Form 5471 Schedule O 2012-2026

What is the Form 5471 Schedule O

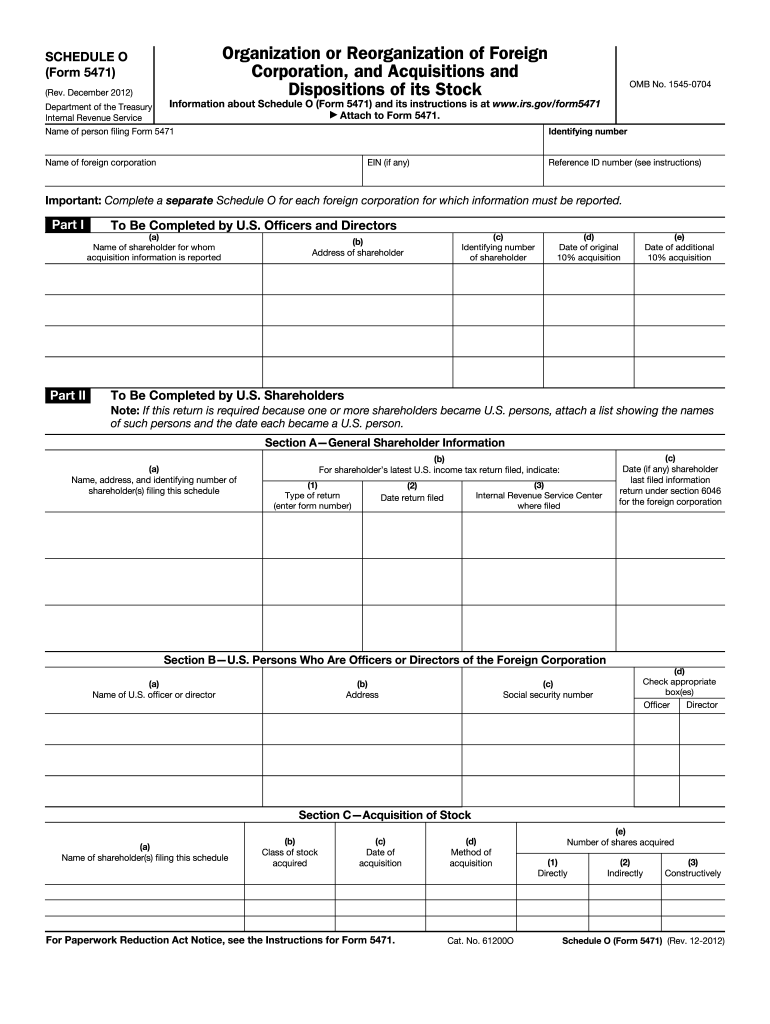

The Form 5471 Schedule O is a crucial document used by U.S. citizens and residents to report information regarding foreign corporations in which they have ownership interests. Specifically, this schedule is part of the Form 5471, which is required by the IRS for certain U.S. persons who are officers, directors, or shareholders in foreign corporations. The Schedule O focuses on the organization and reorganization of these foreign entities, detailing the nature of the ownership and any changes that may have occurred during the tax year.

How to use the Form 5471 Schedule O

To effectively use the Form 5471 Schedule O, individuals must first determine their filing requirements based on their ownership interests in foreign corporations. The form requires detailed information about the foreign corporation's structure, including any reorganizations that may have taken place. Users should carefully follow the IRS instructions for completing the schedule, ensuring that all necessary details about ownership percentages, types of stock, and any transactions are accurately reported. This information is vital for compliance with U.S. tax laws and to avoid potential penalties.

Steps to complete the Form 5471 Schedule O

Completing the Form 5471 Schedule O involves several key steps:

- Gather all relevant information about the foreign corporation, including its name, address, and Employer Identification Number (EIN).

- Document your ownership percentage and any changes in ownership throughout the tax year.

- Detail any reorganizations that occurred, specifying the type of reorganization and the impact on your ownership.

- Review the IRS instructions for the Form 5471 Schedule O to ensure all required information is included.

- Double-check for accuracy before submitting the form, either electronically or by mail.

