Fillable Online About Form W 2Internal Revenue Service 2022

Steps to complete the Fillable Online About Form W-2

Completing the W-2 form online involves several key steps to ensure accuracy and compliance with IRS regulations. Begin by gathering all necessary information, including your employer's details, your Social Security number, and your earnings for the year. Once you have this information, access the fillable online form through a secure platform.

Next, carefully enter your personal information in the designated fields. Pay particular attention to Box 12, which requires specific codes depending on the type of compensation or benefits you received. Each code corresponds to a different type of income or deduction, so refer to the IRS guidelines for the correct entries.

After filling in all required fields, review the form for any errors or omissions. It's essential to ensure that all figures are accurate, as mistakes can lead to complications with your tax filing. Once verified, save the document securely and proceed to eSign it using a trusted electronic signature service.

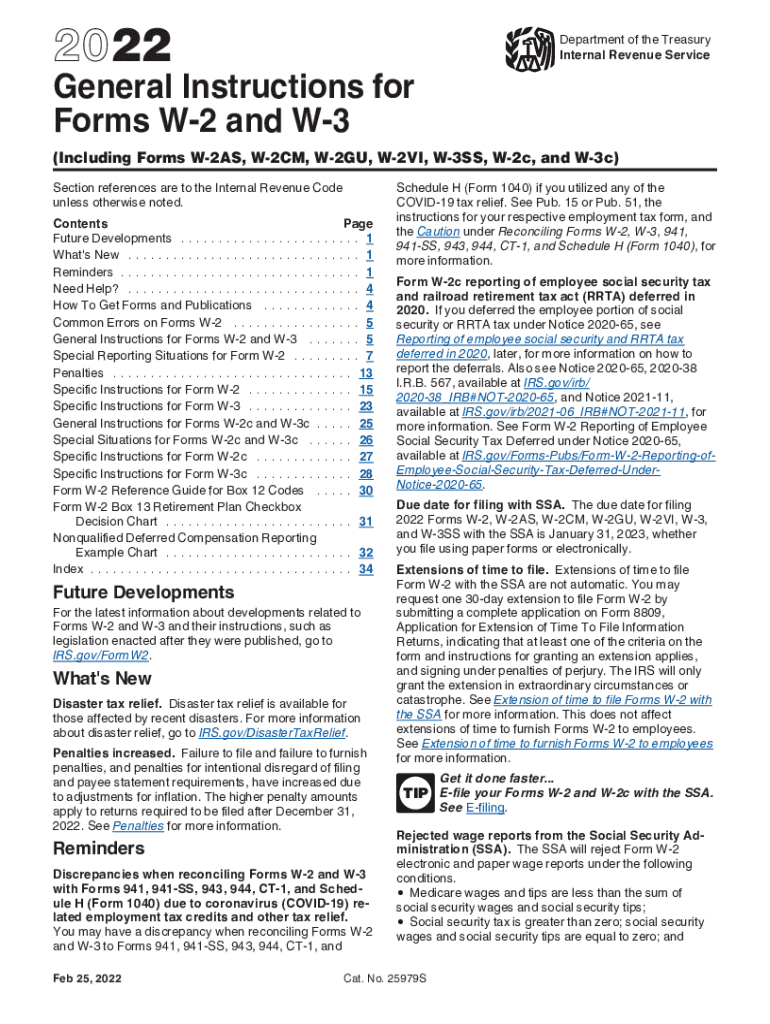

IRS Guidelines

The IRS provides detailed guidelines for completing the W-2 form, including specific instructions for Box 12. Each code listed in this box has a distinct meaning and affects how your income is reported and taxed. For instance, code D indicates elective deferrals to a 401(k) plan, while code DD reports the cost of employer-sponsored health coverage.

Consult the IRS instructions for the W-2 form to understand the implications of each code and how they apply to your tax situation. This ensures compliance with federal tax laws and helps avoid potential penalties. The guidelines also include information on filing deadlines, which are crucial for timely submission.

Legal use of the Fillable Online About Form W-2

The W-2 form is a legal document that reports an employee's annual wages and the amount of taxes withheld from their paycheck. When completing the form online, it is important to use a secure and compliant platform to ensure that the document is legally binding. Electronic signatures are recognized under the ESIGN Act, provided that the signing process meets specific requirements.

Using a reliable eSignature service can enhance the legal validity of your W-2 form. This service should provide an electronic certificate that verifies the identity of the signer and maintains an audit trail of the signing process. This documentation is essential in case of disputes or audits.

Required Documents

To complete the W-2 form accurately, several documents are necessary. These include your previous year’s W-2 forms, pay stubs, and any relevant tax documents that reflect your earnings and deductions. Collecting this information beforehand can streamline the process and reduce the likelihood of errors.

Additionally, if you have received any benefits or compensation that need to be reported in Box 12, ensure you have documentation for those as well. This may include statements from retirement plans, health insurance providers, or other benefit programs.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the W-2 form is crucial for compliance. Employers are required to send out W-2 forms to employees by January 31 of the following year. If you are filing your taxes, you must include the W-2 form with your tax return, which is typically due by April 15. Be aware of these dates to avoid penalties and ensure timely processing of your tax return.

For any corrections, such as those made using a W-2c form, similar deadlines apply. It is important to address any discrepancies as soon as possible to maintain compliance with IRS regulations.

Examples of using the Fillable Online About Form W-2

The W-2 form is commonly used by employees to report their earnings and tax withholdings. For example, if you worked for multiple employers throughout the year, you would receive a separate W-2 from each employer. Each form will detail your earnings and the taxes withheld by that employer.

Additionally, if you received bonuses or other forms of compensation, these would also be reported on your W-2. Understanding how to accurately fill out and submit this form is essential for ensuring that your tax return reflects all income received during the year.

Quick guide on how to complete fillable online about form w 2internal revenue service

Effortlessly prepare Fillable Online About Form W 2Internal Revenue Service on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without unnecessary delays. Manage Fillable Online About Form W 2Internal Revenue Service on any device using airSlate SignNow’s Android or iOS applications and streamline your document-centric processes today.

The easiest way to edit and eSign Fillable Online About Form W 2Internal Revenue Service seamlessly

- Locate Fillable Online About Form W 2Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Fillable Online About Form W 2Internal Revenue Service and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online about form w 2internal revenue service

Create this form in 5 minutes!

People also ask

-

What are the w2 instructions for box 12?

The w2 instructions for box 12 outline how to report additional tax information on your W-2 form. Box 12 can contain codes that represent various types of compensation or benefits, such as retirement plan contributions or health insurance premiums. Understanding these codes is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with W-2 forms?

airSlate SignNow streamlines the process of sending and eSigning W-2 forms, ensuring that all required information, including w2 instructions for box 12, is included. Our platform allows for easy document management and secure signing, making it a cost-effective solution for businesses looking to simplify their tax-related paperwork.

-

Does airSlate SignNow support W-2 eSigning?

Yes, airSlate SignNow supports W-2 eSigning, allowing employees to sign their forms electronically. This method not only speeds up the process but also ensures that the w2 instructions for box 12 and other important details are clearly understood. Our solution is designed to enhance efficiency in document workflows.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers competitive pricing plans tailored to various business needs. Pricing varies based on features and number of users, enabling you to choose the right plan for your organization. Investing in our service simplifies processes, including adherence to w2 instructions for box 12, ultimately providing value for your business.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with popular software platforms, enhancing your existing workflows. These integrations allow you to simplify tasks and ensure that your W-2 forms and related w2 instructions for box 12 are managed efficiently across systems.

-

What features does airSlate SignNow provide for document management?

AirSlate SignNow includes a range of features tailored for document management, including eSignature capabilities, templates, and customizable workflows. These features ensure that every aspect of preparing and signing W-2 forms, including adhering to w2 instructions for box 12, is efficient and user-friendly.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security when it comes to handling sensitive documents like W-2 forms. Our platform uses advanced encryption and authentication protocols to protect your data, ensuring that all information, including compliance with w2 instructions for box 12, is kept secure throughout the signing process.

Get more for Fillable Online About Form W 2Internal Revenue Service

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497320204 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497320205 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497320206 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497320207 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497320208 form

- Marital property agreement template form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497320210 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497320211 form

Find out other Fillable Online About Form W 2Internal Revenue Service

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney