Skip a Pay Application, 2018-2026

What is the Skip A Pay Application

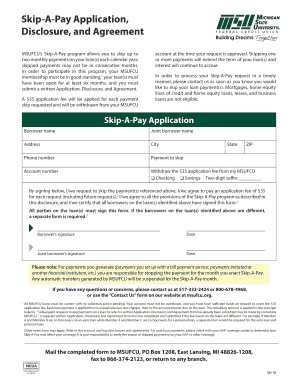

The Skip A Pay application allows members of MSU Federal Credit Union (MSUFCU) to temporarily defer their loan payments. This program is designed to provide financial relief during challenging times, such as unexpected expenses or temporary loss of income. By submitting a Skip A Pay request, borrowers can manage their cash flow more effectively while maintaining their credit standing.

How to Use the Skip A Pay Application

To utilize the Skip A Pay application, members must first ensure they meet eligibility criteria set by MSUFCU. Once eligibility is confirmed, applicants can access the application form through the credit union's website or by visiting a local branch. After filling out the necessary information, members can submit the form electronically or in person, depending on their preference.

Steps to Complete the Skip A Pay Application

Completing the Skip A Pay application involves several key steps:

- Verify eligibility by reviewing MSUFCU's guidelines.

- Access the application form online or at a branch.

- Fill in the required personal and loan information accurately.

- Review the terms and conditions associated with the skip payment.

- Submit the completed application either online or in person.

Legal Use of the Skip A Pay Application

The Skip A Pay application is legally binding once submitted and approved by MSUFCU. It is essential for members to understand the implications of deferring loan payments, including any fees or interest that may accrue during the skipped period. Compliance with the terms outlined in the application is crucial to avoid potential penalties.

Eligibility Criteria

To qualify for the Skip A Pay program, members must meet specific criteria established by MSUFCU. Generally, eligibility may depend on factors such as the type of loan, payment history, and current financial status. It is advisable for members to review these criteria before applying to ensure they meet the necessary requirements.

Application Process & Approval Time

The application process for the Skip A Pay program is straightforward. After submission, MSUFCU typically reviews applications within a few business days. Members will be notified of the approval status, and if approved, the deferment will be applied to their loan account as per the terms specified in the application. Timely communication from the credit union ensures that members are informed throughout the process.

Quick guide on how to complete skip a pay application

Complete Skip A Pay Application, effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers a superb environmentally-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without hold-ups. Manage Skip A Pay Application, on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The ideal method to modify and eSign Skip A Pay Application, effortlessly

- Find Skip A Pay Application, and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important areas of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your adjustments.

- Choose how you would prefer to send your form, either by email, SMS, or invitation link, or download it to your computer.

Create this form in 5 minutes or less

Find and fill out the correct skip a pay application

Create this form in 5 minutes!

How to create an eSignature for the skip a pay application

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is msufcu skip a pay feature?

The msufcu skip a pay feature allows members to temporarily defer their loan payments. This is beneficial for those facing financial challenges, providing relief without penalty. It's designed to give members flexibility in managing their finances.

-

How do I apply for msufcu skip a pay?

To apply for msufcu skip a pay, you can visit the MSUFCU website or your local branch. The application process is straightforward, requiring you to provide basic information about your loan and finances. Ensure that you submit your application before the deadline to qualify.

-

Are there any fees associated with msufcu skip a pay?

Typically, there are no fees for utilizing the msufcu skip a pay option, making it a cost-effective solution for members in need. However, it's best to check directly with MSUFCU for any specific terms and conditions. This feature is designed to alleviate financial pressure without incurring extra costs.

-

How many times can I use the msufcu skip a pay option?

Members can utilize the msufcu skip a pay option once a year, providing ample time for financial recovery. This limit ensures that members can plan accordingly and don’t overextend their payment deferral opportunities. It's important to review your eligibility each year.

-

What types of loans are eligible for msufcu skip a pay?

The msufcu skip a pay program typically applies to various loan types, including auto loans and personal loans. It's important to verify your specific loan eligibility by contacting MSUFCU directly. This option helps a wide range of borrowers manage their payment schedules effectively.

-

What are the benefits of using msufcu skip a pay?

The primary benefit of the msufcu skip a pay feature is financial flexibility during tough times. By skipping a payment, members can allocate funds to essential expenses. Additionally, this option helps maintain a positive credit score by preventing potential late payments.

-

How does msufcu skip a pay affect my loan balance?

Using the msufcu skip a pay feature will not reduce your loan balance, but it delays payment for a specified month. Interest may continue to accrue during the skip, so it's vital to understand how it impacts your overall loan. This ensures you're fully informed about the long-term financial implications.

Get more for Skip A Pay Application,

- Texas landlord in form

- Texas lieu form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497327519 form

- Texas lien form

- Letter tenant notice 497327521 form

- Vendors lien form

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497327523 form

- Tx violation form

Find out other Skip A Pay Application,

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors