Form 8804 Fax Number

What is Form 8804?

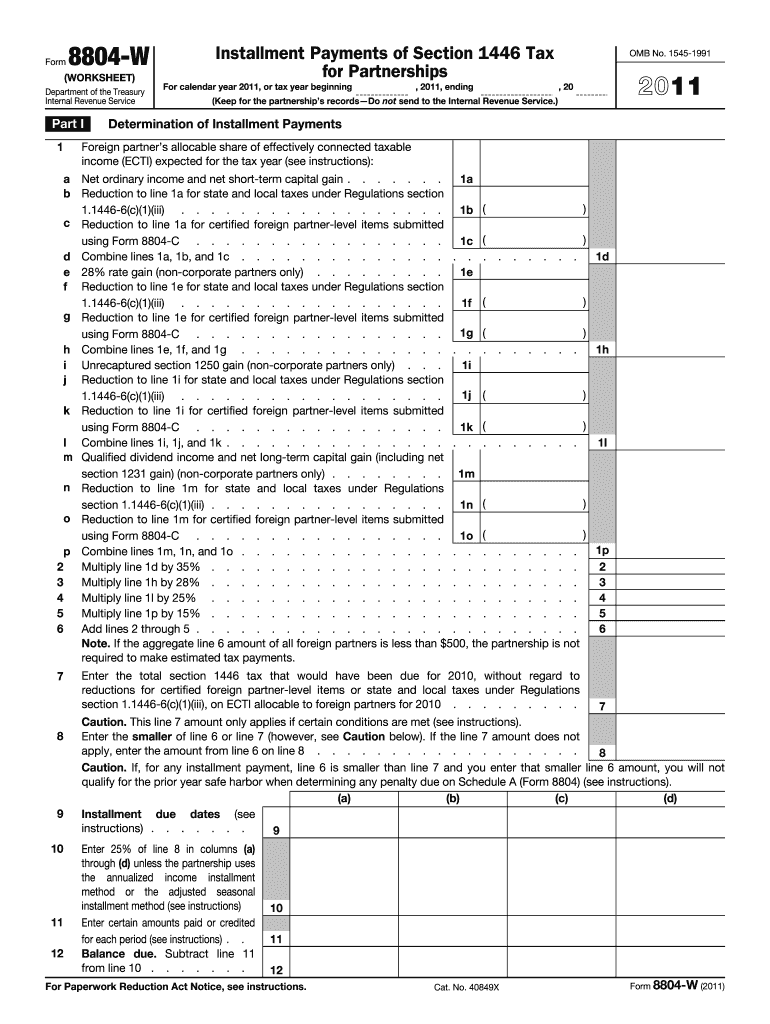

Form 8804 is a tax document used by partnerships to report their income and the taxes owed on that income. Specifically, it is utilized to report the partnership's effectively connected taxable income and to calculate the tax liability for non-resident partners. This form is essential for ensuring compliance with IRS regulations regarding partnership taxation.

Filing Deadlines for Form 8804

Understanding the filing deadlines for Form 8804 is crucial for compliance. Generally, Form 8804 must be filed on or before the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is typically due by April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Required Documents for Form 8804

To complete Form 8804, certain documents are necessary. These include:

- Partnership agreement

- Financial statements showing income and expenses

- Records of distributions made to partners

- Tax identification numbers for all partners

Having these documents prepared in advance can streamline the filing process and ensure accuracy.

Form Submission Methods

Form 8804 can be submitted in several ways. Partnerships have the option to file the form electronically through the IRS e-file system or submit a paper version via mail. Electronic filing is often recommended for its speed and efficiency, while paper submissions may take longer to process. It is important to choose the method that best fits the partnership's needs.

Penalties for Non-Compliance

Failing to file Form 8804 on time or providing inaccurate information can result in significant penalties. The IRS imposes fines for late filings, which can accumulate daily until the form is submitted. Additionally, incorrect information may lead to audits or further scrutiny from the IRS. Ensuring timely and accurate submission is essential to avoid these consequences.

IRS Guidelines for Form 8804

The IRS provides specific guidelines for completing Form 8804, which include detailed instructions on how to report income, calculate taxes, and disclose partner information. It is advisable to refer to the IRS instructions for the most current requirements and to ensure compliance with all regulations. Following these guidelines helps prevent errors and potential penalties.

Quick guide on how to complete form 8804 fax number

Effortlessly Prepare Form 8804 Fax Number on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect sustainable alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage Form 8804 Fax Number on any platform with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and eSign Form 8804 Fax Number with Ease

- Obtain Form 8804 Fax Number and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method of delivering your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8804 Fax Number and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I want to create a web app that enables users to sign up/in, fill out a form, and then fax it to a fax machine. How to difficult is this to develop?

Are you sending yourself the fax or are they able to send the fax anywhere? The latter has already been done numerous times. There are email to fax and fax to email applications that have been available for decades. I'm pretty certain that converting email to fax into app or form submission to fax is pretty trivial. They convert faxes to PDF's in many of these apps IIRC so anywhere you could view a PDF you could get a fax.

-

What is the fax number to send the IRS 8962 form back?

I personally would not fax anything to anyone unless I had their contact information.

-

How can I get my tin number?

Most state government commercial tax departments provide Registration form on their website. Download, fill, attach relevant documents and submit at local VAT office. They will inspect your premises and grant registration certificate with TIN. You may contact any sales tax practitioner for this.

-

Why would a doctor send a prescription to a pharmacy, but not respond to repeated requests from the pharmacy to fill out a faxed prior authorization form?

Filling out a prior authorization is not a requirement of our practice. Most of us do this to help our patients, and it is sometimes taken for granted.Think about it. It is your insurance company that is requesting us to fill out this form, taking time away from actually treating patients, to help you save money on your medications. We understand that, and usually do our best to take care of them, but unless we have a large practice, with someone actually paid to spend all their time doing these PA’s, we have to carve out more time from our day to fill out paperwork.It’s also possible, although not likely, that the pharmacy does not have the correct fax number, the faxes have been misplaced, the doctor has some emergencies and is running behind, went on vacation, and so on.Paperwork and insurance requests have become more and more burdensome on our practices, not due to anything on the part of our patients, but a major hassle none the less.

Create this form in 5 minutes!

How to create an eSignature for the form 8804 fax number

How to make an eSignature for your Form 8804 Fax Number in the online mode

How to generate an electronic signature for the Form 8804 Fax Number in Google Chrome

How to make an eSignature for putting it on the Form 8804 Fax Number in Gmail

How to generate an eSignature for the Form 8804 Fax Number from your mobile device

How to make an electronic signature for the Form 8804 Fax Number on iOS

How to create an eSignature for the Form 8804 Fax Number on Android

People also ask

-

What is Form 8804 and what is its purpose?

Form 8804 is a tax form used by partnerships to report and pay the overseas withholding tax on income. It serves to inform the IRS about taxes due regarding effectively connected income that a partnership receives. Understanding Form 8804 is crucial for partnerships to ensure compliance with tax obligations.

-

How can airSlate SignNow help with submitting Form 8804?

airSlate SignNow simplifies the process of submitting Form 8804 by allowing users to fill out and eSign the document digitally. Our platform streamlines the workflow, making it easy to gather necessary signatures quickly. This efficiency helps ensure that your Form 8804 is submitted on time and accurately.

-

Is there a cost associated with using airSlate SignNow for Form 8804?

Yes, airSlate SignNow offers competitive pricing options depending on your needs. Users can choose from various subscription plans that provide access to features enabling efficient management of Form 8804. Our pricing is designed to be cost-effective for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Form 8804?

airSlate SignNow provides features like document templates, advanced eSigning capabilities, and secure cloud storage to aid in managing Form 8804. Users can track document statuses and receive notifications to ensure that the form is completed and filed on time. These features enhance productivity and reduce the likelihood of errors.

-

How can I integrate airSlate SignNow with my existing software for Form 8804?

airSlate SignNow offers seamless integrations with popular accounting and productivity tools, simplifying the process of handling Form 8804 within your existing workflows. Integration helps streamline data transfer between systems, ensuring that all necessary information is easily accessible and up-to-date. You can connect with tools like Zapier, QuickBooks, and more.

-

What are the benefits of using airSlate SignNow for Form 8804 filing?

Using airSlate SignNow for filing Form 8804 provides several advantages, including improved efficiency, higher accuracy, and built-in compliance features. Our platform enables fast turnaround times for document preparation and ensures that all parties can eSign quickly and securely. Additionally, our audit trails provide peace of mind regarding document integrity.

-

Can I customize the Form 8804 within airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize Form 8804 according to their specific needs. You can add logos, modify the layout, and include additional fields as necessary, ensuring that the form meets your business requirements while maintaining compliance with tax regulations.

Get more for Form 8804 Fax Number

- Proper ty division form

- Estate tax forms current period taxnygov

- Mail the original return and tax due to the new mexico taxation and revenue department p form

- Estate tax forms and instructions taxnygov

- Il 1040 individual income tax return income tax forms illinoisgov

- Form tr 20001019e zrep tax information access and transaction authorization formtr2000

- Arizona form 140es

- Po box 29010 form

Find out other Form 8804 Fax Number

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free