Msufcu Skip a Pay 2010

What is the Msufcu Skip A Pay

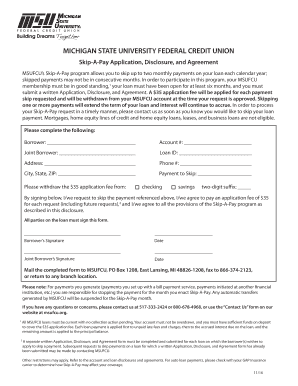

The msufcu skip a pay program allows members of Michigan State University Federal Credit Union to temporarily defer a loan payment. This option can be particularly useful during times of financial strain or unexpected expenses. By skipping a payment, borrowers can manage their cash flow more effectively without incurring penalties or negatively impacting their credit score. It is essential to understand the terms and conditions associated with this program, including any fees that may apply and the impact on the overall loan balance.

How to use the Msufcu Skip A Pay

To utilize the msufcu skip a pay option, members must follow a straightforward process. First, members should review their loan agreement to ensure eligibility for skipping a payment. Next, they can complete the required form, which can typically be found on the msufcu website or obtained directly from a credit union representative. Once the form is filled out, it can be submitted online or in person. Members should confirm the submission and keep a record for their files.

Steps to complete the Msufcu Skip A Pay

Completing the msufcu skip a pay form involves several key steps:

- Review your loan agreement for eligibility.

- Access the msufcu skip a pay form online or request it from a representative.

- Fill out the form with accurate information, including your loan details.

- Submit the completed form through the preferred method (online, mail, or in-person).

- Receive confirmation of your request and keep a copy for your records.

Legal use of the Msufcu Skip A Pay

The msufcu skip a pay program is governed by specific legal guidelines to ensure compliance and protect both the borrower and the credit union. Members must adhere to the terms outlined in their loan agreements and the credit union's policies. Understanding the legal implications of skipping a payment, including how it may affect future payments and interest accrual, is crucial for responsible financial management.

Eligibility Criteria

To qualify for the msufcu skip a pay option, members typically need to meet certain criteria. These may include being in good standing with the credit union, having a loan that is not currently delinquent, and providing necessary documentation to support the request. It is advisable for members to check with the credit union for any specific requirements that may apply to their individual situation.

Key elements of the Msufcu Skip A Pay

Several key elements define the msufcu skip a pay program. These include:

- Eligibility requirements for members.

- The specific loans that qualify for the program.

- Any fees associated with skipping a payment.

- The impact on loan terms and interest rates.

- Submission deadlines for requests.

Quick guide on how to complete msufcu skip a pay

Complete Msufcu Skip A Pay effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents rapidly and without delays. Handle Msufcu Skip A Pay on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Msufcu Skip A Pay with ease

- Locate Msufcu Skip A Pay and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Identify important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device you choose. Modify and eSign Msufcu Skip A Pay while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct msufcu skip a pay

Create this form in 5 minutes!

How to create an eSignature for the msufcu skip a pay

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is msufcu skip a pay?

MSUFCU Skip a Pay is a financial service that allows eligible members to temporarily defer their loan payments. This program offers flexibility for those who may need a break due to unexpected expenses or financial challenges. By using this service, members can maintain financial stability while managing their budgets effectively.

-

How do I qualify for the msufcu skip a pay program?

To qualify for the MSUFCU Skip a Pay program, members must meet specific eligibility criteria set by the credit union. Generally, your account must be in good standing, and you should not have any delinquencies on your loans. For complete details, it's best to contact MSUFCU directly or check their guidelines online.

-

Is there a fee associated with msufcu skip a pay?

Yes, there is typically a fee for the MSUFCU Skip a Pay service, which can vary based on your loan type and the specific terms of your agreement. This fee is usually nominal compared to the benefit of skipping a payment, allowing members to manage their finances more effectively during challenging times.

-

How many times can I use the msufcu skip a pay option?

Members can generally use the MSUFCU Skip a Pay option once per loan, per calendar year. However, the specific usage limits may vary based on individual loan agreements. It's advisable to review your terms or contact MSUFCU for personalized information.

-

What loans are eligible for msufcu skip a pay?

MSUFCU Skip a Pay is typically available for a variety of loans, including auto loans, personal loans, and certain secured loans. However, eligibility may vary, so it's important to check with the credit union for specifics on which loans can participate in the program.

-

What are the benefits of using msufcu skip a pay?

The primary benefit of using MSUFCU Skip a Pay is gaining financial relief during challenging periods by temporarily reducing your financial obligations. This program can help you redirect funds toward other pressing expenses without defaulting on your loans, aiding in maintaining your overall financial health.

-

How do I apply for msufcu skip a pay?

Applying for MSUFCU Skip a Pay can typically be done through your MSUFCU online banking account, by phone, or in-person at a local branch. The process is straightforward, requiring you to complete an application and provide any necessary documentation to confirm your eligibility.

Get more for Msufcu Skip A Pay

- 2016 northwestern university personal data form

- 2018 rae matt properties rental application formerly application for tenancy

- 2014 nj follow up incident report form

- 2018 ny storing vaccine in a stand alone refrigerator unit form

- 2014 ny ocfs ldss 4433 form

- 2019 tx dshs ef23 10618 form

- 2014 tx form 4122

- 2018 tx form 4117

Find out other Msufcu Skip A Pay

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors