Schedule O Form 5471 2011

What is the Schedule O Form 5471

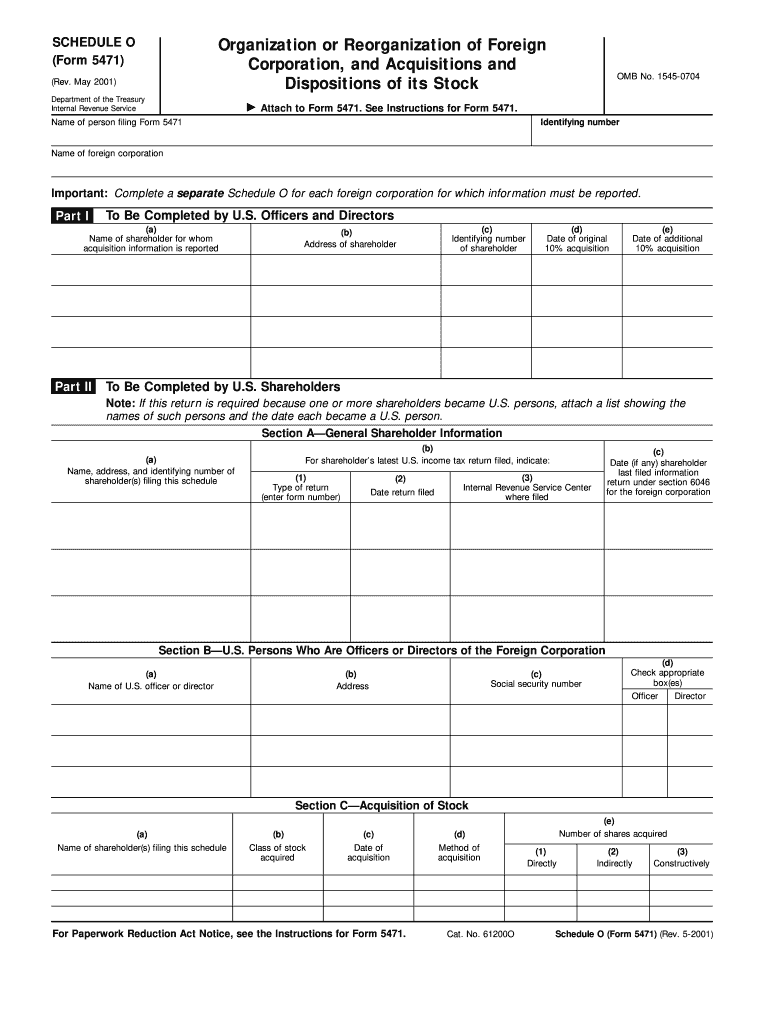

The Schedule O Form 5471 is a crucial document used by U.S. taxpayers who are shareholders in certain foreign corporations. This form is part of the IRS Form 5471, which is required for reporting the activities of foreign corporations and their U.S. shareholders. Schedule O specifically provides additional information regarding the organization, structure, and financial condition of the foreign corporation. It helps the IRS assess compliance with tax laws and ensures that U.S. taxpayers accurately report their foreign income and investments.

How to use the Schedule O Form 5471

Using the Schedule O Form 5471 involves several steps to ensure accurate reporting. First, determine if you are required to file the form based on your ownership in a foreign corporation. If you meet the criteria, download the form from the IRS website or obtain it through tax preparation software. Next, complete the required sections, providing detailed information about the foreign corporation, including its structure, ownership, and financial activities. Ensure that all information is accurate and complete, as discrepancies can lead to penalties.

Steps to complete the Schedule O Form 5471

Completing the Schedule O Form 5471 requires careful attention to detail. Follow these steps:

- Gather necessary information about the foreign corporation, including its name, address, and Employer Identification Number (EIN).

- Provide details about your ownership percentage and the type of entity.

- Complete the sections regarding the corporation’s financial information, including income, expenses, and assets.

- Review the form for accuracy and completeness before submission.

Legal use of the Schedule O Form 5471

The Schedule O Form 5471 is legally binding when completed and submitted in accordance with IRS regulations. It is essential to adhere to the guidelines set forth by the IRS, as failure to file or inaccuracies can result in significant penalties. The form must be submitted along with your tax return, and it is advisable to keep copies for your records. Understanding the legal implications of the information reported is vital for compliance and to avoid potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule O Form 5471 align with the due date of your tax return. Typically, this means the form is due on April 15 for individual taxpayers, with extensions available until October 15. However, if you are a foreign corporation or have a different fiscal year, deadlines may vary. It is crucial to stay informed about any changes in IRS regulations regarding filing dates to ensure timely submission.

Penalties for Non-Compliance

Non-compliance with the Schedule O Form 5471 can lead to severe penalties. The IRS imposes fines for failure to file, inaccuracies, or late submissions. Penalties can range from $10,000 for each form not filed on time to additional fines for continued non-compliance. Understanding these penalties emphasizes the importance of accurate and timely filing to avoid financial repercussions.

Quick guide on how to complete schedule o form 5471 2011

Finalize Schedule O Form 5471 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Schedule O Form 5471 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Schedule O Form 5471 without effort

- Obtain Schedule O Form 5471 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule O Form 5471 and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule o form 5471 2011

Create this form in 5 minutes!

How to create an eSignature for the schedule o form 5471 2011

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Schedule O Form 5471 and why is it important?

The Schedule O Form 5471 is a document required by the IRS that reports the activities of foreign corporations in which U.S. taxpayers have an ownership interest. It's crucial for ensuring compliance with tax regulations and helps to avoid penalties. Properly completing the Schedule O Form 5471 can help businesses demonstrate their foreign investments and associated activities.

-

How does airSlate SignNow facilitate completing the Schedule O Form 5471?

airSlate SignNow provides a user-friendly platform that allows businesses to easily fill out and eSign the Schedule O Form 5471. With customizable templates and an intuitive interface, users can ensure that all necessary information is submitted accurately and efficiently. This automation signNowly reduces the time and effort needed to manage compliance.

-

What are the pricing options for using airSlate SignNow to manage Schedule O Form 5471?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs for handling the Schedule O Form 5471. Each plan provides essential features for document signing, sharing, and storage while ensuring cost-effectiveness. Businesses can choose a plan that aligns best with their requirements and budget.

-

Are there any specific features in airSlate SignNow that help with the Schedule O Form 5471?

Yes, airSlate SignNow includes features like template creation, automated workflows, and in-app collaboration, which are highly beneficial when handling the Schedule O Form 5471. These features streamline the process, allowing multiple users to work on the document simultaneously, ensuring accuracy and compliance. This enhances overall productivity and minimizes errors.

-

Can I integrate airSlate SignNow with other software to help with filing the Schedule O Form 5471?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, such as accounting and tax preparation tools, to assist you in managing your Schedule O Form 5471 efficiently. These integrations enhance data accuracy and streamline your overall workflow when filing and tracking tax-related documents.

-

How does using airSlate SignNow benefit my business when dealing with the Schedule O Form 5471?

By utilizing airSlate SignNow for the Schedule O Form 5471, your business benefits from enhanced document security, increased efficiency, and simplified compliance. Users can eSign and share documents securely, ensuring sensitive information remains confidential. This not only boosts productivity but also helps to alleviate the stress associated with tax filing.

-

Is there a trial available for airSlate SignNow for managing Schedule O Form 5471?

Yes, airSlate SignNow typically offers a free trial that allows users to explore its features, including those tailored to manage the Schedule O Form 5471, without any financial commitment. This trial period enables potential customers to assess the platform's usability and determine how it can streamline their document management processes.

Get more for Schedule O Form 5471

- Landscaping contractor package iowa form

- Commercial contractor package iowa form

- Excavation contractor package iowa form

- Renovation contractor package iowa form

- Concrete mason contractor package iowa form

- Demolition contractor package iowa form

- Security contractor package iowa form

- Insulation contractor package iowa form

Find out other Schedule O Form 5471

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form