Form 8233 Rev September 2018-2026

What is the Form 8233?

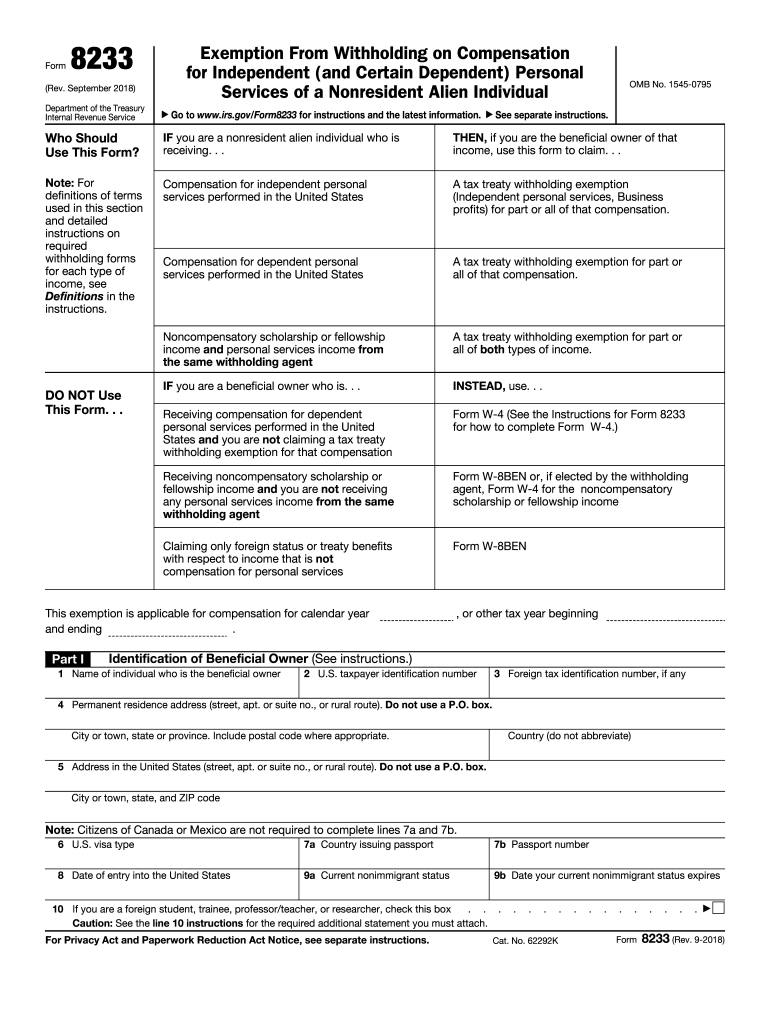

The Form 8233, officially known as the Exemption From Withholding on Compensation for Independent Personal Services of a Nonresident Alien Individual, is a crucial document for nonresident aliens working in the United States. This form allows eligible individuals to claim exemption from withholding on certain types of income, specifically income earned from independent personal services. Understanding the purpose and function of the form is essential for ensuring compliance with U.S. tax regulations.

How to use the Form 8233

Using the Form 8233 involves several steps to ensure that the exemption from withholding is correctly applied. First, the nonresident alien must complete the form by providing personal information, including their name, address, and taxpayer identification number. Next, they must specify the type of income for which they are claiming the exemption. After completing the form, it should be submitted to the payer of the income, who will use it to determine the appropriate tax withholding. It is important to retain a copy of the form for personal records.

Steps to complete the Form 8233

Completing the Form 8233 requires careful attention to detail. Here are the steps involved:

- Provide your personal information, including your name, address, and taxpayer identification number.

- Indicate the type of compensation you are receiving and the reason for the exemption.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the income payer, ensuring that they understand the exemption being claimed.

Following these steps will help ensure that the form is completed accurately and submitted properly.

Eligibility Criteria for Form 8233

To qualify for exemption from withholding using Form 8233, certain eligibility criteria must be met. The individual must be a nonresident alien who is providing independent personal services in the United States. Additionally, the individual must not be a resident alien for tax purposes and must meet specific income thresholds. Understanding these criteria is essential for ensuring that the exemption is valid and compliant with IRS regulations.

IRS Guidelines for Form 8233

The IRS provides specific guidelines regarding the use of Form 8233. It is important to follow these guidelines to ensure compliance and avoid potential penalties. The IRS outlines the types of income eligible for exemption, the documentation required, and the process for submitting the form. Familiarizing oneself with these guidelines can help nonresident aliens navigate the complexities of U.S. tax law effectively.

Penalties for Non-Compliance

Failure to comply with the requirements associated with Form 8233 can result in significant penalties. If a nonresident alien incorrectly claims an exemption or fails to submit the form, they may be subject to withholding taxes that could have been avoided. Additionally, the IRS may impose fines or interest on any unpaid taxes. It is crucial to understand the importance of compliance to avoid these potential consequences.

Quick guide on how to complete form 8233 rev september 2018

Complete Form 8233 Rev September effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8233 Rev September on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Form 8233 Rev September with ease

- Find Form 8233 Rev September and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as an ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow addresses all your document management necessities in just a few clicks from any device of your choosing. Adjust and eSign Form 8233 Rev September to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8233 rev september 2018

Create this form in 5 minutes!

How to create an eSignature for the form 8233 rev september 2018

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the pricing structure for the 8233 plan?

The 8233 plan offers competitive pricing that fits various budgets. With options for monthly or annual subscriptions, businesses can choose a plan that best suits their needs. Our pricing structure is transparent, with no hidden fees, ensuring you get the best value for your investment.

-

What features are included in the 8233 plan?

The 8233 plan includes a comprehensive suite of features such as unlimited eSignatures, document templates, and customizable workflows. These tools empower businesses to streamline their document processes efficiently. With the 8233 plan, you also gain access to advanced security measures to protect your sensitive information.

-

How does the 8233 plan benefit small businesses?

For small businesses, the 8233 plan provides an affordable eSigning solution that enhances productivity. It allows you to send and sign documents quickly, reducing turnaround times. With its user-friendly interface, even those with minimal technical skills can utilize the full capabilities of airSlate SignNow.

-

Can I integrate other software with the 8233 plan?

Yes, the 8233 plan supports various integrations with popular software tools, such as CRMs and document management systems. This flexibility allows businesses to connect their existing workflows seamlessly. With these integrations, you can automate processes and enhance efficiency while using airSlate SignNow.

-

Is there a free trial available for the 8233 plan?

Absolutely! We offer a free trial of the 8233 plan, allowing you to experience our features risk-free. This gives you the opportunity to evaluate how airSlate SignNow can streamline your document management before committing to a subscription. Sign up today and see how it fits your business needs.

-

What types of documents can I send using the 8233 plan?

With the 8233 plan, you can send a variety of documents, including contracts, agreements, and any other files that require electronic signatures. The platform supports multiple file formats, making it versatile for different industries. Regardless of the document type, airSlate SignNow simplifies the signing process.

-

How secure is the 8233 plan for my documents?

The 8233 plan is designed with top-notch security protocols to ensure your documents are safe. We utilize encryption, secure server storage, and compliance with industry standards like GDPR. Your peace of mind is important to us, and the 8233 plan prioritizes the security of your sensitive data.

Get more for Form 8233 Rev September

- Concession form for students in college

- Domicile certificate assam form

- Borang b2 upsi form

- Pindics form pdf

- Sarah pdf form

- Rayalaseema university convocation notification 2021 form

- Affidavit to verify requirements for moped classification name of dps texas form

- Lego club st benedict catholic school form

Find out other Form 8233 Rev September

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online