Form Simple Ira Contribution 2019-2026

What is the Form Simple IRA Contribution

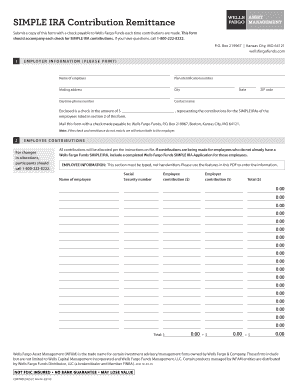

The simple IRA contribution form is a crucial document used by employers and employees to facilitate contributions to a Simple Individual Retirement Account (IRA). This form outlines the amount of money that an employer will contribute to an employee's retirement savings, which is essential for tax benefits and retirement planning. It is designed to simplify the process of retirement savings for small businesses and their employees, allowing for easy management of contributions.

How to use the Form Simple IRA Contribution

Using the simple IRA contribution form involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from your financial institution or employer. Next, fill in the required fields, including your personal information and the contribution amount. Once completed, the form should be submitted to the appropriate financial institution managing your simple IRA. It is important to keep a copy for your records to track contributions over time.

Steps to complete the Form Simple IRA Contribution

Completing the simple IRA contribution form requires attention to detail. Begin by entering your name, address, and Social Security number accurately. Next, specify the contribution amount you wish to make, ensuring it aligns with IRS guidelines for contribution limits. After filling out the necessary information, review the form for any errors. Finally, sign and date the form before submitting it to your financial institution, either online or by mail.

Legal use of the Form Simple IRA Contribution

The simple IRA contribution form must comply with specific legal requirements to be considered valid. This includes adherence to IRS regulations regarding contribution limits and eligibility. Employers must ensure that they provide accurate information and maintain records of contributions for tax reporting purposes. Utilizing a secure platform for electronic signatures can enhance the legal validity of the form, ensuring compliance with eSignature laws.

Key elements of the Form Simple IRA Contribution

Several key elements must be included in the simple IRA contribution form. These include the contributor's personal information, the designated contribution amount, and the signature of the contributor. Additionally, the form may require details about the financial institution managing the simple IRA and any applicable plan numbers. Ensuring all these elements are present is vital for the form's acceptance and processing.

Filing Deadlines / Important Dates

Filing deadlines for the simple IRA contribution form are critical to ensure compliance with IRS regulations. Contributions for a given tax year must typically be made by the tax filing deadline, which is usually April 15 of the following year. It is advisable to check for any updates or changes to these deadlines annually, as they can affect retirement savings strategies.

Eligibility Criteria

To use the simple IRA contribution form, both employers and employees must meet specific eligibility criteria. Employers must have no more than 100 employees and cannot have another retirement plan. Employees must earn at least $5,000 in compensation during any two preceding years and expect to earn at least that amount in the current year. Understanding these criteria is essential for effective retirement planning and compliance.

Quick guide on how to complete form simple ira contribution

Effortlessly prepare Form Simple Ira Contribution on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Form Simple Ira Contribution on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest way to edit and electronically sign Form Simple Ira Contribution with ease

- Locate Form Simple Ira Contribution and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign feature, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and electronically sign Form Simple Ira Contribution and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form simple ira contribution

Create this form in 5 minutes!

How to create an eSignature for the form simple ira contribution

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is a simple IRA form?

A simple IRA form is a document that allows employees to contribute to a retirement account, which employers can also match. It is designed to simplify the process of setting up and managing retirement plans for small businesses. With airSlate SignNow, you can easily send and eSign simple IRA forms digitally.

-

How can I create a simple IRA form using airSlate SignNow?

To create a simple IRA form with airSlate SignNow, simply log in to your account and select the option to create a new document. You can either use templates or upload your own IRA form to facilitate quick e-signature. The process is user-friendly and ensures compliance with industry standards.

-

What features does airSlate SignNow offer for managing simple IRA forms?

airSlate SignNow offers various features for managing simple IRA forms, such as customizable templates, bulk sending, and electronic signatures. These tools streamline the onboarding and documentation process, making it easier for both employers and employees. Additionally, the platform offers secure storage for all signed documents.

-

Are there any costs associated with using airSlate SignNow for simple IRA forms?

airSlate SignNow offers a cost-effective solution for handling simple IRA forms, with pricing plans suited for businesses of all sizes. You can choose a plan that fits your budget while enjoying the benefits of a robust e-signature solution. There are no hidden fees, and you can start with a free trial to test the service.

-

Can I integrate airSlate SignNow with other software for simple IRA forms?

Yes, airSlate SignNow can easily integrate with various software applications, making it convenient to manage simple IRA forms alongside your existing tools. Integration options include popular platforms like Google Workspace, Salesforce, and more. This seamless connectivity enhances productivity and simplifies data management.

-

What are the benefits of using airSlate SignNow for simple IRA forms?

Using airSlate SignNow for simple IRA forms provides a range of benefits including faster document turnaround times, improved security, and the convenience of e-signatures. Businesses can reduce paper waste and streamline the signing process, leading to increased efficiency. Moreover, the platform is designed to be user-friendly for all parties involved.

-

Is airSlate SignNow compliant with regulations regarding simple IRA forms?

Yes, airSlate SignNow is fully compliant with legal regulations regarding e-signatures and document handling. This ensures that your simple IRA forms meet all necessary legal standards. You can trust that your digital transactions are secure and legally binding, complying with laws such as the ESIGN Act.

Get more for Form Simple Ira Contribution

- Tax commission of the city of new york welcome to nycgov form

- Claim for nyc school tax credit xpcourse form

- Form st 809 new york state and local sales and use tax

- Wwwpdffillercom506764396 transient occupancy2020 2022 form ca transient occupancy tax return fill online

- Fill and print form 593 v payment voucher for real estate

- Get the free fl rental tax rates 2020 form pdffiller

- Department of taxation and finance certificate of form

- Florida department of revenue dr 309640 r 0113 form

Find out other Form Simple Ira Contribution

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now