Form 990 or 990 Ez Sch a Printable 2011

What is the Form 990 Or 990 Ez Sch A Printable

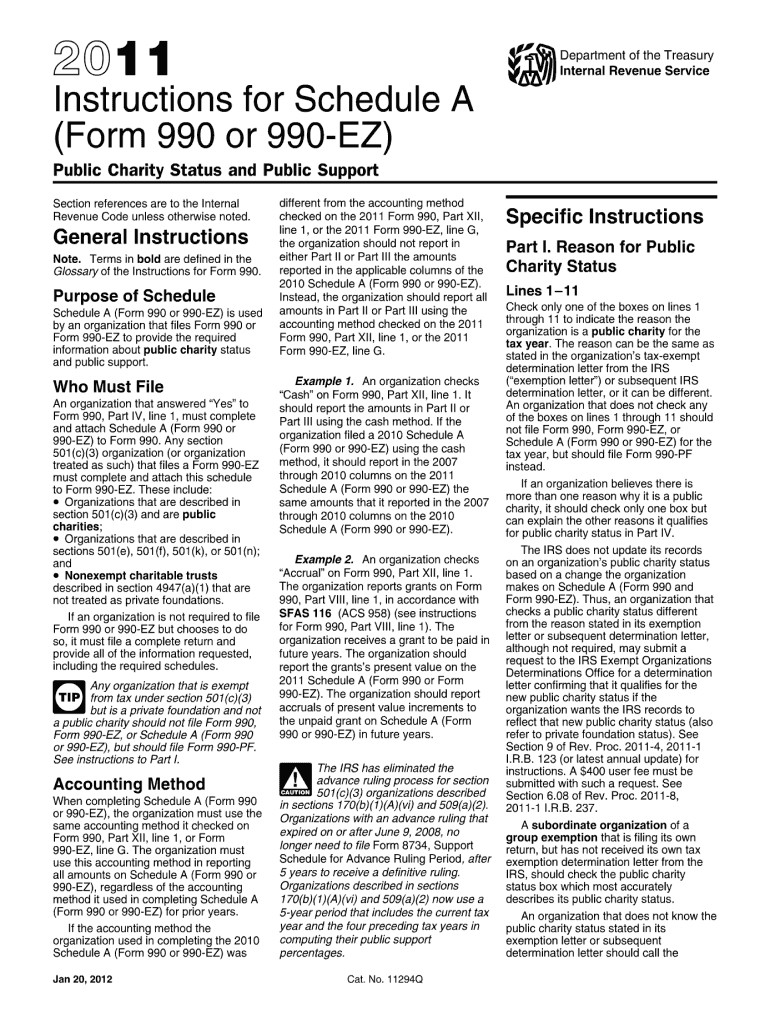

The Form 990 or 990 EZ Schedule A is a crucial document for tax-exempt organizations in the United States. It provides detailed information about the organization's public charity status and the sources of its revenue. This form is essential for compliance with IRS regulations, ensuring transparency and accountability for non-profits. The Schedule A specifically helps organizations demonstrate their eligibility for tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

How to use the Form 990 Or 990 Ez Sch A Printable

Using the Form 990 or 990 EZ Schedule A involves several steps. First, organizations must determine which version of the form they need based on their financial activities and revenue levels. Once the correct form is identified, it can be filled out electronically or printed for manual completion. It is important to follow the instructions provided by the IRS carefully, ensuring all required information is included. After completion, the form must be submitted to the IRS by the designated deadline to maintain compliance.

Steps to complete the Form 990 Or 990 Ez Sch A Printable

Completing the Form 990 or 990 EZ Schedule A requires attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and expense reports.

- Identify the correct version of the form based on your organization’s revenue.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the Form 990 Or 990 Ez Sch A Printable

The legal use of the Form 990 or 990 EZ Schedule A is governed by IRS regulations. Organizations must ensure that the information provided is truthful and accurate to avoid penalties. Filing this form is a legal requirement for tax-exempt organizations, and failure to comply can result in loss of tax-exempt status or financial penalties. It is important to maintain proper records and documentation to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 or 990 EZ Schedule A vary depending on the organization’s fiscal year. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due on May fifteenth. Extensions may be available, but organizations must file for them before the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 990 or 990 EZ Schedule A can be submitted in several ways. Organizations have the option to file electronically through the IRS e-file system, which is often the fastest method. Alternatively, the form can be mailed to the appropriate IRS address based on the organization’s location and type. In-person submission is generally not available for this form. It is important to keep a copy of the submitted form for the organization’s records.

Quick guide on how to complete 2011 form 990 or 990 ez sch a printable

Complete Form 990 Or 990 Ez Sch A Printable effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 990 Or 990 Ez Sch A Printable on any platform using airSlate SignNow's Android or iOS applications and simplify your document-centered tasks today.

How to modify and electronically sign Form 990 Or 990 Ez Sch A Printable without any hassle

- Locate Form 990 Or 990 Ez Sch A Printable and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information carefully and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Form 990 Or 990 Ez Sch A Printable to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 990 or 990 ez sch a printable

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 990 or 990 ez sch a printable

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Form 990 Or 990 Ez Sch A Printable?

The Form 990 Or 990 Ez Sch A Printable is a tax form used by nonprofit organizations to report their finances to the IRS. It provides detailed information about the organization’s revenue, expenses, and operational structure. By utilizing airSlate SignNow, users can easily create, fill, and eSign these forms, ensuring compliance and accuracy.

-

How can airSlate SignNow help with the Form 990 Or 990 Ez Sch A Printable?

AirSlate SignNow offers a user-friendly platform for creating and managing the Form 990 Or 990 Ez Sch A Printable. With customizable templates, electronic signatures, and secure document storage, organizations can streamline their reporting process and enhance efficiency. This way, you can focus more on your mission while handling your tax documentation with ease.

-

Is there a cost associated with using airSlate SignNow for Form 990 Or 990 Ez Sch A Printable?

Yes, there is a subscription fee to use airSlate SignNow, but it offers plans that are cost-effective for nonprofits. The pricing structure is designed to provide value while ensuring access to features that simplify the process of managing the Form 990 Or 990 Ez Sch A Printable. You can evaluate different plans to find one that fits your budget and needs.

-

What features does airSlate SignNow provide for creating Form 990 Or 990 Ez Sch A Printable?

AirSlate SignNow provides several features specifically designed for creating Form 990 Or 990 Ez Sch A Printable, including drag-and-drop functionality, template customization, and the ability to invite collaborators. These features help ensure that forms are completed accurately and efficiently, facilitating smoother submissions to the IRS.

-

Can I integrate airSlate SignNow with other tools when working on Form 990 Or 990 Ez Sch A Printable?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, including accounting software and document management systems. This ensures that all your data and workflows are interconnected, making it easier to handle the Form 990 Or 990 Ez Sch A Printable alongside your other financial documentation.

-

What are the benefits of using airSlate SignNow for my Form 990 Or 990 Ez Sch A Printable?

Using airSlate SignNow for your Form 990 Or 990 Ez Sch A Printable brings numerous benefits, such as enhanced efficiency, reduced paperwork, and secure electronic signatures. Not only does this save time, but it also minimizes the risk of errors during filing. Overall, it’s a reliable solution for nonprofits looking to streamline their tax reporting processes.

-

How secure is airSlate SignNow when managing Form 990 Or 990 Ez Sch A Printable?

AirSlate SignNow prioritizes security, ensuring that your Form 990 Or 990 Ez Sch A Printable and all documents are protected with bank-level encryption. Additionally, the platform complies with various data protection regulations to safeguard your information. You can rest assured that your sensitive data is handled securely in a compliant manner.

Get more for Form 990 Or 990 Ez Sch A Printable

- Safe travels accidental death and dismemberment claim form safe travels accidental death and dismemberment claim form

- Beneficiary designation form nebco

- Intake inquiry packet form

- Customs clearance services csaci form

- Prenatal trio form

- Doh intake form

- Providence prior authorization form for medical services

- Please answer the following questions about your history form

Find out other Form 990 Or 990 Ez Sch A Printable

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP