W Form 2010

What is the W Form

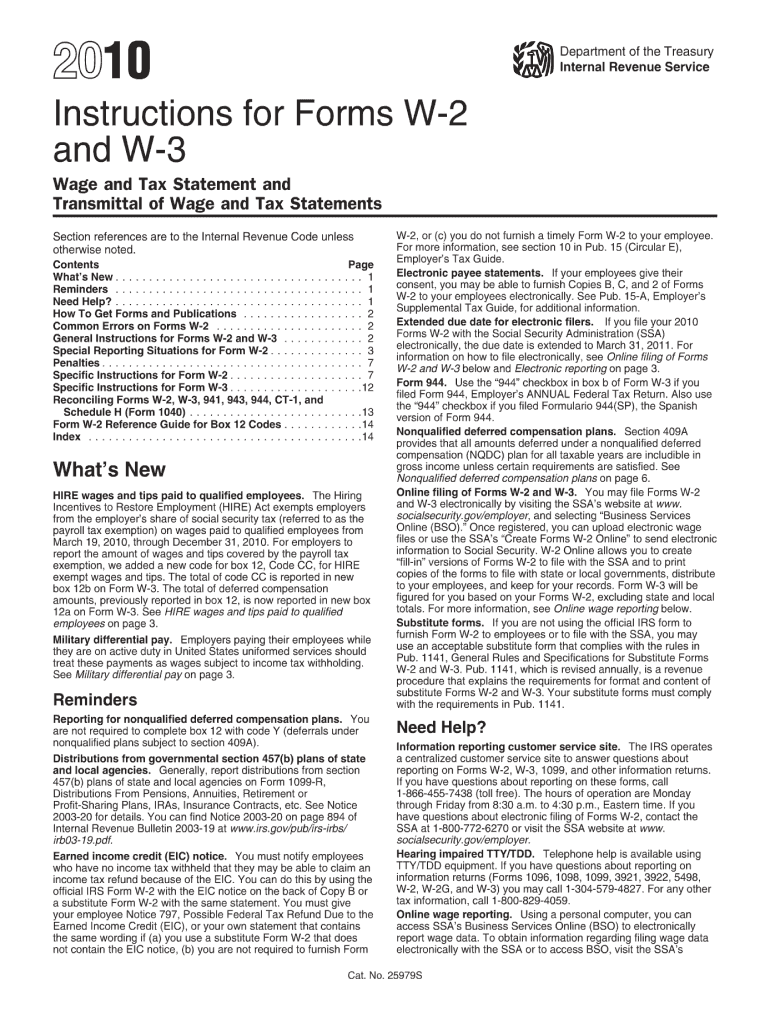

The W Form, specifically the 2010 W, is a tax form used in the United States for various purposes, including reporting income for tax withholding. This form is typically utilized by employers to report the amount of wages paid to employees and the taxes withheld from those wages. It is essential for ensuring that employees receive accurate tax information for their annual tax filings.

How to use the W Form

To use the 2010 W form, individuals must first obtain the form from the appropriate source, usually the IRS website or through their employer. Once obtained, users should fill out the form accurately, providing necessary details such as personal identification information and income details. After completing the form, it should be submitted to the relevant tax authority or employer as required.

Steps to complete the W Form

Completing the 2010 W form involves several key steps:

- Obtain the form from the IRS or your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your employment and income.

- Indicate your filing status and any applicable exemptions.

- Review the form for accuracy before submission.

Legal use of the W Form

The legal use of the 2010 W form is governed by IRS regulations. It must be completed accurately to ensure compliance with tax laws. Any discrepancies or inaccuracies can lead to penalties or issues with tax filings. It is important to maintain records of submitted forms for future reference, as they can be requested during audits or reviews by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the 2010 W form typically align with the annual tax filing season. Generally, employers must provide completed W forms to employees by January 31 of the following tax year. Employees should ensure they have received their W forms in time to file their taxes accurately and on schedule. Missing these deadlines can result in delays and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The 2010 W form can be submitted through various methods depending on the requirements of the employer or tax authority. Common submission methods include:

- Online submission through tax preparation software.

- Mailing a physical copy to the employer or relevant tax office.

- In-person submission at designated tax offices or employer locations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 2010 W form. These guidelines include instructions on how to fill out the form correctly, deadlines for submission, and the importance of accuracy in reporting income and taxes withheld. Familiarity with these guidelines can help ensure compliance and avoid potential issues with tax authorities.

Quick guide on how to complete 2010 w form

Prepare W Form effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle W Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and eSign W Form with ease

- Find W Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring searches for forms, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign W Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 w form

Create this form in 5 minutes!

How to create an eSignature for the 2010 w form

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 2010 w?

airSlate SignNow is a digital document signing solution that empowers businesses to send and eSign documents efficiently. Built with user-friendliness in mind, SignNow provides an intuitive experience for managing legal documents, making it an ideal choice for businesses looking to streamline their processes since 2010 w.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers flexible pricing plans designed to accommodate a range of business needs. Each plan provides essential features to enhance your signing experience, making it a cost-effective solution for businesses of all sizes since 2010 w.

-

What features does airSlate SignNow include?

airSlate SignNow includes a variety of features such as document templates, signing workflows, and secure cloud storage. These features are designed to simplify document management and signing processes, supporting businesses effectively since 2010 w.

-

How does airSlate SignNow ensure document security?

Document security is a top priority for airSlate SignNow, employing advanced encryption and compliance with industry standards. By ensuring that documents are securely signed and stored, businesses can trust SignNow to protect their sensitive information since 2010 w.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers numerous integrations with popular software solutions, enhancing your workflow capabilities. By connecting with tools you already use, SignNow ensures a seamless document signing experience since 2010 w.

-

What are the benefits of using airSlate SignNow?

By using airSlate SignNow, businesses can enjoy faster transaction times, reduced paper usage, and enhanced productivity. These benefits stem from the platform’s easy-to-use features that have been optimizing the document signing process since 2010 w.

-

Is airSlate SignNow compliant with legal standards?

Absolutely, airSlate SignNow complies with legislation surrounding electronic signatures, ensuring that your signed documents are legally binding. This compliance has been maintained since 2010 w, giving businesses peace of mind when using the platform.

Get more for W Form

- Lawmakers unveil details of historic federal paid parental form

- Uk eep form

- Application procedures ampamp deadlinesohio university form

- Universityofkentuckycollegeofagriculturefoodampenvironment form

- International student agreement minnesota state university form

- Texas aampampm international university application for form

- Red cross adult first aidcpraed training registration uah form

- Trial schedule fallspring jacksonville state university jsu form

Find out other W Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF