T2 Income 2020

What is the T2 Income?

The T2 Income refers to the T2 Corporation Income Tax Return, which is a form used by corporations in the United States to report their income, expenses, and taxes owed to the Internal Revenue Service (IRS). This form is essential for corporations to fulfill their tax obligations and ensure compliance with federal tax laws. The T2 Income includes various sections where corporations must provide details about their financial activities, including revenue, deductions, and credits. Understanding the T2 form is crucial for any corporation looking to maintain accurate financial records and meet regulatory requirements.

Steps to Complete the T2 Income

Completing the T2 Income involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and receipts for expenses.

- Fill Out the Form: Begin filling out the T2 form by entering your corporation's information, such as name, address, and Employer Identification Number (EIN).

- Report Income: Accurately report all sources of income, including sales revenue, interest, and any other earnings.

- Deduct Expenses: List all allowable business expenses, such as salaries, rent, and utilities, to determine your taxable income.

- Calculate Taxes Owed: Use the information provided to calculate the total taxes owed based on the applicable corporate tax rates.

- Review and Sign: Carefully review the completed form for accuracy and ensure it is signed by an authorized representative of the corporation.

- Submit the Form: File the completed T2 Income form with the IRS by the designated deadline.

Required Documents

To successfully complete the T2 Income form, several documents are necessary. These include:

- Financial Statements: Income statements and balance sheets that reflect the corporation's financial performance.

- Receipts and Invoices: Documentation of business expenses that can be deducted.

- Tax Identification Number: The Employer Identification Number (EIN) assigned to the corporation.

- Previous Tax Returns: Copies of prior year tax returns may be helpful for reference and consistency.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines for filing the T2 Income form to avoid penalties. Typically, the T2 form is due on the fifteenth day of the third month following the end of the corporation's fiscal year. For example, if a corporation's fiscal year ends on December 31, the T2 Income form must be filed by March 15 of the following year. It is essential to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or legislative updates.

Legal Use of the T2 Income

The T2 Income form is legally binding and must be completed accurately to comply with federal tax regulations. Misrepresentation or failure to file the form can result in significant penalties, including fines and interest on unpaid taxes. Corporations are encouraged to maintain thorough records and consult with tax professionals to ensure compliance with all legal requirements. Utilizing electronic filing options can also enhance security and streamline the submission process.

Who Issues the Form

The T2 Income form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that corporations understand their obligations and the necessary steps for compliance. It is important for corporations to refer to the IRS website or official publications for the most current information regarding the T2 Income form.

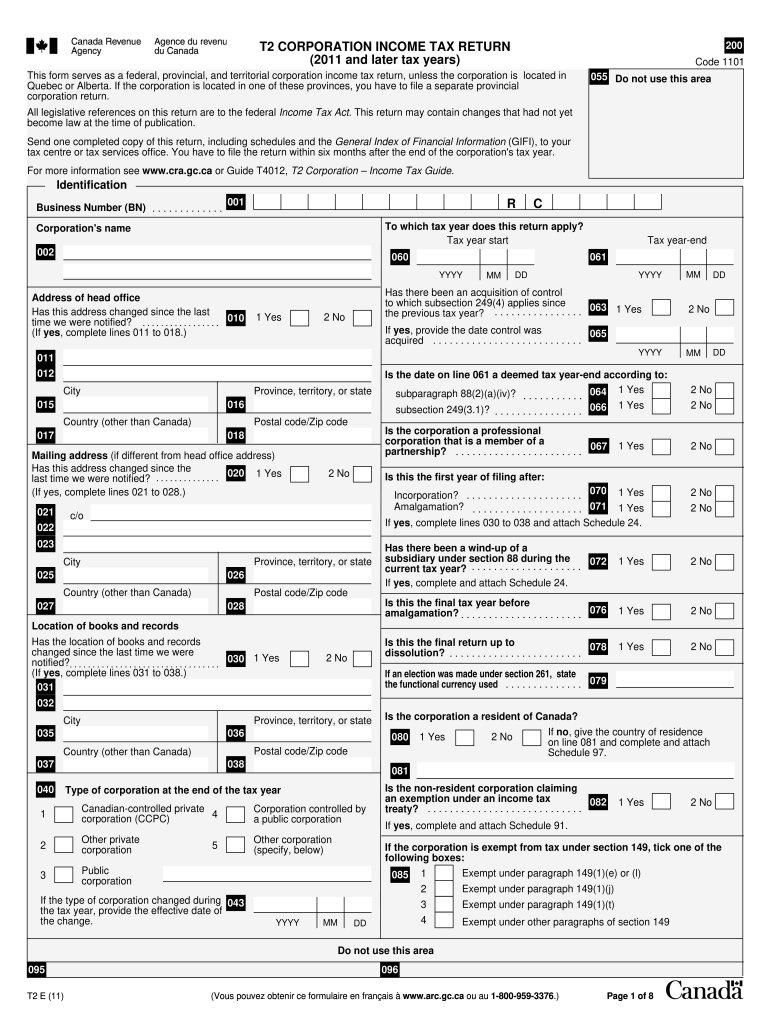

Quick guide on how to complete t2 income 2011

Complete T2 Income effortlessly on every device

Managing documents online has gained traction among companies and individuals alike. It serves as an optimal environmentally friendly option for conventional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle T2 Income on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign T2 Income with ease

- Find T2 Income and then select Get Form to commence.

- Make use of the tools we provide to fill out your document.

- Indicate relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional pen-and-ink signature.

- Verify all details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign T2 Income and ensure seamless communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2 income 2011

Create this form in 5 minutes!

How to create an eSignature for the t2 income 2011

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is a T2 form and why is it important?

A T2 form is a crucial document used for corporate income tax returns in Canada. It is important for businesses to file this form accurately to ensure compliance with tax laws and to avoid penalties. Proper submission of the T2 form can help companies maintain good standing with the Canada Revenue Agency (CRA).

-

How can airSlate SignNow help in managing T2 forms?

airSlate SignNow provides a seamless platform for preparing, signing, and managing your T2 forms digitally. With our user-friendly interface, you can easily fill out and eSign your T2 forms from anywhere, streamlining the process and saving valuable time. Our solution not only simplifies the T2 form management but also ensures security and compliance.

-

Are there any costs associated with using airSlate SignNow for T2 forms?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Depending on your requirements, you can choose a plan that provides access to essential features for managing T2 forms effectively. Our cost-effective solutions ensure you get great value while simplifying your document processes.

-

Can airSlate SignNow integrate with other accounting software to manage T2 forms?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your T2 forms. With seamless connectivity to your existing tools, you can streamline the process, ensuring your T2 form is prepared accurately and submitted on time.

-

What security features does airSlate SignNow offer for T2 forms?

Security is a top priority for airSlate SignNow, especially when handling sensitive T2 forms. We employ advanced encryption, secure authentication, and compliance with industry standards to protect your documents. Rest assured that your T2 forms are safe and confidential throughout the signing and storage process.

-

Is it easy to track the status of my T2 form with airSlate SignNow?

Yes, tracking the status of your T2 forms is straightforward with airSlate SignNow. Our platform provides real-time updates on whether your document is signed, pending, or completed. This feature allows you to stay informed and ensures that your T2 form is handled in a timely manner.

-

Can I access my T2 forms from mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully mobile-compatible, allowing you to access and manage your T2 forms from your smartphone or tablet. This convenience ensures that you can work on your forms anytime and anywhere, making the eSigning process flexible and efficient. Stay productive on the go with airSlate SignNow!

Get more for T2 Income

- Cp 00 17 form

- Weekly homework sheet pdf form

- Mt sac petition for exceptional action form

- Application for production of documents format 100280084

- Identifying nutrients gizmo answer key pdf form

- In patient claim form igi insurance

- Small estate affidavit 1310 form

- Demande dimmatriculation ou titre de proprit dun vhicule form

Find out other T2 Income

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online