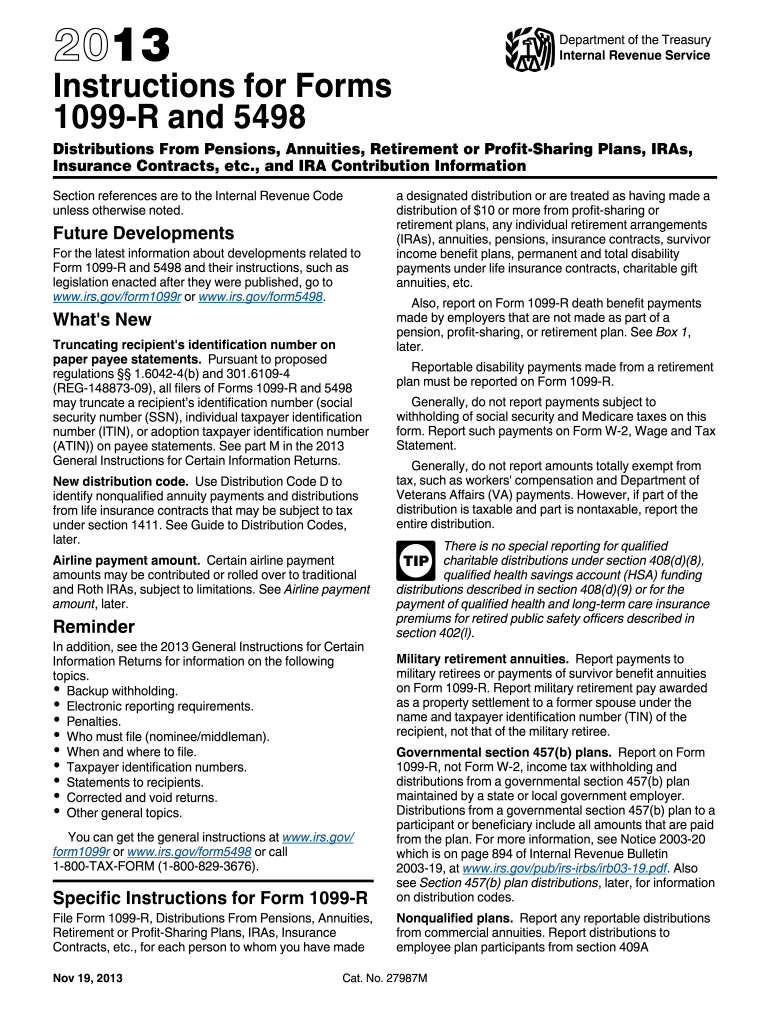

1099 R Instructions Form 2013

What is the 1099 R Instructions Form

The 1099 R Instructions Form provides guidance on reporting distributions from pensions, annuities, retirement plans, or other similar sources. This form is crucial for both taxpayers and financial institutions, ensuring that income received from retirement accounts is accurately reported to the Internal Revenue Service (IRS). It outlines the necessary steps for completing the 1099-R form, including how to report different types of distributions and any applicable tax implications.

Steps to complete the 1099 R Instructions Form

Completing the 1099 R Instructions Form involves several key steps:

- Gather relevant information, including the payer's and recipient's details, the amount distributed, and any tax withheld.

- Identify the type of distribution being reported, as this affects the tax treatment.

- Fill out the form accurately, ensuring all fields are completed according to IRS guidelines.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS and provide a copy to the recipient by the specified deadline.

How to obtain the 1099 R Instructions Form

The 1099 R Instructions Form can be obtained directly from the IRS website or through various tax preparation software. It is essential to ensure that you are using the most current version of the form, as tax laws and reporting requirements may change annually. Additionally, financial institutions that issue 1099-R forms often provide their clients with the necessary instructions as part of their tax documentation.

IRS Guidelines

The IRS provides specific guidelines on how to complete the 1099 R Instructions Form. These guidelines include details on reporting requirements, deadlines for submission, and instructions for various types of distributions. It is important for taxpayers to familiarize themselves with these guidelines to ensure compliance and avoid potential penalties. The IRS also offers resources and publications that can assist in understanding the requirements for the 1099-R reporting process.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 R Instructions Form are crucial for compliance. Typically, the form must be submitted to the IRS by the end of January following the tax year in which the distributions were made. Additionally, recipients must receive their copies by the same deadline. It is important to stay informed about any changes to these dates, as they can vary based on specific circumstances or IRS announcements.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the 1099 R Instructions Form can result in penalties. The IRS imposes fines for late filings, incorrect information, or failure to provide the form to recipients. The penalties can increase depending on how late the form is submitted, so it is essential to adhere to the deadlines and ensure all information is accurate to avoid additional costs.

Quick guide on how to complete 1099 r instructions 2013 form

Prepare 1099 R Instructions Form effortlessly on any device

Online document administration has gained immense traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Handle 1099 R Instructions Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign 1099 R Instructions Form with ease

- Find 1099 R Instructions Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive data with specialized tools that airSlate SignNow provides for that purpose.

- Create your eSignature using the Sign tool, which takes just a few moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Edit and eSign 1099 R Instructions Form and ensure effective communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 r instructions 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 r instructions 2013 form

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the 1099 R Instructions Form and why do I need it?

The 1099 R Instructions Form is essential for reporting distributions from retirement plans, annuities, and other sources. If you receive such payments, filing this form accurately is crucial to ensure compliance with IRS regulations and avoid penalties. Using airSlate SignNow can streamline the process of signing and submitting your 1099 R Instructions Form easily.

-

How can airSlate SignNow help me with the 1099 R Instructions Form?

airSlate SignNow offers a user-friendly platform that allows you to eSign and send your 1099 R Instructions Form securely and efficiently. With our solution, you can eliminate the hassle of printing and mailing paperwork, ensuring that your form is submitted quickly and accurately. Our software also provides reminders and tracking features to keep you on top of your filing deadlines.

-

Is airSlate SignNow suitable for businesses that need to manage multiple 1099 R Instructions Forms?

Yes, airSlate SignNow is an ideal solution for businesses handling multiple 1099 R Instructions Forms. Our platform allows for bulk sending and signing, making it easy to manage numerous documents at once. This efficiency can save your business time and resources while ensuring that all forms are properly completed and submitted.

-

What are the pricing options for using airSlate SignNow to manage the 1099 R Instructions Form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including packages tailored for individuals and enterprises. We provide a cost-effective solution for managing your 1099 R Instructions Form and other documents, with transparent pricing and no hidden fees. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for my 1099 R Instructions Form needs?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, including accounting software and CRMs, to simplify the management of your 1099 R Instructions Form. These integrations enhance your workflow by allowing you to automate processes and keep all your documents organized in one place.

-

What features does airSlate SignNow offer for completing the 1099 R Instructions Form?

airSlate SignNow provides a range of features tailored for completing the 1099 R Instructions Form, including customizable templates, eSignature capabilities, and document tracking. These tools ensure that your form is filled out correctly and signed by all necessary parties without any delays. Additionally, our platform is designed to be intuitive, making the entire process straightforward.

-

Is my data secure when using airSlate SignNow for the 1099 R Instructions Form?

Yes, data security is a top priority at airSlate SignNow. We utilize industry-standard encryption and security protocols to protect your information when completing and submitting your 1099 R Instructions Form. You can trust that your sensitive data is safe with us, allowing you to focus on getting your documents signed and submitted.

Get more for 1099 R Instructions Form

- Employee statement regarding injuryillnessincident form

- Facility use applicationxls form

- Divisiondepartment goals form

- Aflac cancer claim form core docss3amazonawscom

- Volunteer release form thank you for offering your

- Officer or delegate nomination form osea

- Residential gas service agreement 2018 form

Find out other 1099 R Instructions Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors