990 Ez 2017

What is the 990 EZ?

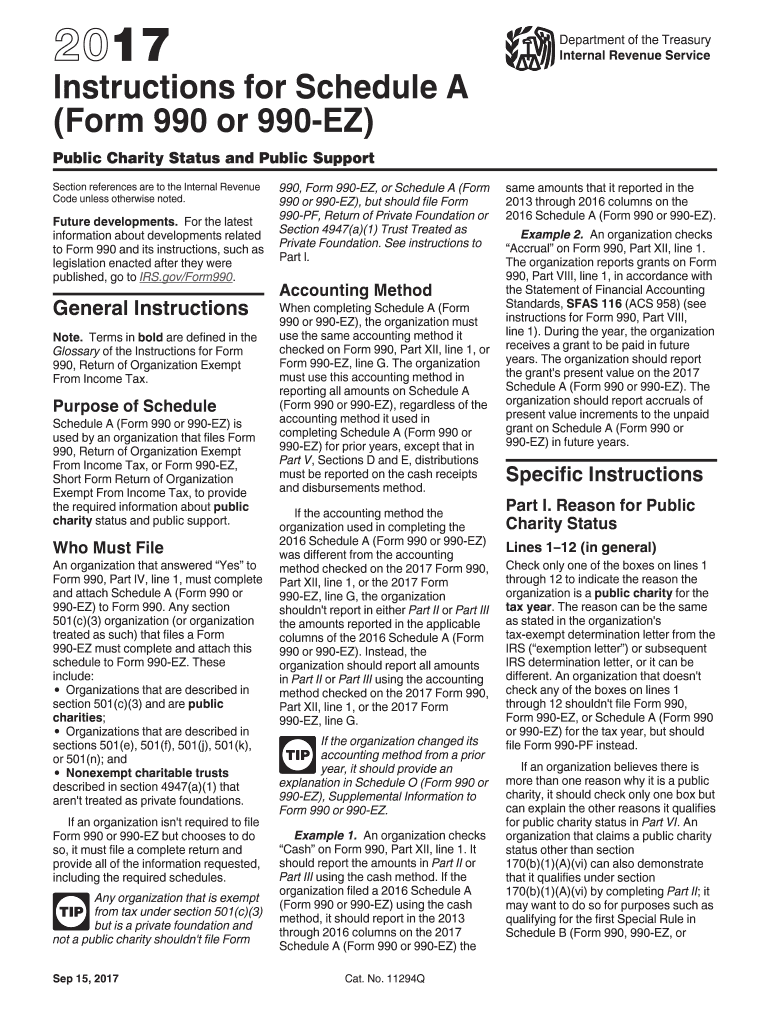

The IRS Form 990 EZ is a streamlined version of the standard Form 990, designed for smaller tax-exempt organizations. This form provides a concise overview of the organization's financial activities, governance, and compliance with tax regulations. It is typically used by organizations with gross receipts of less than two hundred fifty thousand dollars and total assets under five hundred thousand dollars. The 990 EZ helps organizations report their income, expenses, and changes in net assets, ensuring transparency and accountability to the public and the IRS.

How to use the 990 EZ

Using the IRS Form 990 EZ involves several key steps. First, organizations must gather relevant financial data, including income statements, balance sheets, and details about expenses. Once the necessary information is compiled, organizations can fill out the form, which includes sections on revenue, expenses, and net assets. It is crucial to ensure accuracy and completeness to avoid potential penalties. After completing the form, organizations must submit it to the IRS by the appropriate deadline, typically the fifteenth day of the fifth month after the end of their fiscal year.

Steps to complete the 990 EZ

Completing the IRS Form 990 EZ requires a systematic approach. Follow these steps for accurate completion:

- Gather financial records, including income, expenses, and asset details.

- Fill out Part I, which covers revenue and expenses.

- Complete Part II, detailing the balance sheet.

- Provide information about governance and management in Part III.

- Review the form for accuracy and completeness.

- Submit the completed form to the IRS by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 990 EZ. Organizations must adhere to these instructions to ensure compliance. Key guidelines include accurately reporting all sources of income, categorizing expenses correctly, and maintaining proper documentation to support the reported figures. The IRS also emphasizes the importance of timely filing to avoid penalties and maintain tax-exempt status. Organizations should consult the IRS website or seek professional advice if they have questions regarding the guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 990 EZ are crucial for compliance. Generally, organizations must file the form by the fifteenth day of the fifth month following the end of their fiscal year. For example, if an organization’s fiscal year ends on December thirty-first, the form is due by May fifteenth of the following year. Organizations can apply for an extension, but they must file Form 8868 to receive an additional three months. It is essential to keep track of these dates to avoid penalties and maintain good standing with the IRS.

Required Documents

Before completing the IRS Form 990 EZ, organizations should prepare several key documents. These include:

- Financial statements, including income and balance sheets.

- Records of all sources of income and expenses.

- Documentation of any significant changes in net assets.

- Details about governance, including board member information.

- Any additional schedules that may be required based on the organization's activities.

Penalties for Non-Compliance

Failure to comply with the IRS Form 990 EZ filing requirements can result in significant penalties. Organizations that do not file on time may incur fines, which can accumulate for each month the form is late. Additionally, repeated failure to file can lead to the loss of tax-exempt status. It is vital for organizations to understand these risks and ensure timely and accurate filing to avoid negative consequences.

Quick guide on how to complete 2011 form 990 or 990 ez sch a printable 2017 2019

Complete 990 Ez effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents swiftly without delays. Handle 990 Ez on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The simplest way to modify and eSign 990 Ez seamlessly

- Find 990 Ez and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign 990 Ez and ensure effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 990 or 990 ez sch a printable 2017 2019

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 990 or 990 ez sch a printable 2017 2019

How to create an eSignature for the 2011 Form 990 Or 990 Ez Sch A Printable 2017 2019 in the online mode

How to make an electronic signature for the 2011 Form 990 Or 990 Ez Sch A Printable 2017 2019 in Chrome

How to create an electronic signature for signing the 2011 Form 990 Or 990 Ez Sch A Printable 2017 2019 in Gmail

How to generate an electronic signature for the 2011 Form 990 Or 990 Ez Sch A Printable 2017 2019 right from your smartphone

How to generate an eSignature for the 2011 Form 990 Or 990 Ez Sch A Printable 2017 2019 on iOS devices

How to make an electronic signature for the 2011 Form 990 Or 990 Ez Sch A Printable 2017 2019 on Android devices

People also ask

-

What is the IRS Form 990EZ Schedule A used for?

The IRS Form 990EZ Schedule A is used by organizations to provide additional information about their tax-exempt status. It outlines the types of contributions and activities the organization engages in. Understanding this form is crucial for maintaining compliance and ensuring accurate tax reporting.

-

How does airSlate SignNow streamline the eSigning process for IRS Form 990EZ Schedule A?

AirSlate SignNow simplifies the eSigning process for IRS Form 990EZ Schedule A by providing a user-friendly platform for document management. You can easily send, sign, and store your forms in one place, reducing processing time and enhancing operational efficiency.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow offers competitive pricing plans tailored to different business needs. Whether you're a small nonprofit or a larger organization, you can choose a plan that suits your budget while gaining full access to features like templates for IRS Form 990EZ Schedule A.

-

Is airSlate SignNow compliant with government regulations for IRS Form 990EZ Schedule A?

Yes, airSlate SignNow is fully compliant with electronic signature laws and regulations, ensuring that your IRS Form 990EZ Schedule A is signed legally and securely. This compliance gives users peace of mind, knowing that their documents adhere to the necessary legal standards.

-

Can I integrate airSlate SignNow with other software for IRS Form 990EZ Schedule A?

Absolutely! AirSlate SignNow seamlessly integrates with various software solutions, enhancing the documentation workflow for IRS Form 990EZ Schedule A. You can connect it with CRMs, cloud storage, and other applications to streamline data management and improve efficiency.

-

What features does airSlate SignNow offer for handling IRS Form 990EZ Schedule A?

AirSlate SignNow offers several features for handling IRS Form 990EZ Schedule A. These include customizable templates, in-app collaboration, and real-time tracking of document status, making it easier for organizations to manage their submissions efficiently.

-

How does electronic signing improve the submission of IRS Form 990EZ Schedule A?

Electronic signing with airSlate SignNow speeds up the submission process for IRS Form 990EZ Schedule A by eliminating the need for printing, scanning, and mailing documents. This not only saves time but also reduces costs and enhances the overall workflow of your organization.

Get more for 990 Ez

Find out other 990 Ez

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors