Schedule D and 8453 Form 2010-2026

What is the Schedule D and 8453 Form

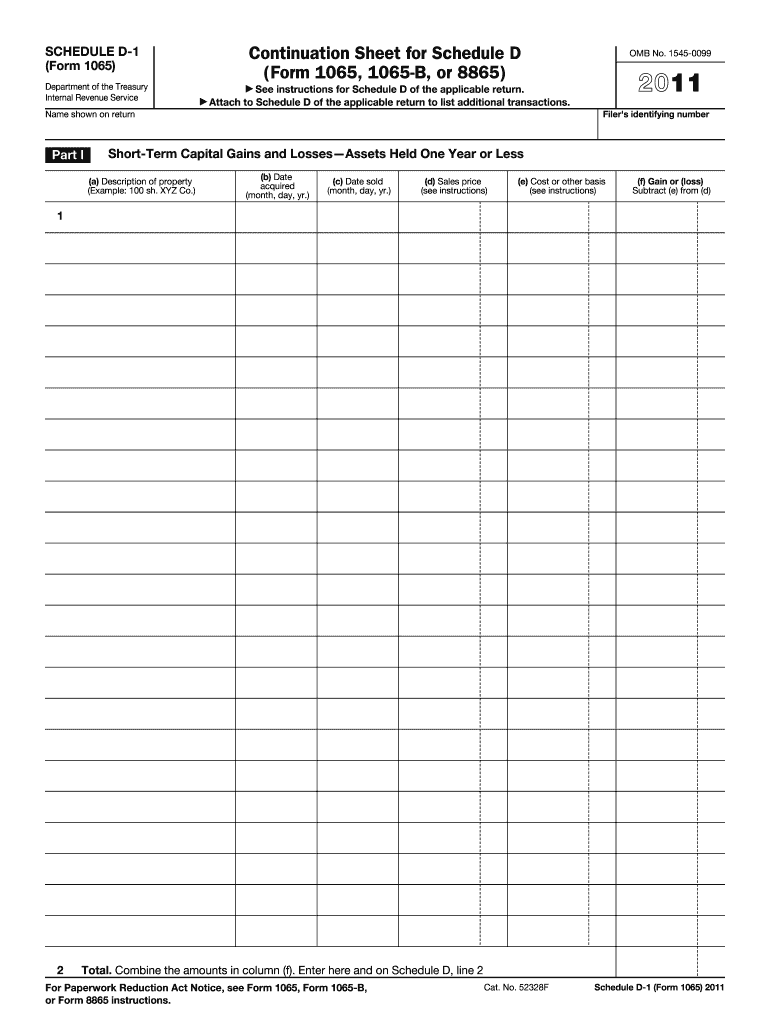

The Schedule D and 8453 form is a crucial document used in the United States for reporting capital gains and losses from the sale of assets. Schedule D specifically details the transactions, while Form 8453 serves as a declaration of the taxpayer's intent to file electronically. This combination is essential for individuals and businesses to accurately report their financial activities to the IRS. Understanding this form is vital for compliance with tax regulations and ensuring that all necessary information is submitted correctly.

How to use the Schedule D and 8453 Form

Using the Schedule D and 8453 form involves several steps. First, gather all necessary documentation regarding your capital gains and losses, including purchase and sale records. Next, complete Schedule D by listing each transaction, categorizing them into short-term and long-term gains or losses. After completing Schedule D, fill out Form 8453, ensuring that all information matches your tax return. Finally, submit both forms electronically, as Form 8453 acts as your signature for the electronic filing process.

Steps to complete the Schedule D and 8453 Form

Completing the Schedule D and 8453 form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including brokerage statements and transaction records.

- Fill out Schedule D by entering each sale, including dates, amounts, and the nature of the asset.

- Calculate total gains and losses, ensuring to differentiate between short-term and long-term transactions.

- Complete Form 8453 by entering your personal information and confirming your electronic filing intentions.

- Review both forms for accuracy before submission.

Legal use of the Schedule D and 8453 Form

The Schedule D and 8453 form must be used in accordance with IRS regulations to ensure legal compliance. When filed correctly, these forms provide a legally binding record of your capital transactions. It is essential to maintain accurate records and adhere to filing deadlines to avoid potential penalties. Additionally, using a reliable electronic signature solution can enhance the security and validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D and 8453 form typically align with the overall tax return deadlines. For most individuals, the deadline is April 15 of the following year. However, if you are unable to meet this deadline, you may file for an extension, which usually extends the deadline to October 15. It is crucial to stay informed about any changes to these dates, as they can vary based on specific circumstances, such as weekends or holidays.

Required Documents

To complete the Schedule D and 8453 form, you will need several key documents:

- Brokerage statements detailing all transactions.

- Purchase and sale records for each asset sold.

- Previous tax returns that may include carryover losses.

- Any relevant IRS publications or guidelines related to capital gains.

IRS Guidelines

Following IRS guidelines is essential when completing the Schedule D and 8453 form. The IRS provides detailed instructions on how to fill out these forms, including definitions of terms and examples of transactions. Familiarizing yourself with these guidelines can help ensure that you report your capital gains and losses accurately. Additionally, the IRS updates these guidelines periodically, so it is important to check for the latest information each tax season.

Quick guide on how to complete schedule d and 8453 2010 form

Effortlessly Prepare Schedule D And 8453 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage Schedule D And 8453 Form on any device with the airSlate SignNow Android or iOS applications and enhance your document-centered processes today.

How to Edit and Electronically Sign Schedule D And 8453 Form with Ease

- Obtain Schedule D And 8453 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive data using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Schedule D And 8453 Form to ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule d and 8453 2010 form

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow's pricing model for the 2010 d plan?

The 2010 d pricing model is designed to be affordable for businesses of all sizes. With tiered subscription options, you can choose the plan that best fits your organization's needs. Stay informed about current promotions to potentially save even more on your airSlate SignNow subscription.

-

What key features does airSlate SignNow offer in the 2010 d package?

The 2010 d package includes essential features such as document creation, eSignature capabilities, and real-time tracking. It simplifies the document workflow, making it efficient for teams to manage contracts and agreements securely. You’ll find these features particularly useful for streamlining processes in your business.

-

How can airSlate SignNow benefit my business with the 2010 d option?

By utilizing the 2010 d option, your business can save time and reduce operational costs through streamlined document management. The platform’s intuitive interface ensures that all team members can easily utilize its capabilities, enhancing productivity. Additionally, the eSignature feature confirms authenticity, which is vital for legal compliance.

-

Can I integrate airSlate SignNow with other software using the 2010 d plan?

Yes, the 2010 d plan supports integrations with a variety of popular applications. You can seamlessly connect with CRMs, cloud storage services, and more, to enhance your document workflow. This flexibility allows for a more cohesive operation within your existing technology stack.

-

Is there a mobile app available for the 2010 d service?

Absolutely! The airSlate SignNow mobile app allows you to manage documents on-the-go with the 2010 d plan. This means you can send, sign, and organize documents from your mobile device, ensuring you remain productive no matter where you are. The app is user-friendly, making it easy to navigate on any device.

-

What security features does airSlate SignNow provide in the 2010 d plan?

With the 2010 d plan, airSlate SignNow prioritizes the security of your documents. The platform uses advanced encryption methods and complies with industry standards to protect sensitive information. This gives you peace of mind when sending and signing important documents online.

-

Are there any limits on document storage with the 2010 d subscription?

The 2010 d subscription includes generous document storage options, ensuring that you have ample space to manage and archive your files. However, it’s always a good idea to check the latest updates on storage capacities. This flexibility allows businesses to maintain a well-organized library of documents.

Get more for Schedule D And 8453 Form

- Instructions for forms ct 3 a ct 3 aatt and ct 3 ab general business corporation combined franchise tax return tax year 2020

- Instructions for forms c 3 s new york s corporation franchise tax returns tax year 2020

- Instructions for form ct 34 net operating loss deduction nold tax year 2020

- Form st 10010 i308 quarterly schedule fr instructions

- Form ct 300 mandatory first installment mfi of estimated 541624132

- Form tp 215 application for registration as a distributor of

- Number for this 1099 r form

- Financial hardship addendum texas tech university departments form

Find out other Schedule D And 8453 Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document