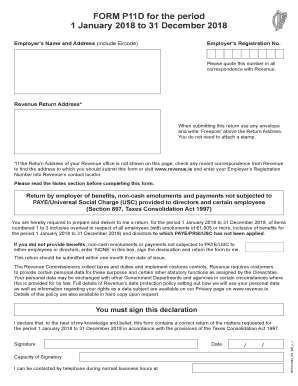

Form P11D for the Period 1 Jan to 31 Dec Return by Employer for Benefits, Non Cash Emoluments 2018

What is the Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments

The Form P11D for the period 1 Jan to 31 Dec is a document used by employers in the United States to report non-cash benefits and emoluments provided to employees. This form is crucial for ensuring compliance with tax regulations, as it details the value of benefits that are not included in an employee's salary but may still be subject to taxation. Examples of such benefits include company cars, health insurance, and other perks that enhance employee compensation. Employers must accurately complete and submit this form to the Internal Revenue Service (IRS) to avoid penalties and ensure proper tax reporting.

Steps to Complete the Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments

Completing the Form P11D involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the non-cash benefits provided to employees throughout the year. This includes the type of benefit, its value, and the employee's details. Next, accurately fill in each section of the form, ensuring that all figures are correct and reflect the actual benefits provided. Double-check for any errors or omissions before finalizing the form. Once completed, the form should be submitted to the IRS by the designated deadline, typically by July 31 of the following year. Keeping a copy for your records is also advisable.

Legal Use of the Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments

The legal use of the Form P11D is essential for employers to demonstrate compliance with tax laws. This form serves as an official record of non-cash benefits provided to employees, which must be reported to the IRS. Failure to properly complete and submit the form can lead to significant penalties, including fines and increased scrutiny from tax authorities. Employers must ensure that the information reported is accurate and complete, as discrepancies can result in legal issues. Utilizing digital tools for completing and submitting the form can enhance security and ensure compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form P11D are critical for compliance. Employers must submit the form to the IRS by July 31 of the year following the reporting period. For instance, for benefits provided from January 1 to December 31, the form must be filed by July 31 of the subsequent year. It is important to keep track of these dates to avoid penalties. Additionally, employers should also be aware of any state-specific deadlines that may apply, as these can vary by jurisdiction.

Examples of Using the Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments

Examples of using the Form P11D include reporting various non-cash benefits provided to employees. For instance, if an employer provides a company car for personal use, the value of that benefit must be reported on the form. Similarly, if an employee receives health insurance coverage that exceeds certain thresholds, that value should also be included. Other examples might include gym memberships, educational assistance, or stock options. Accurately reporting these benefits ensures that both the employer and employee meet their tax obligations.

Digital vs. Paper Version

Employers have the option to complete the Form P11D digitally or on paper. The digital version offers several advantages, including ease of use, faster submission, and enhanced security features. Digital tools can help streamline the completion process and ensure compliance with eSignature laws, making it a preferred choice for many businesses. However, some employers may still opt for the traditional paper version, which requires careful handling and mailing to ensure timely delivery. Regardless of the method chosen, accuracy in reporting is paramount.

Quick guide on how to complete form p11d for the period 1 jan 2018 to 31 dec 2018 return by employer for benefits non cash emoluments

Prepare Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments effortlessly

- Locate Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your modifications.

- Select your preferred method of delivering the form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes requiring the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form p11d for the period 1 jan 2018 to 31 dec 2018 return by employer for benefits non cash emoluments

Create this form in 5 minutes!

How to create an eSignature for the form p11d for the period 1 jan 2018 to 31 dec 2018 return by employer for benefits non cash emoluments

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments?

The Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments is a tax form that employers use to report employee benefits that are not paid in cash. This form includes information on various non-cash emoluments provided to employees, ensuring compliance with UK tax regulations.

-

How does airSlate SignNow simplify the process of filing the Form P11D?

airSlate SignNow simplifies the process of filing the Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments by allowing employers to eSign and send the necessary documents quickly. Our user-friendly platform streamlines document management, helping you meet deadlines effortlessly.

-

What are the benefits of using airSlate SignNow for Form P11D submissions?

Using airSlate SignNow for Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments offers several benefits, including increased efficiency, reduced errors, and secure storage. Our solution allows you to manage multiple submissions without the hassle of paper forms, saving time and resources.

-

Are there any integration options available with airSlate SignNow for financial software?

Yes, airSlate SignNow integrates seamlessly with various financial software solutions to facilitate the completion of the Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments. This ensures that you can sync data efficiently, minimizing administrative workload and enhancing accuracy.

-

What pricing plans does airSlate SignNow offer for businesses needing to handle Form P11D?

airSlate SignNow offers flexible pricing plans designed to meet the needs of various businesses handling the Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments. Each plan includes features tailored to streamline document handling and eSigning processes.

-

How secure is the submission of the Form P11D using airSlate SignNow?

Security is a priority at airSlate SignNow. When submitting the Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments, our platform employs advanced encryption and security protocols to protect sensitive employee data, ensuring compliance and peace of mind.

-

Can I track the status of my Form P11D submissions with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments submissions. Real-time updates keep you informed about where your documents are in the workflow, enabling timely follow-ups.

Get more for Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments

- Fillable online coachampamp39s agreement orange county form

- Scottish widows opt out form

- Continuing education and bridging programs form

- Ampampamp form

- Application of worker form

- If you want to combine super from multiple accounts youll need to complete a separate form with original signatures for each

- Pdf pdf transcript request form concordia university

- Us customs and border protection declaration form 6059b pdf

Find out other Form P11D For The Period 1 Jan To 31 Dec Return By Employer For Benefits, Non cash Emoluments

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors