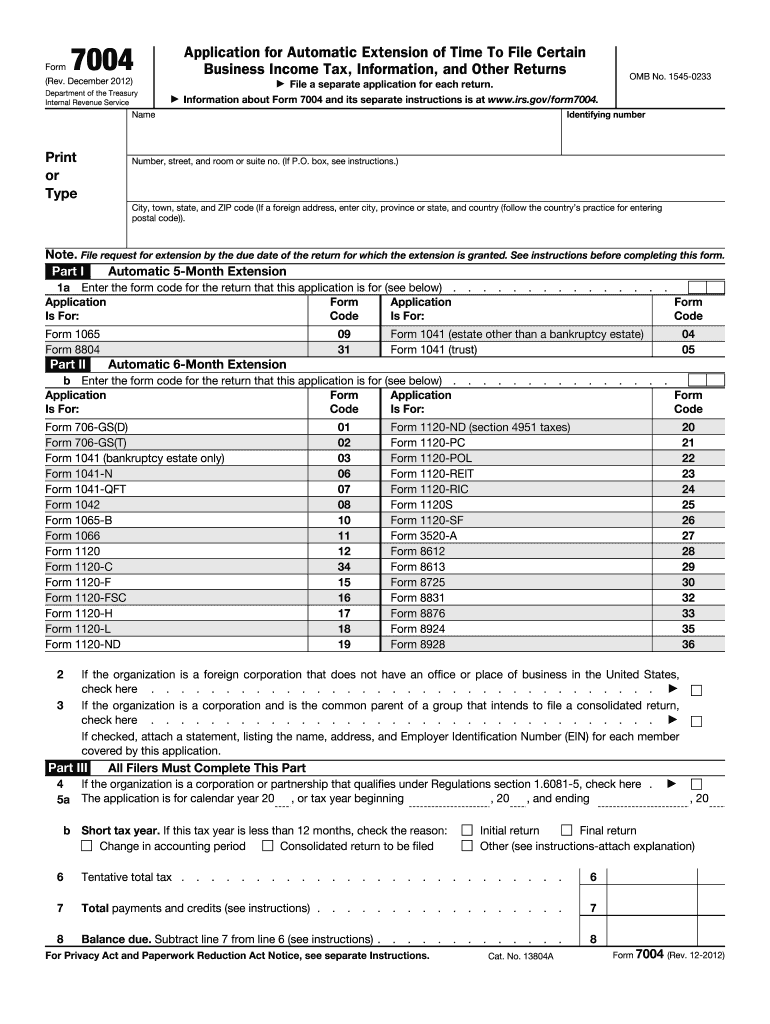

The Form 7004 is an application used by businesses to request an automatic extension of time to file certain business tax returns with the Internal Revenue Service (IRS). This form is applicable to various business entities, including corporations and partnerships. By submitting Form 7004, businesses can gain additional time to prepare their tax returns without incurring late filing penalties, provided they meet the necessary requirements. It is important to note that while the form extends the filing deadline, it does not extend the time to pay any taxes owed.

How to use the Form 7004

To effectively use Form 7004, businesses must first determine their eligibility based on the type of tax return they are filing. The form can be completed electronically or by hand. When filling out the form, it is essential to provide accurate information, including the business name, address, and Employer Identification Number (EIN). After completing the form, it should be submitted to the IRS by the original due date of the tax return to avoid penalties. Businesses can file electronically through authorized e-file providers or mail a paper copy to the appropriate IRS address.

Steps to complete the Form 7004

Completing Form 7004 involves several clear steps:

- Identify the type of business entity and the specific tax return for which an extension is being requested.

- Gather necessary information, such as the business name, address, and EIN.

- Fill out the form, ensuring all fields are accurately completed.

- Check the form for any errors or omissions before submission.

- Submit the form electronically or by mail to the IRS by the original due date of the tax return.

Filing Deadlines / Important Dates

Filing deadlines for Form 7004 vary based on the type of business entity and the specific tax return. Generally, the form must be filed by the original due date of the tax return, which is typically the fifteenth day of the fourth month following the end of the tax year for corporations. For partnerships and S corporations, the deadline is usually the fifteenth day of the third month following the end of the tax year. It is crucial for businesses to be aware of these deadlines to avoid penalties and ensure compliance with IRS regulations.

Legal use of the Form 7004

The legal use of Form 7004 is governed by IRS regulations, which stipulate that the form must be filed correctly and on time to obtain an extension. The form serves as a formal request for additional time to file a tax return, and its acceptance by the IRS provides legal protection against late filing penalties. However, it is important to remember that the extension granted by Form 7004 does not extend the time to pay any taxes owed, and businesses must ensure that any estimated tax payments are made on time to avoid interest and penalties.

Required Documents

When filing Form 7004, businesses may need to provide certain documents to support their request for an extension. Key documents typically include:

- The completed Form 7004 itself.

- Supporting schedules or forms related to the specific tax return being filed.

- Any previous tax returns that may be relevant for reference.

Having these documents ready can help streamline the filing process and ensure compliance with IRS requirements.

Quick guide on how to complete form 7004 2012

Complete Form 7004 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to acquire the right form and store it securely online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without any holdups. Manage Form 7004 on any platform using airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to modify and eSign Form 7004 effortlessly

- Obtain Form 7004 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 7004 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 7004 2012

Create this form in 5 minutes!

How to create an eSignature for the form 7004 2012

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is Form 7004 and why is it important?

Form 7004 is a necessary form used to apply for an automatic extension of time to file certain business income tax returns. Businesses looking to extend their filing deadlines can benefit from using Form 7004, as it provides additional time to prepare their tax returns without incurring penalties.

-

How does airSlate SignNow simplify the completion of Form 7004?

airSlate SignNow offers a streamlined process for filling out Form 7004, making it easy for users to input their information accurately. The platform's intuitive interface allows users to complete and eSign the form quickly, ensuring compliance with tax filing deadlines.

-

Is there a cost associated with using airSlate SignNow for Form 7004?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans provide access to features that simplify the filing of Form 7004, ensuring a cost-effective solution for document management and eSigning.

-

Can I integrate airSlate SignNow with other applications to manage Form 7004?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, enhancing your workflow when managing Form 7004. Whether you need to connect with accounting software or CRM systems, these integrations help streamline document handling.

-

What are the benefits of using airSlate SignNow for Form 7004?

Using airSlate SignNow for Form 7004 offers numerous benefits, including saving time and reducing paperwork. By digitizing the process, users can complete and sign documents from anywhere, leading to increased productivity and efficiency.

-

Is electronic filing of Form 7004 allowed through airSlate SignNow?

Yes, airSlate SignNow allows for the electronic signing of Form 7004, making it compliant with IRS regulations. Users can easily prepare, eSign, and submit their forms electronically, ensuring a smooth filing process.

-

How secure is my data when using airSlate SignNow with Form 7004?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your data, including information related to Form 7004. Users can rest assured that their sensitive information remains confidential throughout the signing process.

Get more for Form 7004

Find out other Form 7004

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form