Legal use of the Form 5471 Schedule O

The legal use of the Form 5471 Schedule O is governed by U.S. tax laws, which mandate that U.S. persons report their interests in foreign corporations. Failure to file the form accurately and on time can result in significant penalties. The IRS requires this form to ensure transparency in foreign investments and to prevent tax evasion. Therefore, it is essential for filers to understand their legal obligations and ensure compliance with all reporting requirements.

Filing Deadlines / Important Dates

The filing deadlines for the Form 5471 Schedule O generally align with the tax return deadlines for U.S. taxpayers. Typically, the form must be filed by the due date of the taxpayer's income tax return, including extensions. For most individuals, this means April 15 of the following year, unless an extension has been filed. It is critical to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 5471 Schedule O can lead to severe penalties. The IRS imposes a penalty of $10,000 for each failure to file the form, with additional penalties for continued failures. If the IRS determines that the failure was due to willful neglect, the penalties can increase significantly. Therefore, it is essential for individuals to understand their obligations and ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete form 5471 schedule o

Complete Form 5471 Schedule O effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents promptly without delays. Handle Form 5471 Schedule O on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 5471 Schedule O without effort

- Locate Form 5471 Schedule O and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form-finding, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 5471 Schedule O and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5471 schedule o

Create this form in 5 minutes!

How to create an eSignature for the form 5471 schedule o

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the form 5471 schedule form and why is it important?

The form 5471 schedule form is a critical document for U.S. taxpayers who have certain interests in foreign corporations. It provides the IRS with necessary information regarding these foreign entities, ensuring compliance with tax regulations. Properly completing this form can help avoid signNow penalties and ensure accurate tax reporting.

-

How can airSlate SignNow help me with the form 5471 schedule form?

airSlate SignNow offers an efficient platform to fill out and eSign your form 5471 schedule form quickly and securely. With its user-friendly interface, you can easily upload, edit, and send your documents for signature, streamlining the entire process. This ensures that your forms are handled professionally and efficiently.

-

Is airSlate SignNow cost-effective for managing tax forms like the form 5471 schedule form?

Yes, airSlate SignNow provides a cost-effective solution for managing various tax forms, including the form 5471 schedule form. With flexible pricing plans, businesses can choose the option that best fits their budget while accessing essential features. This pricing approach helps save money while ensuring compliance and efficiency.

-

Can I integrate airSlate SignNow with other software for my form 5471 schedule form management?

Absolutely! airSlate SignNow easily integrates with various software solutions, allowing you to manage your form 5471 schedule form alongside your existing systems. This enhances workflow and ensures that all your documents are organized and accessible from one platform, further simplifying your tax management process.

-

What features does airSlate SignNow offer for the form 5471 schedule form?

airSlate SignNow offers a range of features that streamline the management of the form 5471 schedule form. Key features include customizable templates, robust collaboration tools, and secure eSignature capabilities. These features help ensure your forms are completed accurately and efficiently, reducing the risk of errors.

-

How secure is airSlate SignNow when handling sensitive documents like the form 5471 schedule form?

Security is a top priority for airSlate SignNow. When handling sensitive documents like the form 5471 schedule form, all data is protected with advanced encryption and secure cloud storage. This ensures that your information remains confidential and safe from unauthorized access.

-

Can I track the status of my form 5471 schedule form through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 5471 schedule form in real time. You can see when a document has been viewed, signed, or if any action is required. This feature helps you keep tabs on your compliance deadlines and ensures your forms are processed promptly.

Get more for Form 5471 Schedule O

- Form fin 1 financial statement for individuals form fin 1 financial statement for individuals

- Kansas city form rd 113

- Form ca 1 virginia cattle assessment return virginia cattle assessment return form ca 1

- Fr900q form

- Fillable online tax virginia form oic fee offer in

- Oic individual doubtful collectibility package offer in compromise individual doubtful collectibility package form

- Np1 form

- Form np 1 sales and use tax exemption application for nonprofit organizations virginia form np 1 sales and use tax exemption

Find out other Form 5471 Schedule O

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate