PDF 1099r Form 2017

What is the Pdf 1099r Form

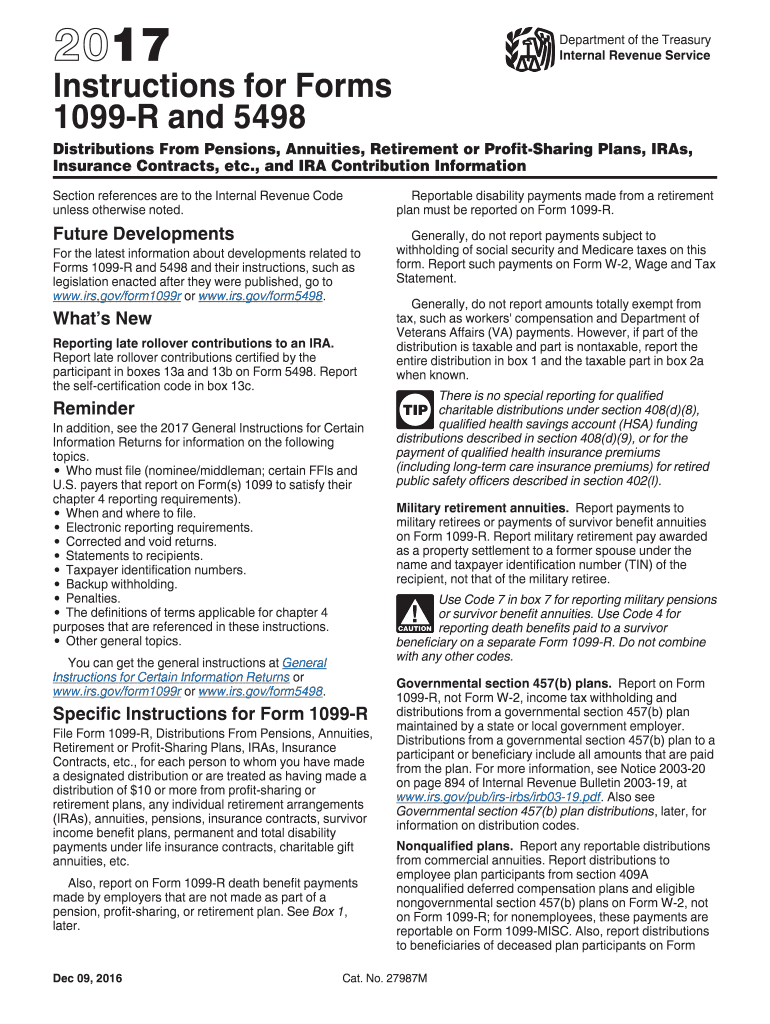

The Pdf 1099-R Form is an essential tax document used in the United States to report distributions from pensions, annuities, retirement plans, and other similar sources. This form is issued by financial institutions and employers to individuals who have received these distributions during the tax year. It provides crucial information, including the total amount distributed, the taxable amount, and any federal income tax withheld. Understanding the Pdf 1099-R Form is vital for accurately reporting income on your tax return.

How to obtain the Pdf 1099r Form

Obtaining the Pdf 1099-R Form is straightforward. You can request it directly from the financial institution or employer that issued the distributions. Most organizations provide this form electronically, allowing you to download it from their secure online portals. If you prefer a physical copy, you can also ask for it to be mailed to you. Additionally, the IRS website offers a downloadable version of the Pdf 1099-R Form for reference, but this should not be used for filing your taxes.

Steps to complete the Pdf 1099r Form

Completing the Pdf 1099-R Form involves several key steps:

- Gather your financial documents, including any previous tax returns that may help in filling out the form.

- Enter your personal information, such as your name, address, and Social Security number, in the designated fields.

- Input the payer's information, including the name and identification number of the organization issuing the form.

- Fill in the distribution amounts, ensuring accuracy in both the total and taxable amounts.

- Review the form for any errors or omissions before finalizing it.

Legal use of the Pdf 1099r Form

The Pdf 1099-R Form is legally required for reporting retirement distributions to the IRS. It ensures compliance with federal tax laws and helps taxpayers accurately report their income. Failure to file this form when required can lead to penalties or audits. It is crucial to ensure that all information provided on the form is correct and complete to avoid any legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Pdf 1099-R Form are typically set by the IRS. Generally, the form must be sent to recipients by January thirty-first of the year following the tax year in which the distributions were made. Additionally, the form must be filed with the IRS by the end of February if submitting by paper, or by the end of March if filing electronically. Staying aware of these deadlines is essential to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Pdf 1099-R Form can be submitted through various methods, depending on the recipient’s preference and the requirements of the issuing organization. Common submission methods include:

- Online: Many organizations allow for electronic submission, which can be done through secure portals.

- Mail: The form can be printed and mailed to the IRS or the designated recipient.

- In-Person: Some institutions may allow for in-person submission at their offices.

Quick guide on how to complete pdf 1099r 2017 form

Discover the most efficient method to complete and sign your Pdf 1099r Form

Are you still spending time preparing your official paperwork on paper instead of online? airSlate SignNow presents a superior solution for finishing and signing your Pdf 1099r Form and associated forms for public services. Our intelligent electronic signature platform equips you with all the tools necessary to handle documentation swiftly and in compliance with formal standards - powerful PDF editing, managing, securing, signing, and sharing features readily available within a user-friendly interface.

Only a few steps are required to fill out and sign your Pdf 1099r Form:

- Upload the editable template to the editor using the Get Form button.

- Check what details you must input in your Pdf 1099r Form.

- Navigate between the fields using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Click on Sign to generate a legally valid electronic signature using any method you prefer.

- Add the Date beside your signature and conclude your task with the Done button.

Store your finalized Pdf 1099r Form in the Documents folder within your account, download it, or export it to your chosen cloud storage. Our platform also offers versatile file sharing options. There’s no need to physically print your templates when sending them to the appropriate public agency - you can email, fax, or request a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct pdf 1099r 2017 form

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

Create this form in 5 minutes!

How to create an eSignature for the pdf 1099r 2017 form

How to make an eSignature for your Pdf 1099r 2017 Form online

How to create an electronic signature for the Pdf 1099r 2017 Form in Google Chrome

How to make an electronic signature for signing the Pdf 1099r 2017 Form in Gmail

How to generate an electronic signature for the Pdf 1099r 2017 Form right from your smart phone

How to make an eSignature for the Pdf 1099r 2017 Form on iOS

How to generate an electronic signature for the Pdf 1099r 2017 Form on Android devices

People also ask

-

What is a Pdf 1099r Form?

A Pdf 1099r Form is a tax document used to report distributions from pensions, annuities, retirement plans, and IRAs to the IRS. It provides essential information about the amounts distributed and the taxes withheld. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can I fill out a Pdf 1099r Form using airSlate SignNow?

airSlate SignNow allows you to easily fill out a Pdf 1099r Form by uploading the document and using our intuitive editing tools. You can add text, signatures, and dates effortlessly. This streamlines the process of completing your tax forms without the hassle of printing and scanning.

-

Is airSlate SignNow a cost-effective solution for managing Pdf 1099r Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Pdf 1099r Forms with various pricing plans tailored to your business needs. Our platform eliminates the need for paper-based processes, reducing costs associated with printing and mailing. Plus, with our subscription, you gain access to numerous features that enhance document management.

-

What features does airSlate SignNow offer for Pdf 1099r Forms?

airSlate SignNow provides a range of features for Pdf 1099r Forms, including electronic signatures, document templates, and secure storage. Our platform ensures that your forms are compliant with regulations while providing a user-friendly experience. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for handling Pdf 1099r Forms?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, enhancing your workflow for handling Pdf 1099r Forms. Whether you use accounting software or CRM systems, our integrations simplify the process of managing documents and data. This ensures that your forms are processed efficiently across platforms.

-

What are the benefits of using airSlate SignNow for Pdf 1099r Forms?

Using airSlate SignNow for Pdf 1099r Forms streamlines your document management process, saves time, and enhances security. Our platform allows you to eSign documents easily, ensuring faster approvals and compliance. Additionally, you can access your forms anytime, anywhere, which signNowly boosts productivity.

-

Is it safe to send Pdf 1099r Forms through airSlate SignNow?

Yes, it is safe to send Pdf 1099r Forms through airSlate SignNow. We prioritize security and use encryption protocols to protect your sensitive data. Our platform is compliant with industry standards, ensuring that your tax documents remain confidential and secure during transmission.

Get more for Pdf 1099r Form

- Everybody wins the story and lessons behind remax pdf download form

- Cfs 600 pg1 additional insured certificate request form

- Pre delivery service check sheet fixed ops form

- Republic of the union of myanmar associations income tax return form

- Request for waiver of penalty for late report and or payment form

- Passr forms west virginia

- Application for issue of visitors pass form

- Social media service level agreement template form

Find out other Pdf 1099r Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors