Form Canada T2 Corporation Income Tax Return 2023-2026

What is the Form Canada T2 Corporation Income Tax Return

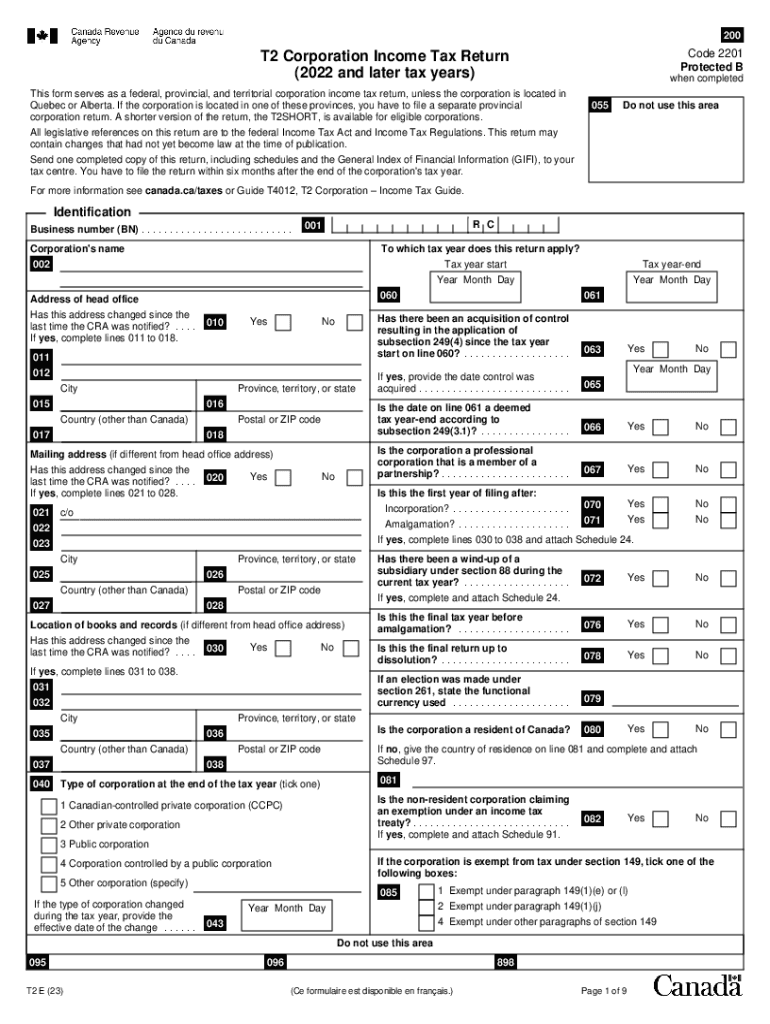

The Form Canada T2 Corporation Income Tax Return is a critical document used by corporations in Canada to report their income, calculate taxes owed, and disclose various financial details to the Canada Revenue Agency (CRA). This form is essential for all resident corporations, including non-profit organizations and tax-exempt corporations, to ensure compliance with Canadian tax laws. The T2 form provides a comprehensive overview of a corporation's financial activities over the fiscal year, including revenue, expenses, and tax credits. Understanding this form is vital for accurate tax reporting and maintaining good standing with tax authorities.

How to use the Form Canada T2 Corporation Income Tax Return

Using the Form Canada T2 Corporation Income Tax Return involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant tax documents. Next, complete the form by entering financial data accurately in the designated sections. Corporations must provide details about their income, deductions, and any applicable tax credits. Once the form is filled out, it must be reviewed for accuracy before submission. This ensures that all information is correct and helps avoid potential penalties from the CRA.

Steps to complete the Form Canada T2 Corporation Income Tax Return

Completing the Form Canada T2 Corporation Income Tax Return requires a systematic approach. Follow these steps for effective completion:

- Gather all financial records, including previous tax returns, income statements, and expense reports.

- Fill out the identification section, providing the corporation's legal name, business number, and fiscal year-end date.

- Report total income by including all sources of revenue earned during the fiscal year.

- Detail allowable deductions, such as operating expenses, salaries, and other business costs.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax payable using the appropriate corporate tax rate.

- Complete any additional schedules required for specific deductions or credits.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form Canada T2 Corporation Income Tax Return to avoid penalties. Generally, the T2 form is due six months after the end of the corporation's fiscal year. For example, if a corporation's fiscal year ends on December 31, the T2 form must be filed by June 30 of the following year. It is important to note that if the corporation has a balance owing, payment is due two months after the fiscal year-end to avoid interest charges. Keeping track of these dates is crucial for compliance and financial planning.

Penalties for Non-Compliance

Failing to file the Form Canada T2 Corporation Income Tax Return on time can result in significant penalties. The Canada Revenue Agency imposes a late-filing penalty, which is calculated based on the amount of tax owed and the length of the delay. Additionally, corporations may face interest charges on any unpaid tax amounts. In severe cases, non-compliance can lead to legal actions or audits. Therefore, it is essential for corporations to file their T2 forms accurately and on time to avoid these repercussions.

Required Documents

To successfully complete the Form Canada T2 Corporation Income Tax Return, certain documents are necessary. These typically include:

- Financial statements, including income statements and balance sheets.

- Details of all income sources, including sales and investments.

- Records of expenses, including operating costs, salaries, and interest paid.

- Previous tax returns, if applicable, for reference.

- Any relevant tax credits or deductions documentation.

Having these documents organized and accessible will streamline the process of completing and filing the T2 form.

Quick guide on how to complete form canada t2 corporation income tax return

Manage Form Canada T2 Corporation Income Tax Return effortlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle Form Canada T2 Corporation Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign Form Canada T2 Corporation Income Tax Return with ease

- Locate Form Canada T2 Corporation Income Tax Return and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data with the tools that airSlate SignNow provides for this specific purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your edits.

- Decide how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form Canada T2 Corporation Income Tax Return and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form canada t2 corporation income tax return

Create this form in 5 minutes!

How to create an eSignature for the form canada t2 corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2010 T2 tax form?

The 2010 T2 tax form is a Canadian corporate income tax return that businesses must file annually. It outlines the income, deductions, and credits that affect the corporation’s tax obligations. Understanding this form is crucial for compliance and tax efficiency.

-

How does airSlate SignNow help with 2010 T2 tax filing?

airSlate SignNow simplifies the process of collecting signatures on documents required for filing your 2010 T2 tax. With its document management features, you can easily prepare and send tax-related documents for eSigning, saving time and ensuring accuracy.

-

Is airSlate SignNow cost-effective for managing 2010 T2 tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing 2010 T2 tax documents. By streamlining the signing process, businesses can reduce the time and resources spent on document management, ultimately lowering overall costs.

-

What features does airSlate SignNow offer for handling 2010 T2 tax documents?

AirSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools enhance the management of 2010 T2 tax documents, ensuring that every important document is efficiently handled and securely stored.

-

Can airSlate SignNow integrate with accounting software for 2010 T2 tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration ensures that your 2010 T2 tax data flows smoothly from your accounting system to the signing process, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for 2010 T2 tax submissions?

Using airSlate SignNow for 2010 T2 tax submissions offers substantial benefits, including expedited signing times and enhanced document security. It also helps reduce administrative overhead and minimizes the risk of errors during the submission process.

-

How secure is airSlate SignNow for handling sensitive 2010 T2 tax information?

Security is a priority at airSlate SignNow; all documents, including those related to the 2010 T2 tax, are protected with advanced encryption methods. This ensures that your sensitive tax information remains confidential and secure throughout the signing process.

Get more for Form Canada T2 Corporation Income Tax Return

- Poder y declaraci n de representaci n departamento de hacienda gobierno form

- Doubletree credit card authorization form

- Element builder gizmo answer key pdf activity b form

- Usutu forest school form

- De 2525xfa form

- Medi cal dental handicapping labio lingual deviation index california modification score sheet form

- Ics225cg incident personnel performance rating

- Immunization form essex county college essex

Find out other Form Canada T2 Corporation Income Tax Return

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe