Number for This 1099 R 2020

What is the Number for This 1099 R

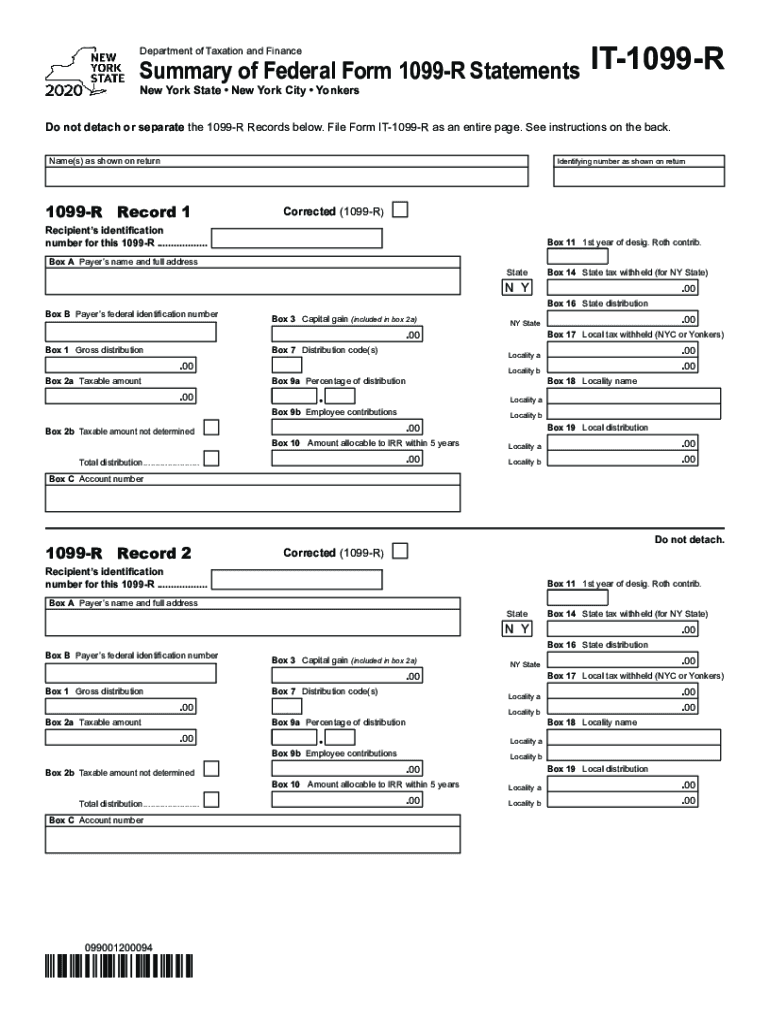

The 1099 R form is used to report distributions from pensions, annuities, retirement plans, IRAs, or insurance contracts. The number associated with this form is crucial for accurately reporting income on your tax return. This number typically includes the payer's identification number, which helps the IRS track the distributions made to you throughout the tax year.

How to Obtain the Number for This 1099 R

To obtain the number for your 1099 R form, you can follow these steps:

- Check your tax documents: Your 1099 R should be sent to you by the financial institution or plan administrator that issued the distributions.

- Contact your financial institution: If you have not received your form, reach out directly to the issuer for assistance.

- Log into your online account: Many institutions provide electronic access to tax documents, allowing you to download your 1099 R directly.

Steps to Complete the Number for This 1099 R

Completing the 1099 R form involves several key steps:

- Gather your personal information, including your Social Security number and the payer's information.

- Fill in the distribution amounts accurately, ensuring you include any taxable amounts.

- Review the distribution codes provided on the form to ensure they correspond with your situation.

- Sign and date the form, if required, before submitting it to the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the 1099 R form. It is essential to:

- File the form by the deadline, which is typically January 31 for recipients and February 28 for paper filings with the IRS.

- Ensure that all information is accurate to avoid penalties or delays in processing your tax return.

- Keep a copy of the form for your records, as it may be needed for future reference or audits.

Penalties for Non-Compliance

Failing to file the 1099 R form or providing incorrect information can result in penalties from the IRS. These penalties may include:

- Fines for late filing, which can increase based on how late the form is submitted.

- Additional charges for incorrect information, which can complicate your tax situation.

- Potential audits if discrepancies are found between your reported income and IRS records.

Form Submission Methods

There are several methods for submitting the 1099 R form:

- Online: Many tax software programs allow you to file your 1099 R electronically.

- Mail: You can also print and mail the form directly to the IRS.

- In-Person: Some individuals may choose to file in person at local IRS offices, although this option may vary by location.

Quick guide on how to complete number for this 1099 r

Effortlessly prepare Number For This 1099 R on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it on the web. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Number For This 1099 R on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

The simplest way to edit and electronically sign Number For This 1099 R with ease

- Obtain Number For This 1099 R and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important portions of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that require new printed copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device. Edit and electronically sign Number For This 1099 R and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct number for this 1099 r

Create this form in 5 minutes!

How to create an eSignature for the number for this 1099 r

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is an IT 1099 R and why is it important?

An IT 1099 R is a tax form that reports distributions from pensions, annuities, retirement plans, or other similar plans. For businesses and individuals, understanding this form is crucial for accurate tax reporting and ensuring compliance with IRS regulations.

-

How can airSlate SignNow help in managing IT 1099 R forms?

airSlate SignNow offers an efficient solution for electronically signing and managing IT 1099 R forms. With our easy-to-use platform, you can send, sign, and store documents securely, ensuring you stay organized during tax season.

-

Is airSlate SignNow cost-effective for handling IT 1099 R documents?

Yes, airSlate SignNow provides a cost-effective solution for handling IT 1099 R documents. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you can manage important tax forms without breaking the bank.

-

What features does airSlate SignNow offer for IT 1099 R form management?

airSlate SignNow features include secure eSigning, document templates, real-time tracking, and integration with various platforms. These tools streamline the process of handling IT 1099 R forms, making it easier to manage your tax-related documents.

-

Can I integrate airSlate SignNow with other tax software for IT 1099 R forms?

Absolutely! airSlate SignNow integrates with various accounting and tax software solutions, enhancing your ability to manage IT 1099 R forms. These integrations ensure a seamless workflow and data transfer between systems, optimizing your tax preparation process.

-

What are the benefits of using airSlate SignNow for my IT 1099 R needs?

Using airSlate SignNow for your IT 1099 R needs offers several benefits including enhanced security, time savings, and improved accuracy in document management. Our platform helps you expedite the signing process, allowing you to focus more on your core business activities.

-

Is airSlate SignNow user-friendly for handling IT 1099 R forms?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to handle IT 1099 R forms. Our intuitive interface requires minimal training, allowing you to quickly adapt to the platform and manage your documents efficiently.

Get more for Number For This 1099 R

- Fillable spell cards 5e form

- Pathfinder 2e familiar sheet form

- Software 16pf 5 bajar gratis form

- Sss form l 501

- Non fiction book report form rescatholicschool

- Imputernicire pentru certificat de nastere form

- Formatul word al documentului 1 procur eliberare carte de identitate pe care l ai solicitat

- Borang b dbkl form

Find out other Number For This 1099 R

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast